The Institutional Pivot: Wall Street’s On-Chain Evolution Accelerates

Before examining the qualitative implications of these institutional maneuvers, it is crucial to ground the narrative in the quantitative data driving these markets. The scale of capital and the immediate market reactions underscore the magnitude of this week's developments.

$2.4 Billion: The current approximate assets under management (AUM) of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which is now fully integrated for on-chain execution.

$940 Billion: The total traditional assets overseen by Apollo Global Management, which is now actively building out its on-chain credit strategy.

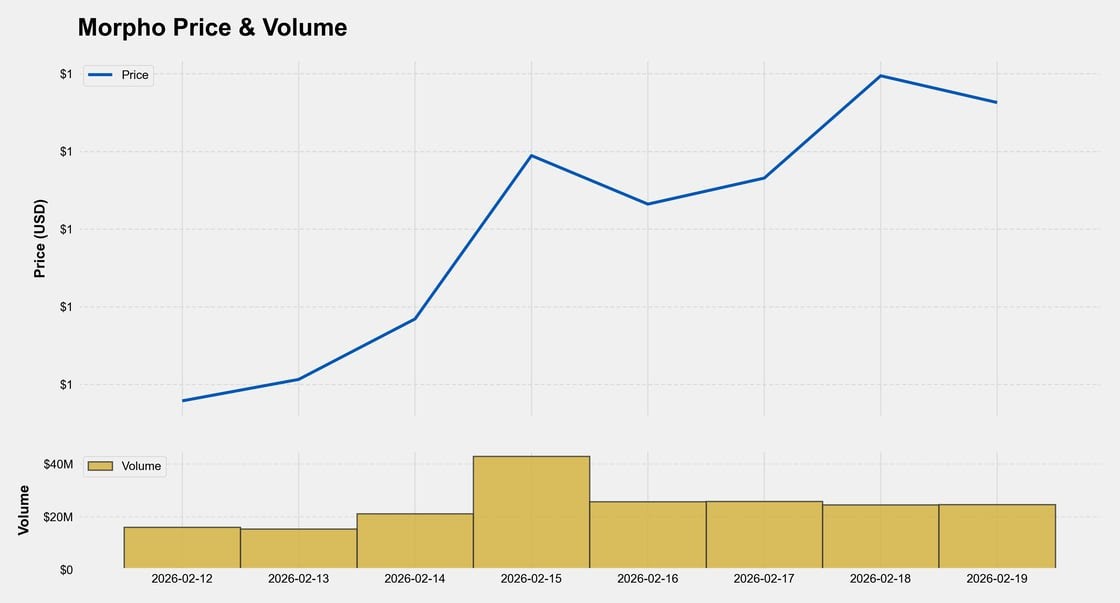

90 Million: The maximum number of MORPHO tokens (representing 9% of the total 1 billion supply) that Apollo and its affiliates are authorized to acquire over the next 48 months.

$5.8 Billion: The Total Value Locked (TVL) within the Morpho lending protocol, cementing its position as the sixth-largest DeFi application by deposited capital.

+17.8%: The week price rally of the MORPHO token following the formal announcement of the Apollo cooperation agreement.

Source: Coingecko

TradFi Giants Bridge the Gap: BlackRock Integrates BUIDL with Uniswap

BlackRock has partnered with Securitize and Uniswap Labs to integrate its BUIDL fund into the UniswapX trading infrastructure. This development transitions institutional tokenization from a static issuance model into a dynamic, liquid on-chain environment. Eligible institutional investors can now trade BUIDL against USDC seamlessly, 24 hours a day, 7 days a week.

Crucially, this integration does not utilize Uniswap's traditional Automated Market Maker (AMM) liquidity pools. Instead, it leverages UniswapX, an off-chain order routing system that settles on-chain. This structural choice is highly deliberate. By utilizing a Request-for-Quote (RFQ) framework, the system routes orders to whitelisted market makers (such as Wintermute and Flowdesk) acting as "solvers." This allows institutions to source the best bilateral exchange rates without their capital ever co-mingling with non-KYC (Know Your Customer) retail funds in a permissionless AMM pool.

The operational mechanics of this integration highlight a sophisticated compromise between regulatory compliance and decentralized efficiency. Securitize acts as the compliance layer, pre-qualifying and whitelisting all participating wallets to ensure strict adherence to securities regulations. Meanwhile, UniswapX acts as the execution layer, providing the rapid settlement, transparency, and continuous uptime inherent to decentralized architecture.

Beyond the technical integration, BlackRock made a profound strategic statement by purchasing an undisclosed amount of UNI governance tokens. This represents BlackRock's first direct financial engagement with a DeFi protocol's native governance structure. It indicates a shift from merely utilizing decentralized software as a passive service provider to actively acquiring a vested interest in the underlying network's future development and value accrual mechanisms.

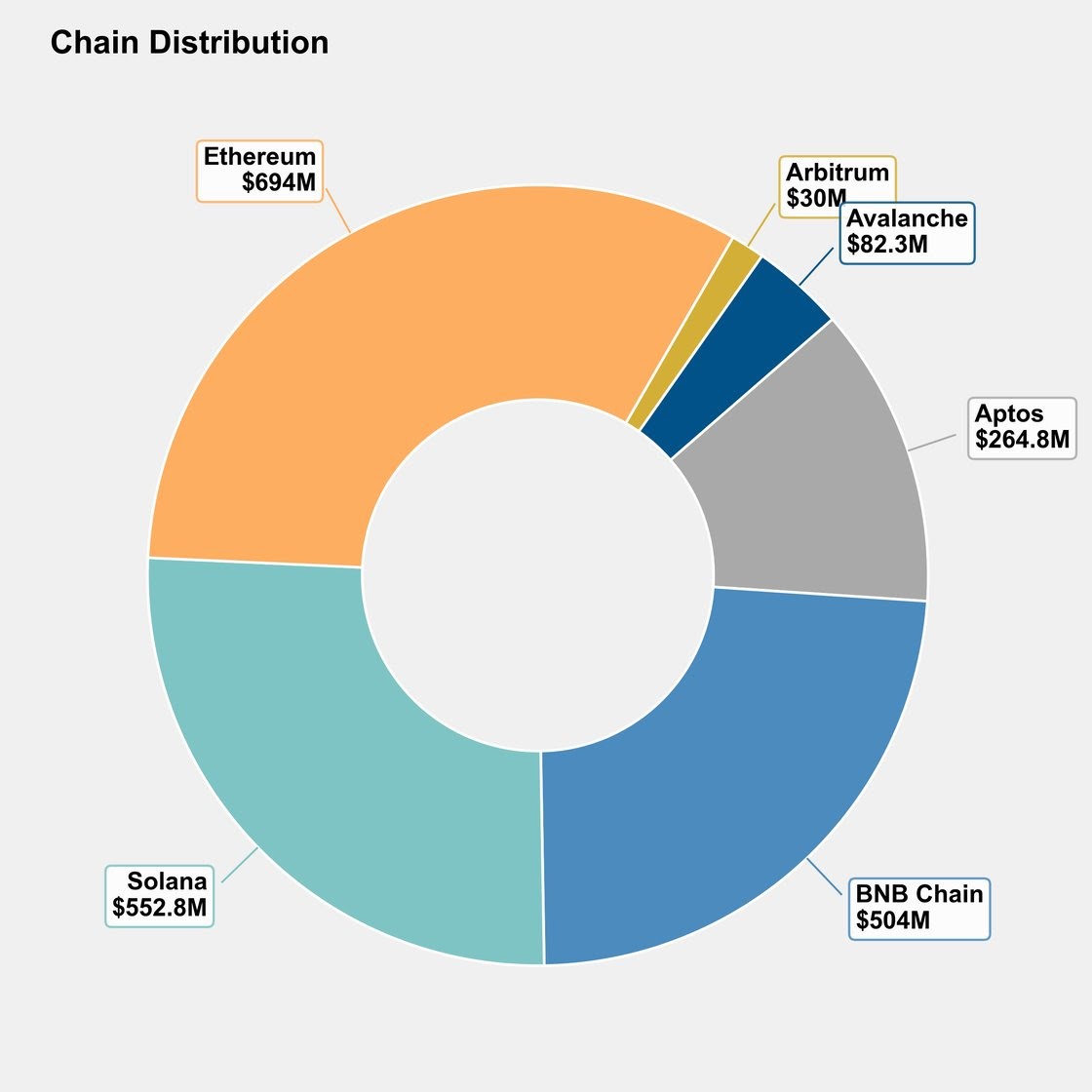

BUIDL chain distribution. Source: rwa.xyz

Apollo Taps Morpho for On-Chain Lending Markets

Parallel to BlackRock’s advancements in decentralized exchange infrastructure, Apollo Global Management has made a decisive entry into decentralized credit. The $940 billion asset manager signed a formal cooperation agreement with Morpho, a premier decentralized lending platform, to support and scale on-chain lending markets. This partnership represents a massive evolution from TradFi firms merely exploring blockchain to actively deploying capital programmatically within DeFi credit protocols.

The centerpiece of this agreement is Apollo’s commitment to acquiring a massive stake in the protocol's governance. Over the next 48 months, Apollo and its affiliates can acquire up to 90 million MORPHO tokens through a combination of open-market purchases and Over-The-Counter (OTC) transactions. By structuring the acquisition with strict ownership caps and transfer restrictions, Apollo is signaling a long-term strategic alignment with the Morpho ecosystem rather than a short-term speculative trade.

The selection of Morpho as the lending protocol is rooted at its underlying architecture. Traditional DeFi lending platforms utilize a pooled-risk model, where adding a new collateral asset requires a decentralized governance vote. Morpho, conversely, features permissionless market creation. This allows anyone, including an institutional giant like Apollo, to instantly spin up isolated, custom lending pairs and curator-managed vaults without waiting for DAO approval.

This isolated risk architecture is fundamentally better suited for traditional asset managers. It allows Apollo to integrate its own tokenized private credit funds or specialized RWAs into bespoke lending pools. Institutional lenders can precisely control their risk parameters, tailoring collateral ratios and interest rate curves to their specific compliance and risk frameworks, all while utilizing Morpho's highly efficient, immutable smart contract infrastructure.

The Strategic Overlap: Wall Street is Buying Governance

When synthesizing BlackRock’s Uniswap integration and Apollo’s Morpho agreement, a clear and highly consequential trend emerges: Wall Street is no longer afraid of governance tokens. Historically, traditional financial institutions have strictly avoided direct interaction with DeFi utility and governance tokens due to acute regulatory anxieties regarding unregistered securities.

The fact that the world's largest asset manager (BlackRock) and a premier private equity powerhouse (Apollo) are now openly acquiring UNI and MORPHO tokens suggests a radical shift in institutional legal confidence. These firms possess the most conservative, highly resourced compliance departments on the planet. Their willingness to buy into DeFi governance implies that they view these assets as essential infrastructure stakes—analogous to holding equity in a clearinghouse or a traditional exchange network.

Furthermore, these moves validate the core thesis of the DeFi power-user: capital efficiency rules all. Traditional markets are burdened by T+1 or T+2 settlement times, fragmented liquidity, and siloed credit facilities. By plugging tokenized Treasuries (BUIDL) into decentralized routing (UniswapX) and building structured credit on permissionless rails (Morpho), institutions are actively upgrading their operational efficiency. They are successfully bridging the gap between the predictable yield generation of traditional finance and the liquid, composable nature of crypto.

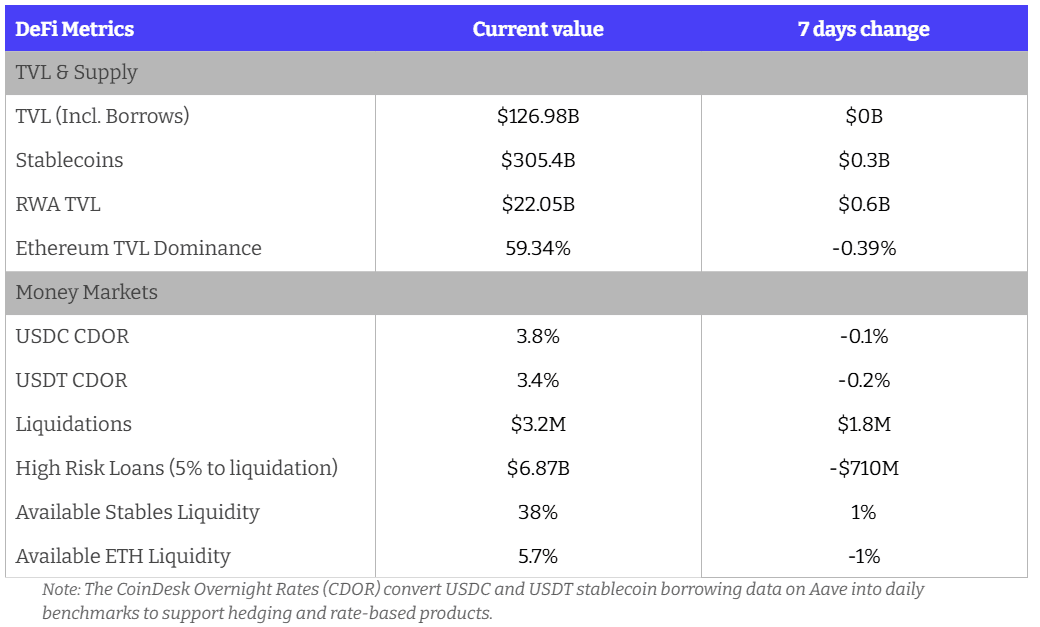

Key Weekly DeFi Metrics

Key takeaways for this week:

TVL and Supply remains flat as markets continue to chop

$700M decrease in highrisk loans, driven by repayments in leveraged restaking

Analysis of the Negative Carry Environment in Leveraged ETH Restaking

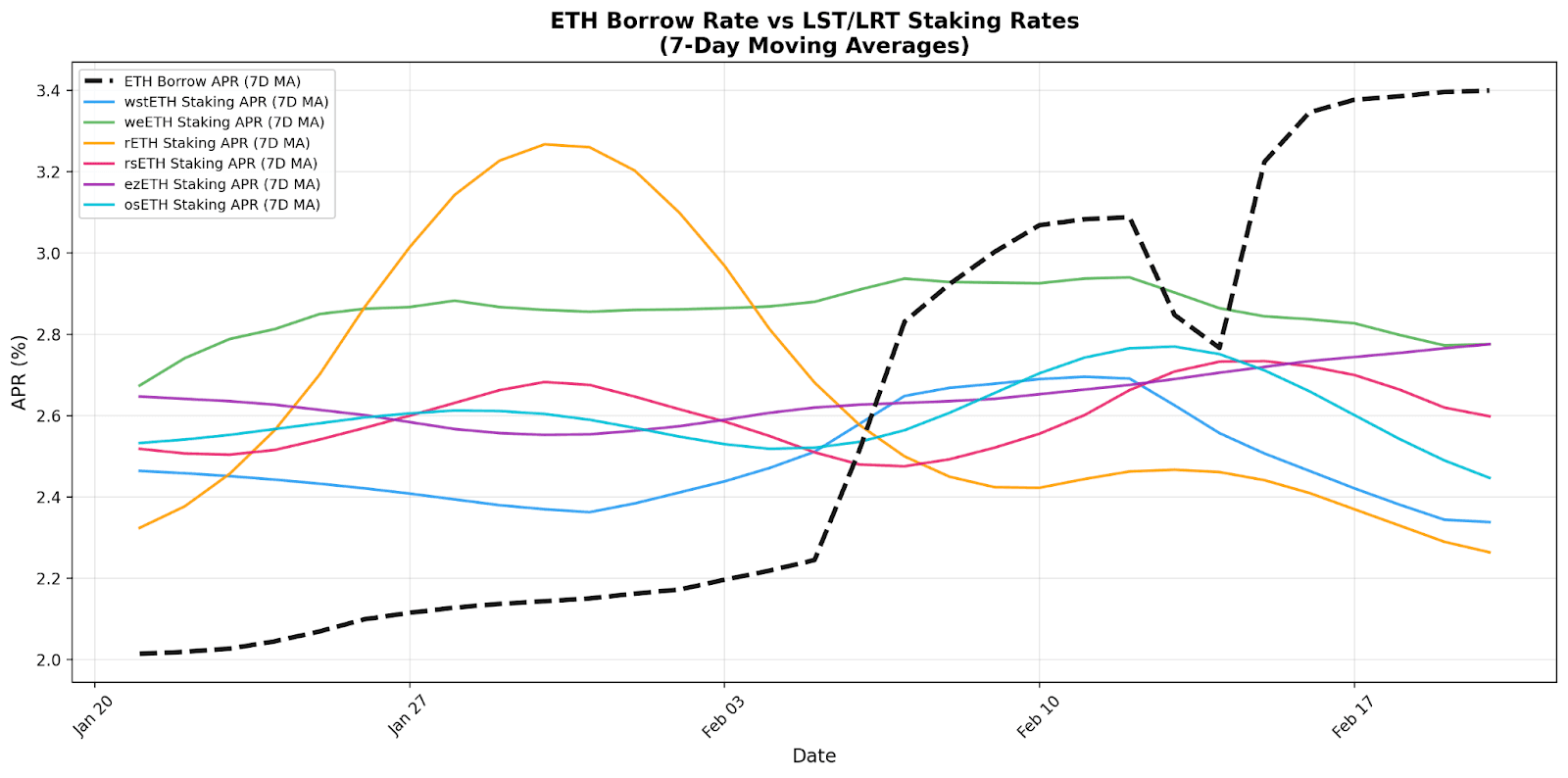

The decentralized finance (DeFi) leveraged staking carry trade,a strategy involving borrowing ETH to capture spreads on liquid staking and restaking protocols, has transitioned into a state of negative carry. As of February 20, 2026, the debt-weighted average cost of borrowing ETH (3.40%) exceeds the staking yields of all major Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) in our coverage universe.

The Structural Crossover

The provided chart illustrates the divergence between borrowing costs and protocol yields throughout the first quarter of 2026. The black dashed line, representing the 7-day moving average of the debt-weighted ETH borrow rate, shows a steady incline from approximately 2.0% in late January. By mid-February, this rate crossed above the yields of all sampled LSTs and LRTs (indicated by the colored lines), creating a persistent negative spread. This trend reflects a structural maturation of the staking ecosystem, where increased validator participation dilutes yields while high utilization in lending markets drives up capital costs.

Source: Sentora Risk Radar and DefiLlama

Impact on Leveraged Positions

The inversion of the unlevered spread creates significant headwinds for institutional strategies employing recursive loops. For a standard 5x leveraged position in wstETH, the current spread translates to an estimated -1.90% annualized return. During peak utilization events where borrow rates have historically spiked above 6%, these annualized losses can expand to the -15% to -18% range. The asymmetry of the trade is a primary risk factor: while staking yields face a structural ceiling, borrowing costs are theoretically unbounded as utilization approaches 100%.

Liquidity and Execution Risks

Exiting these positions is complicated by a duration mismatch between instantaneous borrow rate volatility and prolonged redemption timelines:

Secondary Market Depth: Liquidity-to-TVL ratios for many LRTs remain low (e.g., 0.035% for weETH), necessitating protocol-level redemptions for large-scale deleveraging to avoid prohibitive slippage.

Duration Mismatch: Native redemptions currently require from 9 days for the beacon chain to longer depending on the liquid staking protocol.

Compounding Costs: Borrowers remain exposed to market interest rates during the multi-week withdrawal period, often resulting in capital erosion that compounds throughout the exit process.

Systemic Concentration: Given the high concentration of ETH borrowing for carry trade purposes, a synchronized deleveraging event could lead to further utilization spikes and secondary market volatility.

EXPLORE MORE ARTICLES