TLDR

This article continues the ideas from a previous piece titled “The Tokenization of Equities and Perpetual Futures: A Multi Trillion Dollar Disruption.” It outlines a shift in which tokenized equities and perpetual futures (perps) could weaken traditional prime brokerage, unlocking trillions in liquidity, borrowing capacity, and yield for retail investors. It highlights how tokenized stocks enable DeFi integration, such as depositing them into protocols like Morpho or Euler to borrow stablecoins without selling holdings, while perps reduce reliance on expensive stock borrowing for shorting.

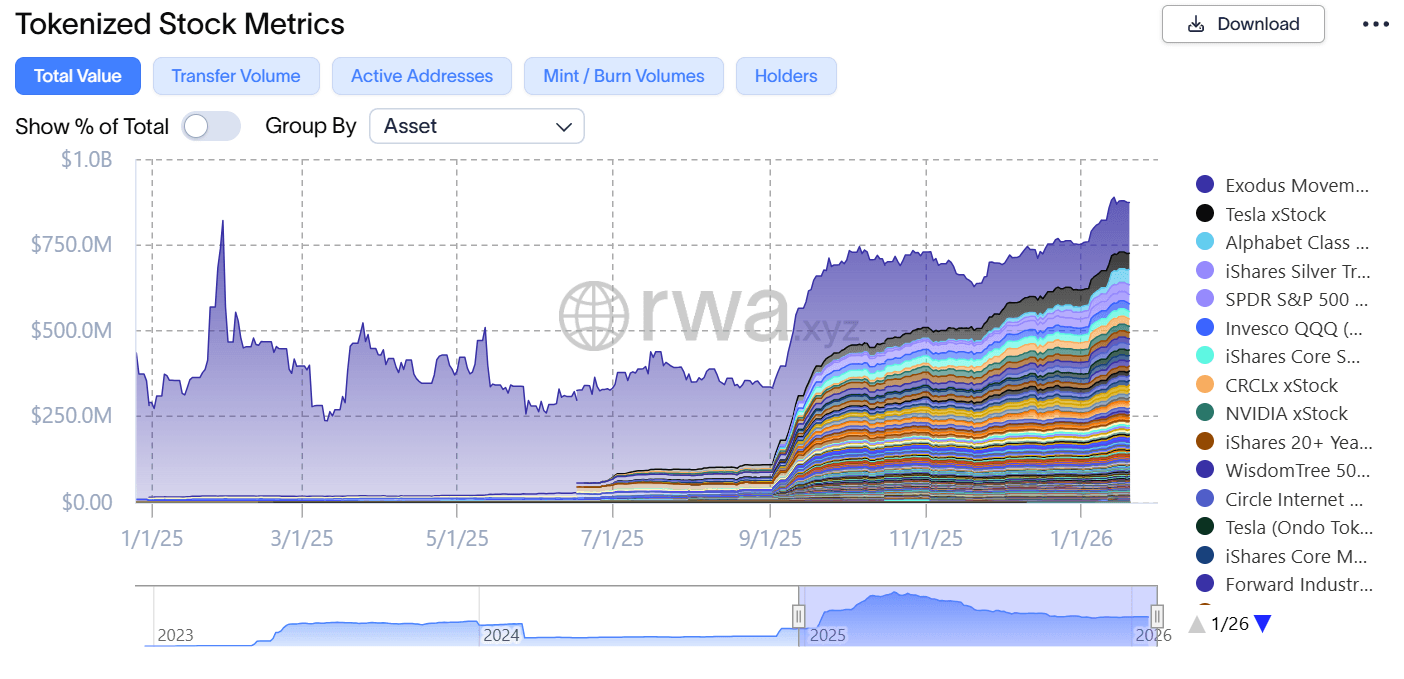

Fast forward to early 2026: Tokenized equities have advanced from experimental proofs of concept to institutional grade products. As a result, the onchain real world asset (RWA) market, excluding stablecoins, surpassed $20 billion by January 2026, while tokenized stocks reached a combined market cap of nearly $1 billion and continue to grow rapidly. This surge is driven by platforms like Backed Finance’s xStocks (integrated deeply with Kraken), Ondo Finance’s Global Markets, and emerging offerings from Securitize. Accordingly, tokenized versions of blue chip stocks (e.g., TSLAx, AAPLx, NVDAx) and ETFs (e.g., SPYx) now deliver 24/7 trading, fractional ownership, and onchain settlement, with billions in trading volume on exchanges such as Kraken and Bitget.

Tokenized Stock Market Cap - RWA.xyz

The next big breakthrough is seamless DeFi borrowing against tokenized equities. Retail investors could transfer traditional stocks to a crypto native platform, click one button to borrow stablecoins, and access liquidity without liquidation. The process, tokenizing shares, depositing them in a DeFi vault, and enabling collateralized borrowing, would be fully abstracted, making it easy for users.

This product would give margin-like access to all. A user with $100,000 in tokenized Apple shares could borrow $70,000 in stablecoins at a 70% loan-to-value ratio. They could earn yield on their collateral or use the stablecoins elsewhere in DeFi, while retaining stock exposure.

Steps Required to Make This Vision a Reality

Regulatory clarity and compliant tokenization frameworks

Advance regulated issuance of tokenized equities that represent direct (not synthetic) ownership or full economic rights, including dividends and voting where applicable.

Platforms like Securitize plan to offer compliant onchain stocks in 2026, while xStocks (via Backed and Kraken) and Ondo offerings provide mirrored exposure. Full regulatory approval (e.g., SEC for U.S. facing products) is essential for mainstream adoption and to avoid gray area restrictions.

Seamless custody transfer and onchain bridging

Enable easy movement of traditional shares from brokers (e.g., Morgan Stanley, Fidelity) to crypto platforms like Kraken. This requires partnerships for in kind transfers, meaning transferring assets without converting to cash, or redemption mechanisms in which users deposit fiat currency and receive tokenized versions 1:1.

Kraken’s xStocks integration already supports this for non U.S. users, issuing tokenized assets, digital representations of traditional shares, on blockchains such as Solana, TON, and Ethereum.

Integration of tokenized equities as DeFi collateral

DeFi protocols need to list tokenized stocks as collateral. This requires oracles for pricing, risk parameters (LTV, liquidation), and overcollateralization to address volatility.

Abstracted user experience via one click products

Build front end interfaces or wallets (e.g., integrated into Kraken or Telegram’s TON Wallet) where users transfer stocks, click “Borrow Stables,” and receive funds instantly. Smart contracts handle tokenization, vault deposit, and borrowing behind the scenes. This requires user-friendly wallets, automated compliance checks (KYC and AML where needed), and seamless on- and off-ramps.

Risk management and infrastructure upgrades

Implement robust oracles (data providers for smart contracts), insurance funds (pools covering losses from adverse events), and liquidation mechanisms (processes for selling assets to cover debts) to mitigate stock price declines.

Liquidations need to be structured so tokenized stocks deployed in DeFi can be quickly unwrapped and sold on TradFi exchanges. This is a key development, and it bypasses the current structure of seeding liquidity pools for liquidations. onchain trading of stocks will grow over time, but in the short term, for this product to succeed, liquidations need to occur where liquidity is highest.

Current Gaps and the Biggest Obstacle

Tokenized equities have grown: xStocks by Backed recorded billions in volume, and RWAs hit $20 to $30 billion TVL. Still, the product vision faces key hurdles:

Regulatory fragmentation

U.S. users are largely restricted (e.g., xStocks geo blocked in the USA), with full shareholder rights and compliant issuance still emerging. Global variations complicate seamless access.

DeFi integration is limited

Tokenized stocks are traded on exchanges or onchain, but using them as collateral in major DeFi protocols is rare. Most RWA collateral today is in treasuries or private credit, not equities.

Fragmented Liquidity

Liquidity is growing, but secondary markets for tokenized equities are still fragmented across chains and exchanges. They have lower turnover than traditional stocks.

Converting Real Shares into DeFi Collateral

The main obstacle is the lack of a simple way to swap fully owned traditional shares for tokenized versions usable in DeFi. Retail holders cannot easily move brokerage stocks (e.g., Morgan Stanley) into a tokenized form suitable as DeFi collateral. Current offerings like xStocks or Ondo provide tokenized exposure, often synthetic or custodial, but do not permit direct conversion of existing owned shares without selling, rebuying, or using complex redemptions. This creates friction: users must liquidate holdings, incur taxes and fees, or buy tokenized versions separately, defeating the “borrow without selling” promise.

Bridging this gap requires broker and crypto platform partnerships for in kind transfers, regulated custodians to hold underlying shares while issuing tokens, and protocols to accept these as verifiable collateral. Until this is solved, the one click borrowing dream stays out of reach for most retail equity holders, limiting the disruption to crypto native users rather than the broader $50 trillion retail equity base.

The tokenized equities revolution is accelerating in 2026 (The Year of Tokenized Equities), but realizing retail borrowing against stocks demands closing the custody to token swap gap. Once achieved, it could unlock trillions in underutilized collateral, redirecting yields and liquidity from centralized brokers to decentralized systems. The infrastructure is being built, and the final bridge is the key unlock.

Sentora is heavily invested in this opportunity and actively progressing work in this area. As part of our roadmap, we expect to roll out an initial set of capabilities next month that expand support across multiple tokenized-stock implementations. While this won’t represent the full end-state outlined above, it’s an important early milestone and a foundational step toward the broader vision. Slow at first,then all at once.

~ ADM

EXPLORE MORE ARTICLES