The Integration: Equities Go Native

The gap between on-chain capital and traditional equity markets just narrowed significantly.

MetaMask announced a direct integration with Ondo Finance, enabling users to swap into tokenized U.S. stocks and ETFs directly within the wallet interface. While RWAs have been the dominant narrative of the 2025–2026 cycle, this integration marks a pivot from institutional permissioned environments to retail-accessible infrastructure.

Powered by Ondo Global Markets (Ondo GM), this feature allows eligible non-U.S. institutions and individuals to trade assets like SPY (S&P 500), QQQ (Nasdaq-100), and single-name stocks (e.g., Tesla, NVIDIA) on the Ethereum mainnet.

By the Numbers: Liquidity & Scale

Ondo has effectively decoupled from broader altcoin volatility, cementing itself as critical infrastructure. The protocol’s metrics underscore demand for yield-bearing, off-chain collateral:

TVL: Ondo Finance has surpassed $2.5B in TVL, with Ondo Global Markets contributing $500M+ rapidly since inception.

Asset depth: Launch support includes 200+ securities, spanning major U.S. equities and commodities.

Availability: Trading is open 24/5 (Sunday 8:05 PM ET to Friday 7:59 PM ET), bridging crypto’s 24/7 nature with TradFi market hours.

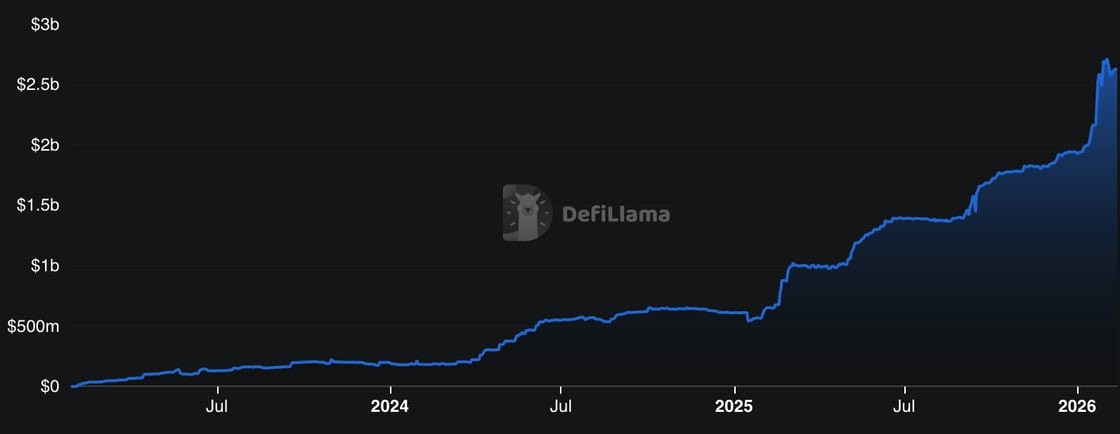

Chart: Ondo TVL (Source: DeFiLlama)

While broad market liquidity has remained choppy throughout Q1 2026, Ondo’s TVL has charted a nearly vertical ascent. This confirms a clear capital rotation: stablecoin liquidity is moving out of idle wallets and into yield-bearing, regulated collateral.

Mechanism: How It Works

This integration uses MetaMask Swaps (native aggregation), meaning users can swap directly in the wallet without connecting to a dApp or signing external permissions.

Custody & settlement: Users hold GM tokens (e.g., SPYon, TSLAon) representing economic exposure to the underlying assets.

Backing: Assets are fully backed 1:1 by securities held at regulated U.S. broker-dealers.

Atomic swaps: Immediate on-chain settlement, eliminating T+1/T+2 settlement cycles common in TradFi.

Strategic Analysis: Why This Matters

The key here is distribution leverage. Until now, RWA protocols faced a “walled garden” problem: users had to actively seek out platforms like Ondo, Securitize, or Centrifuge.

By integrating into MetaMask, Ondo taps the largest active user base in Web3 and reduces acquisition friction to near-zero. Tokenized stocks shift from a niche institutional product into a composable DeFi primitive accessible to power users.

DeFi utility is arriving fast: This Wednesday, Sentora, Ondo, Chainlink, and Euler announced the first DeFi application for Ondo’s tokenized stocks (SPY, QQQ, TSLA) on Ethereum, using Chainlink price feeds to enable lending markets.

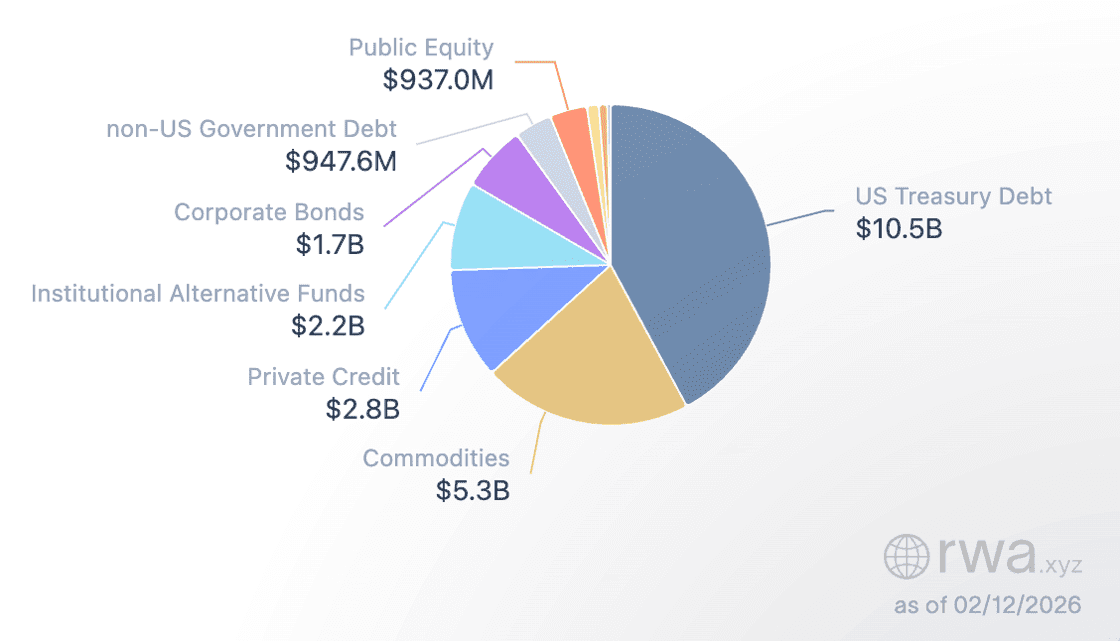

Contextualizing this integration requires looking at the current RWA sector breakdown

Chart: RWA sector breakdown (Source: rwa.xyz)

While tokenized U.S. Treasuries still dominate market cap, equities are the fastest-growing vertical. The MetaMask integration removes a major distribution bottleneck for equities, potentially accelerating a shift from low-risk government debt to risk-on equity exposure through 2026.

This trend was reinforced immediately with Sentora-managed markets on Euler v2 via STEY, enabling permissionless lending markets where users can deposit Ondo’s tokenized equities (e.g., $SPY, $QQQ) as collateral to borrow PYUSD, with risk parameters curated by Sentora.

These developments are a clear signal: 2026 is the year of RWA utility, moving beyond simple treasury yields into complex equity trading and collateralization.

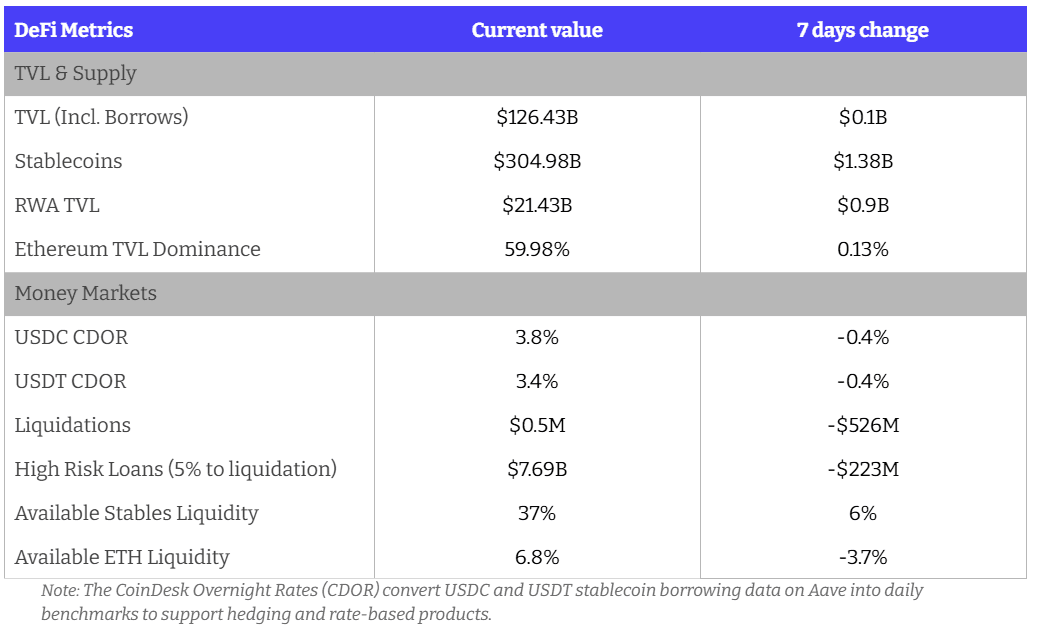

Key Weekly DeFi Metrics

Key takeaways:

TVL and supply have stabilized and started growing again after a major drawdown

RWA TVL continues to ratchet up with nearly $1B gained over last week

Divergence in available liquidity in stables vs. ETH continues to widen, signaling a shift in market dynamics

The Compression of Stablecoin Lending Rates

Stablecoin borrow rates in DeFi have compressed from 8–12% to 3–6% over the past year. This is driven by a maturing market where high capital inflows and protocol competition meet subdued on-chain borrowing demand. The edge once found in passive lending has evaporated, pushing yield-seekers toward more complex strategies (recursive lending, basis trades, and other off-chain approaches).

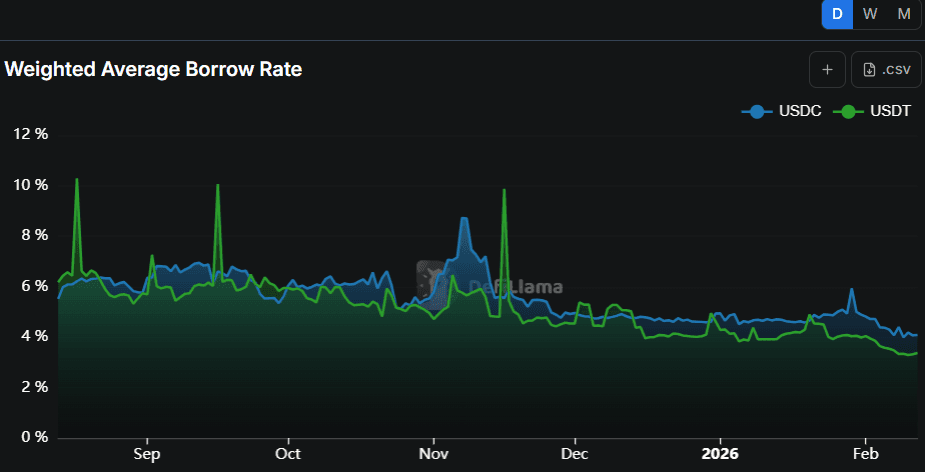

Borrow rates (Source: DeFiLlama)

Borrowers benefit: Lower carry costs make it cheaper to fund directional trades, delta-neutral strategies, and “looping” (leveraging crypto collateral to borrow stables for higher-yield redeployment). For institutions, however, thinner margins increase the relative impact of smart contract and liquidation risks—raising the premium on robust risk infrastructure and active curation.

Outlook: Rate compression likely persists due to an abundance of stablecoins. As RWAs (e.g., tokenized Treasuries) continue to supply capital independent of crypto sentiment, rates should remain suppressed until a sustained market reversal reignites demand for speculative leverage.

Key Points

Rate compression: Base supply rates on major protocols have dropped materially (now largely 3–6%) as liquidity outpaces borrowing demand.

Strategy evolution: Passive lending is no longer optimal—investors are shifting toward layered strategies and isolated markets for incremental yield via nuanced risk underwriting.

Borrower advantage: Lower borrow costs improve breakeven thresholds for leveraged exposure to assets like ETH and BTC.

Risk sensitivity: With lower yields, the “cost” of a single exploit or bad debt event is proportionally higher—active management matters more.

RWA impact: Growth of RWA-backed stablecoins creates structural oversupply, keeping rates low and partially decoupling capital availability from crypto cycles.

EXPLORE MORE ARTICLES