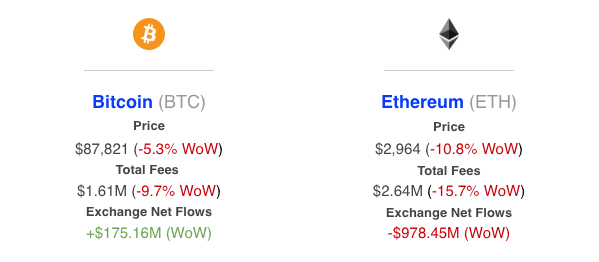

Weekly Key Metrics

Network Fees

Bitcoin: On-chain fees declined by -9.7% to $1.61 million, closely tracking the asset’s -5.3% price correction. This correlation indicates a cooling in on-chain activity consistent with the market pullback, suggesting reduced demand for blockspace as speculative volume temporarily subsides.

Ethereum: Fees saw a sharper retraction, dropping -15.7% to $2.64 million alongside a -10.8% price slump. Despite the reduced revenue, the network continues to generate higher fees than Bitcoin, maintaining its baseline demand as the primary utility layer even during periods of broad market weakness.

Exchange Netflows

BTC: A shift toward liquidity is visible with +$175.16 million in net inflows to exchanges. While not massive, this positive flow suggests some holders are positioning assets for potential sale or hedging during the downturn, adding moderate supply pressure to the order books.

ETH: In stark contrast to its price action, Ethereum recorded massive net outflows of -$978.45 million. This signals aggressive accumulation where investors are likely “buying the dip” and withdrawing assets to cold storage or on-chain environments, tightening the liquid supply despite the negative price momentum.

JPMorgan’s “Public Chain” Pivot: A Double-Header Week

For years, the banking sector’s blockchain thesis relied on “permissioned” gardens -walled-off private networks like Onyx (now Kinexys). This week, that thesis shifted radically. JPMorgan executed two major public-chain plays, signaling that liquidity and composability on public networks now outweigh the perceived safety of private silos.

The Launch of “MONY” on Ethereum

On Tuesday (Dec 16), JPMorgan Asset Management officially opened access to its first tokenized money market fund on the Ethereum mainnet: the My OnChain Net Yield Fund (MONY).

The Structure: The fund is seeded with $100 million of the bank’s own capital. It operates as a Rule 506(c) private placement, accessible only to qualified investors via the Morgan Money platform.

The Asset: It invests strictly in U.S. Treasuries and fully collateralized repos, offering daily dividend reinvestment.

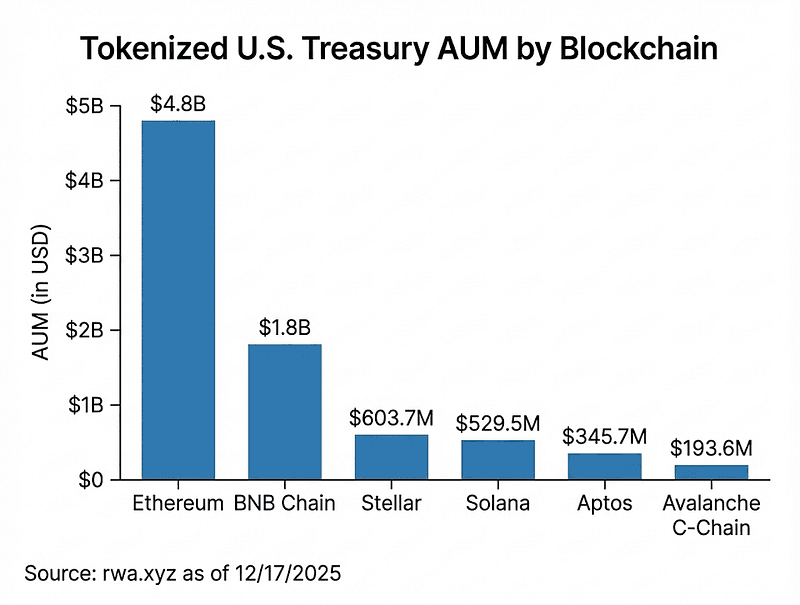

The Shift: Unlike previous pilots on private Quorum chains, MONY lives on public Ethereum. This aligns JPMorgan with BlackRock’s BUIDL (also on Ethereum), acknowledging that the future of RWA (Real World Assets) requires the deep liquidity and interoperability of the world’s largest smart contract network.

Commercial Paper Issuance on Solana

Just days prior (Dec 11), JPMorgan arranged a $50 million commercial paper issuance for Galaxy Digital on the Solana blockchain — a first for the bank on this high-throughput network.

The Mechanics: The debt instrument was issued by Galaxy Digital, structured by JPMorgan, and purchased by Coinbase and Franklin Templeton.

Settlement: The entire transaction settled via Delivery-versus-Payment (DvP) using USDC stablecoins.

Why Solana? JPMorgan’s Digital Assets team cited Solana’s high throughput and low latency as critical for high-frequency financial instruments. This validates Solana not just as a “retail casino” but as viable rails for institutional wholesale finance.

The Takeaway: The “Intranet vs. Internet” debate for banks is settling. By deploying on both Ethereum (for asset depth) and Solana (for settlement speed), JPMorgan is adopting a pragmatic, multi-chain strategy. They are no longer building alternatives to public chains; they are building on top of them.

Tokenized U.S. Treasury AUM by Blockchain. Source: RWA.xyz

XRP ETF Inflows Signal Institutional Appetite

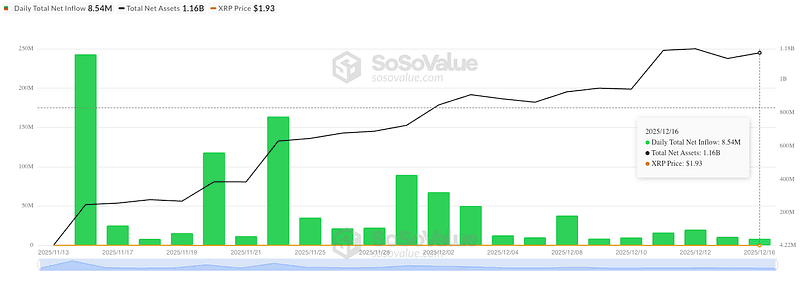

While price action remains choppy, capital flows tell a bullish story. As of the day of writing (Dec 17), spot XRP ETFs have officially surpassed $1 billion in net inflows since their launch on November 13, 2025.

The Data

According to SoSoValue data, U.S. spot XRP ETFs have recorded 30 consecutive days of net inflows — a “green streak” that even Bitcoin ETFs struggled to maintain in their early months.

Total Net Inflows: >$1.18 Billion (Cumulative).

Key Issuers: Canary Capital (first mover), Bitwise, Franklin Templeton (XRPZ), and Grayscale.

Relative Strength: In the last 7 days, while Bitcoin and Ethereum ETFs saw mixed flows due to macro-hedging, XRP products attracted steady capital. For instance, on Dec 15 alone, XRP ETFs added $20.2M while ETH products saw outflows.

The Divergence

There is a stark disconnect between flows and price.

Flows: Massive buy-side pressure from institutional products.

Price: XRP is trading below the psychological $2.00 level (currently ~$1.80-$2.00 range), down ~30% from recent highs.

This divergence suggests that ETF buyers are making long-term structural allocations rather than chasing short-term momentum. Investors are likely positioning for the utility of Ripple’s RLUSD stablecoin and the clarity of post-2025 U.S. crypto regulations.

XRP ETF daily net flows. Source: SoSoValue

The infrastructure for the next cycle is being finalized. When the largest U.S. bank seeds a fund on Ethereum and settles debt on Solana in the same week, the “risk” of using public blockchains has officially been repriced by Wall Street. Meanwhile, the $1B inflow into XRP products proves that demand for diversified crypto exposure extends well beyond BTC and ETH.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

EXPLORE MORE ARTICLES