Network Fees

Bitcoin: On-chain fees decreased by -16.9% to $1.45 million, contrasting with the asset’s modest +1.0% price gain. This divergence suggests that the current price stability is sustained by institutional interest and ETF flows rather than a surge in retail on-chain activity. The lower fee environment allows for a cost-effective holding period as the market awaits a more decisive catalyst following recent volatility near the $90k mark.

Ethereum: Fees saw a similar contraction, falling -10.9% to $2.61 million, while the price rose by +2.9%. This trend underscores the continued efficiency of Layer-2 scaling solutions in absorbing transactional demand. Despite the drop, Ethereum’s fee generation remains nearly 1.8x that of Bitcoin, reaffirming its position as the primary ecosystem for decentralized finance and high-value settlement even during periods of consolidation.

Exchange Netflows

BTC: A significant cooling in sell-side pressure is evident with -$180.92 million in net outflows. After the sharp mid-January volatility, this shift suggests that holders are moving assets back into cold storage or long-term custody. This withdrawal of liquid supply from exchanges provides a supportive floor, reducing the immediate risk of further “sell the news” liquidations following recent Federal Reserve commentary.

ETH: Ethereum experienced a more aggressive trend of accumulation with -$392.28 million in net outflows. As exchange balances hit multi-year lows, users appear to be prioritizing staking and on-chain participation over exchange liquidity. This significant reduction in available supply, paired with a recovery back above the $3,000 psychological level, suggests a tightening market structure that could amplify price movements if demand continues to scale.

Kraken Launches DeFi Earn

Kraken has officially entered the “CeDeFi” arena with the rollout of “DeFi Earn” on January 26, a product available to users in the U.S., Europe, and Canada. This move represents a significant pivot from the “walled garden” approach of typical centralized staking products. Instead of opaque internal yields, Kraken is routing user deposits directly into on-chain protocols, offering APYs up to 8% on USDC.

The backend infrastructure is powered by Veda, a specialized vault infrastructure provider, with risk parameters curated by Chaos Labs and Sentora. This multi-layered architecture allows Kraken to abstract away key management and gas fees while deploying capital into established lending markets.

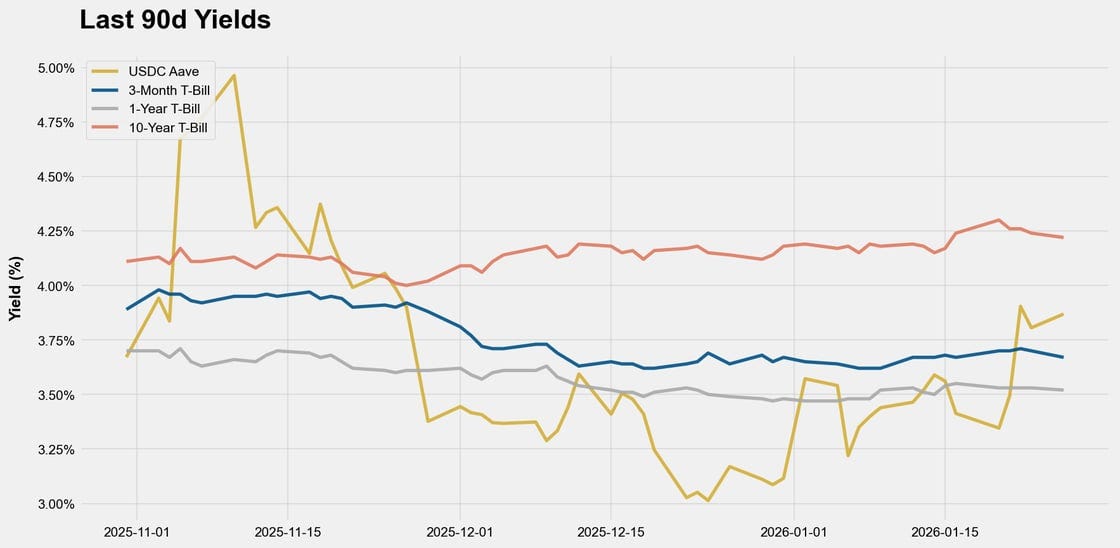

Quantitative Context: The initial offering focuses on USDC vaults, targeting a yield band of 5–8% APY, significantly outperforming traditional high-yield savings accounts (currently averaging ~4% in the U.S.) and other DeFi alternatives. Sentora’s “Advanced Strategy” vault is currently the highest yielding of the new Kraken vaults.

User Experience: By utilizing Privy’s wallet infrastructure, the product eliminates seed phrases entirely. Users select a risk profile (Balanced, High, or Advanced), and the system handles the routing.

Transparency: Unlike the “black box” failures of the past, this model offers on-chain verifiability. Users can theoretically trace the deployment of funds to the underlying protocols, though they interact solely through the Kraken interface.

This launch is a critical signal that institutional-grade DeFi is ready for retail consumption without the friction of self-custody. By partnering with third-party risk managers like Chaos Labs, Kraken is also effectively outsourcing the due diligence burden, creating a defensible model for offering yield in strictly regulated jurisdictions.

Source: FRED and aavescan.com

Crucially, the architecture of this product relies on Ink, Kraken’s own Layer 2 blockchain, to minimize gas friction while maintaining on-chain settlement. By deploying Veda’s “BoringVault” infrastructure directly on Ink, Kraken effectively creates a circular liquidity economy: user deposits remain within their ecosystem (boosting Ink’s TVL) while still interacting with external liquidity layers like Morpho and Sky. This technical structure is a massive differentiator; unlike previous Earn products that were essentially unsecured IOUs, this model offers a verifiable, on-chain footprint where the exchange acts as a non-custodial interface rather than a black-box hedge fund.

This launch also signals the beginning of the “Super Wallet” wars. As exchanges realize that trading fees are a race to the bottom, the battleground is shifting toward owning the user’s entire DeFi lifecycle. By integrating partners like Chaos Labs and Sentora for automated risk curation, Kraken is positioning itself not just as a venue for buying tokens, but as a regulated DeFi curation layer. This creates a formidable moat against both traditional fintechs and decentralized wallets, offering the ease of the former with the yield opportunities of the latter.

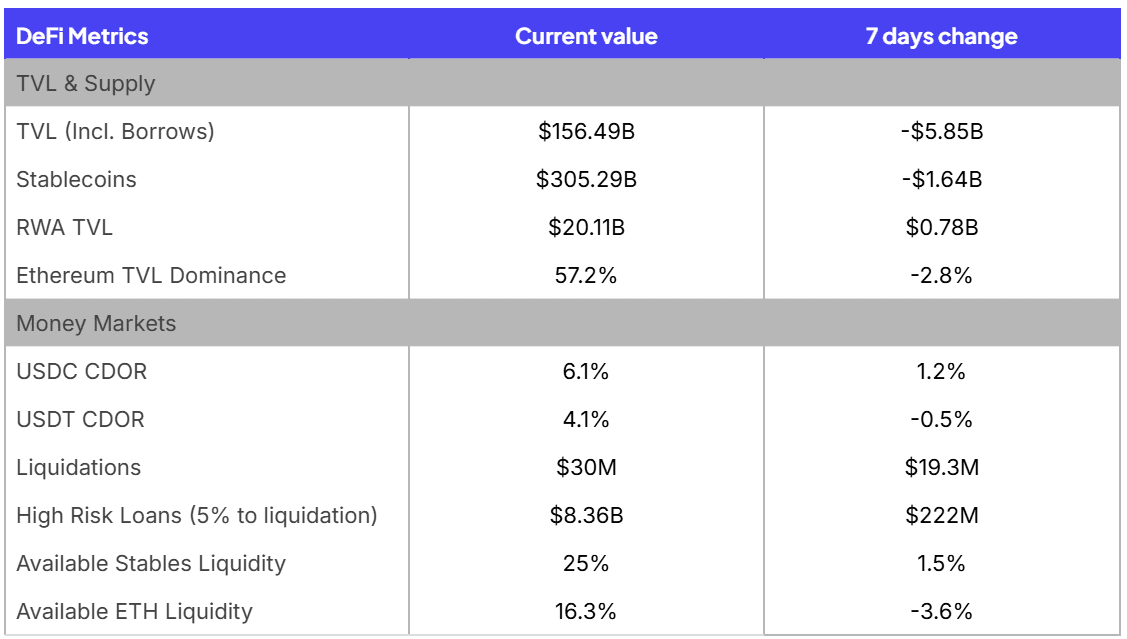

Weekly DeFi Metrics

Note: The CoinDesk Overnight Rates (CDOR) convert USDC and USDT stablecoin borrowing data on Aave into daily benchmarks to support hedging and rate-based products.

Key takeaways for this week:

Relatively flat changes in TVL and Supply

Stablecoin borrow costs continue creeping up

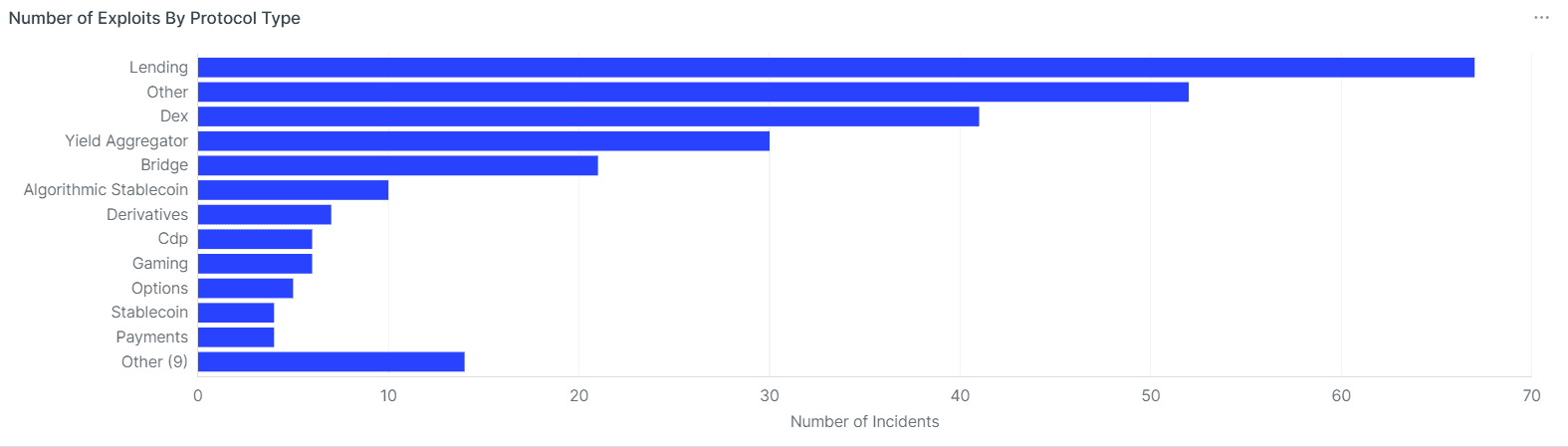

DeFi Exploit Trends: Audit Gaps and Evolving Attack Vectors

Despite the maturation of smart contract auditing practices, unaudited code and out-of-scope vulnerabilities remain significant contributors to DeFi losses. Across 267 documented incidents totaling $10.15B in losses (excluding Terra in 2022), unaudited protocols accounted for 87 exploits ($4.71B lost), while 55 incidents ($1.68B) exploited mechanisms outside the scope of existing audits. Lending protocols and DEXes remain the most targeted type of protocols, primarily due to the number of these that are deployed and generally holding the largest amounts of TVL in DeFi.

Source: Sentora DeFi Exploits

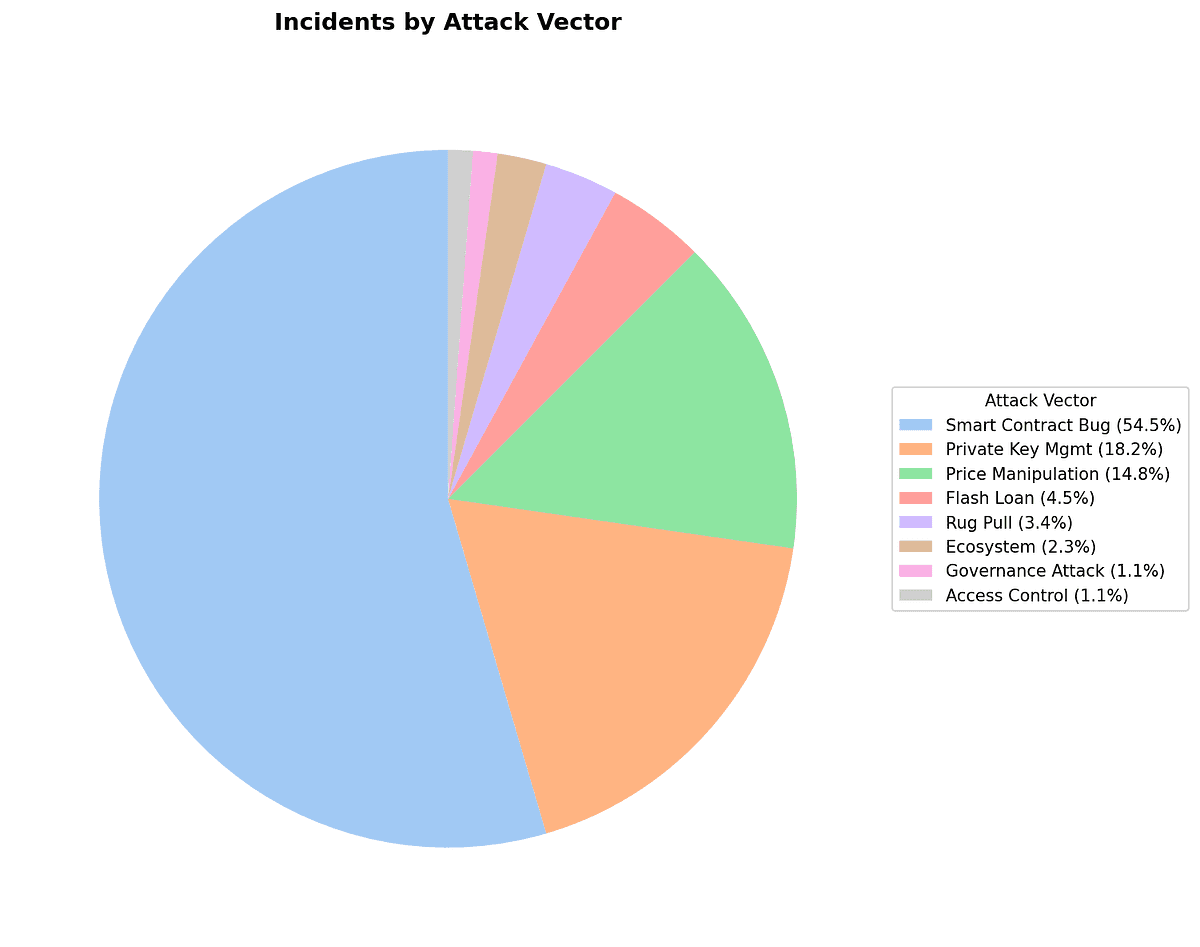

Over the past year (January 2025–January 2026), the distribution of losses by root cause reveals continued dominance of technical vulnerabilities, with smart contract bugs driving the majority of incidents. Operational security failures, driven by private key compromises, have emerged as the second-largest loss category, highlighting that protocol security extends well beyond code quality.

Source: Sentora Research

Key Findings:

Smart contract bugs led with $526M lost across 48 incidents in the past year

Private key management failures caused $172M in losses from 16 incidents

Price manipulation exploits totaled $65M across 13 incidents

Audited protocols still suffered the highest nominal losses last year ($515M), though out-of-scope exploits ($193M across 23 incidents) and unaudited code ($77M across 24 incidents) combined represent a comparable risk surface

Lending protocols experienced the highest incident frequency by protocol type, consistent with their elevated exposure to oracle dependencies and liquidation mechanics

EXPLORE MORE ARTICLES