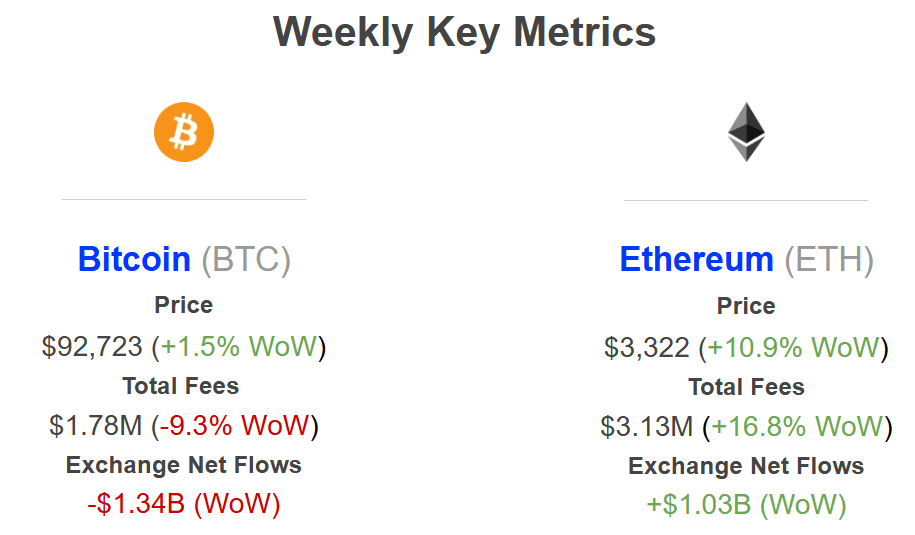

Weekly Key Metrics

Network Fees

Bitcoin: On-chain fees declined by -9.3% to $1.78 million, diverging from the asset’s steady +1.5% price action. This indicates that the $92k price level is being sustained without network congestion, suggesting efficient market activity driven by spot demand rather than frantic on-chain speculation.

Ethereum: Fees surged +16.8% to $3.13 million, closely tracking the +10.9% price rally. Unlike Bitcoin, this correlation signals that the price appreciation is supported by a genuine uptick in on-chain utilization and demand, verifying the network’s activity level is rising alongside valuation.

Exchange Netflows

BTC: A strong accumulation trend has emerged with -$1.34 billion in net outflows from exchanges. This withdrawal of supply suggests high conviction among holders to self-custody at these highs, significantly reducing immediate sell pressure and tightening the liquid supply.

ETH: In contrast to Bitcoin, Ethereum saw +$1.03 billion in net inflows, signaling a shift toward liquidity. Users appear to be moving assets onto exchanges to capitalize on the recent double-digit rally, potentially setting up a supply overhang as traders position themselves to take profits.

BlackRock Launches Staked ETH ETF (ETHB)

The race for yield is on. On Friday, December 8, BlackRock filed an S-1 registration statement with the SEC for the “iShares Staked Ethereum Trust ETF,” set to trade under the ticker ETHB. This product is distinct from their existing spot ETH ETF (ETHA), offering investors a choice between pure price exposure and a yield-enhanced vehicle.

AUM Dominance: BlackRock’s existing spot fund (ETHA) currently commands ~$17 billion in assets, significantly outpacing competitors.

Flow Dynamics: In the last 7 days, we’ve seen a clear divergence. While legacy products like Grayscale’s ETHE faced redemptions, BlackRock’s ETHA recorded over $230 million in net inflows, peaking with a $56.5 million single-day inflow on December 10.

Yield Spread: With Ethereum staking rewards currently sitting at roughly 2.5% APR and traditional risk-free rates compressing following the Fed’s recent cuts, the spread is becoming increasingly attractive to fixed-income desks.

Key Mechanics

Staking Strategy: The fund aims to stake 70% to 90% of its holdings, leaving a liquidity buffer for redemptions.

Custody & Operations: It utilizes a Multi-Custodian Structure by Coinbase and BNY Mellon and will rely on third-party staking providers rather than running its own validators, mitigating operational centralization risks for the issuer.

Yield Distribution: Rewards will be treated as income, likely paid out monthly, though the exact fee structure remains undisclosed.

Why It Matters

This filing is a direct response to the “carry cost” criticism of spot crypto ETFs. By incorporating staking, BlackRock effectively neutralizes the opportunity cost of holding ETH off-chain. It also signals a large regulatory thaw, allowing crypto-native yields to be packaged into a compliant, Nasdaq-listed wrapper. BlackRock’s first-mover advantage in this specific structure (separate yield vs. spot tickers) allows them to segment the market aggressively.

Source: SoSoValue

Fed Delivers Third Rate Cut. Markets Eye January Pause

The Federal Reserve concluded its December FOMC meeting this Wednesday, delivering a 25 basis point (bps) rate cut. This marks the third reduction in this cycle, effectively lowering the benchmark rate to support a cooling labor market. However, while the cut was widely priced in, the forward-looking data from prediction markets suggests the easing cycle may be taking a breather.

The “Smart Money” Win: It is worth noting the predictive power of decentralized markets. Since late November, Polymarket bettors assigned a >90% probability to this December cut, accurately front-running the official announcement while traditional analyst consensus was far more divided.

Volume: The “Fed Decision: December 2025” market generated almost $400M in volume, indicating high conviction and deep liquidity among traders.

Forward Outlook: The market is heavily skewing toward a pause. Current odds for the January 28, 2026 meeting are:

No Change: 76%

25 bps Decrease: 23%

50+ bps Decrease: 1%

Interpretation

The data indicates a “hawkish cut.” While the Fed eased rates this week, the overwhelming 76% probability of “No Change” in January suggests the market believes the Fed will adopt a “wait and see” approach to assess inflation data in Q1.

Crypto Implications

This creates a nuanced environment:

Short Term (Bullish): The confirmed December cut reduces the cost of leverage. We are likely to see borrowing rates on protocols like Aave and Morpho stabilize as on-chain liquidity deepens.

Medium Term (Caution): If the market prices in a January pause, the “up only” momentum driven by liquidity hopes may stall. A pause often leads to choppy, range-bound price action as traders re-evaluate risk appetite without the immediate dopamine hit of cheap money.

Source: Polymarket

The infrastructure for the next cycle is maturing rapidly. We now have a yield-bearing institutional vehicle (BlackRock Staked ETH) and a supportive, albeit cautious, macroeconomic backdrop (Fed Cuts). The data suggests that while the path of least resistance is up, the January rate pause could act as a temporary ceiling on aggressive expansion.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

EXPLORE MORE ARTICLES