Introduction

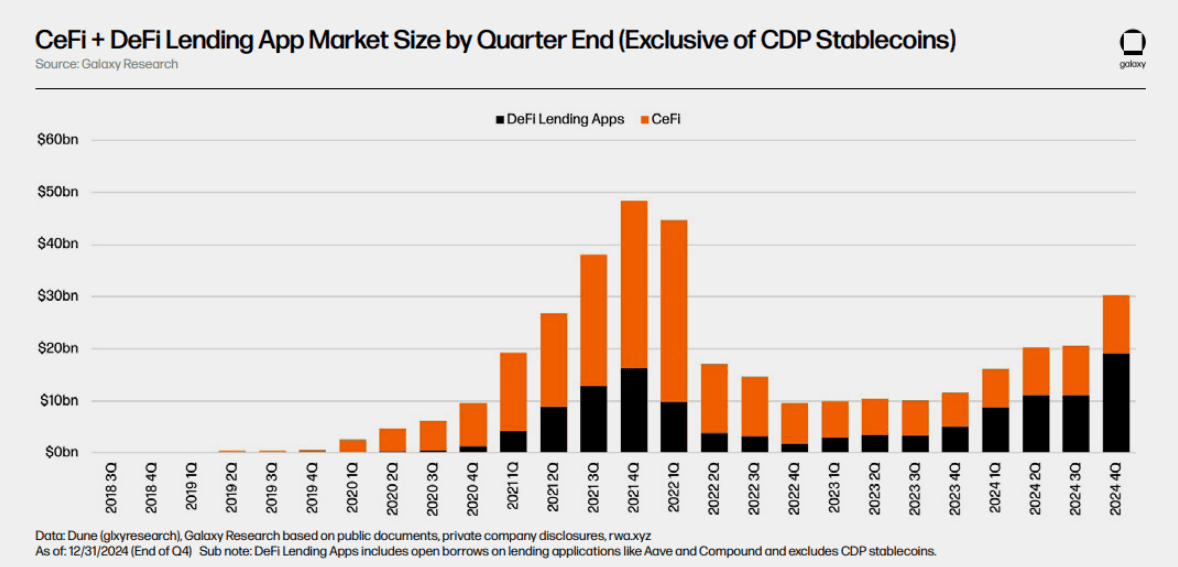

The digital assets market has evolved significantly since the first Bitcoin transaction in 2009, which marked the beginning of a decentralized financial ecosystem, to include digital asset lending. Initially focused on peer-to-peer transactions, the market saw rapid expansion between 2016 and 2018, driven by the rise of initial coin offerings (ICOs) and increasing institutional interest, followed by corrections in 2018-2019 and 2022 -2024 amid regulatory scrutiny, market volatility and the bankruptcies of major market participants like Celsius.

Decentralised vs Centralised

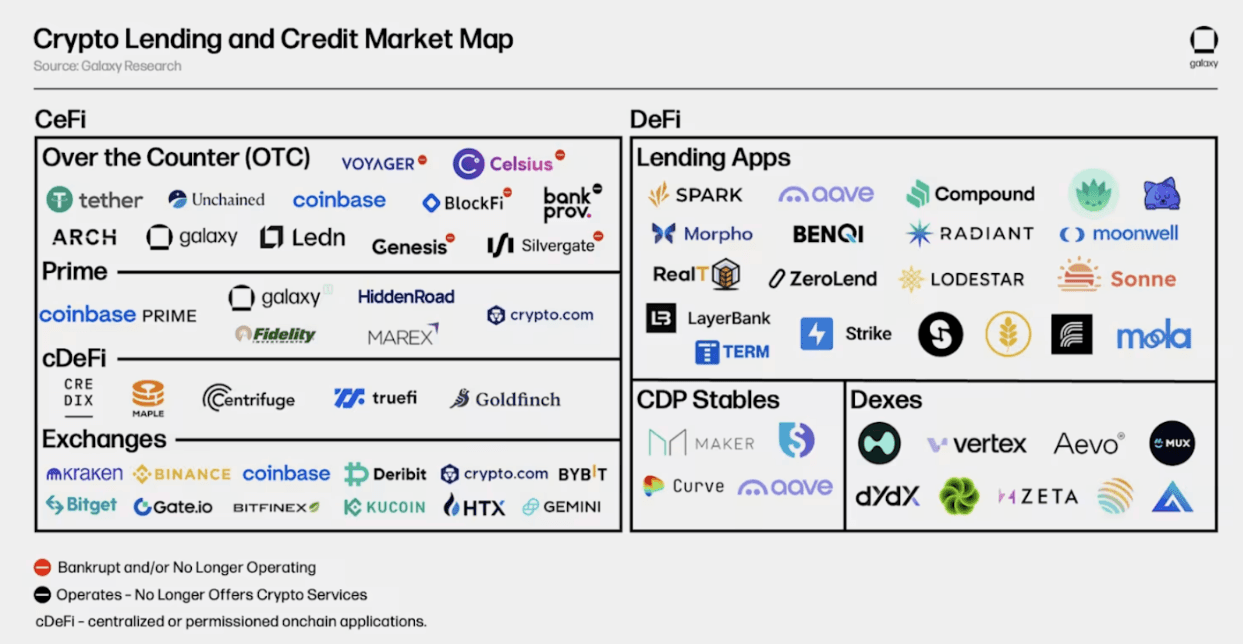

The wholesale market is divided into decentralised lending, which takes place on a permissionless peer-to-peer basis, and centralised lending which happens largely on an OTC basis and is dominated by a number of key intermediaries.

DeFi Lending

By the early 2020s, the emergence of decentralised finance (DeFi) protocols revolutionized lending by enabling automated, blockchain-based loans without traditional intermediaries, allowing users to borrow against collateral like cryptocurrencies while earning yields on deposits.

The lending market plays a key role in providing liquidity to crypto holders, who can access funds without selling their assets, thus avoiding capital gains and other taxes that may be applicable to the sales, while maintaining exposure to the potential price appreciation of their cryptoassets.

Lenders, in turn, generate passive income through interest payments based on rates that often exceed yields in traditional finance markets. However, risks like smart contract vulnerabilities, collateral volatility, and platform insolvencies (e.g., the 2022 collapses of Celsius and FTX) have highlighted the need for market participants to implement and maintain robust risk management processes.

There are also risks that arise when automated liquidation that is a characteristic of DeFi lending meets a sudden significant drop in crypto prices like what occurred on October 10, 2025 when liquidations wiped out to approximately US $20 billion in positions when the price of Bitcoin dropped by approximately 17% in just a few hours, which some attribute to the announcement by President Trump of 100% tariffs on China in response to China’s announced restriction on the export of rare earth minerals.¹

In 2025, the crypto lending sector further matured with increased institutional participation, tokenized assets, and integration with traditional finance, including stablecoin-based loans and securities lending via distributed ledger technology (DLT). Trading volumes remain highly concentrated among top platforms, with ongoing growth fueled by regulatory clarity and innovations like the tokenisation of real-world assets.

Centralised Collateralised Lending

Centralised collateral lending involves intermediary based lending against cryptoassets either between institutional investors or retail investors. Previously, platforms like Celsius and BlockFi, until the downturn in crypto markets that began in 2022, provided a mechanism for retail investors to participate in lending markets.

More recently, with a more crypto friendly regulatory atmosphere in the US since the beginning of 2025, traditional market participants have announced plans to introduce crypto lending product offerings, in some cases in collaboration with crypto native market participants. For example, in October 2025, Coinbase Asset Management and Apollo announced a partnership to develop a lending platform which is expected to be available to clients in 2026.² The platform offerings will include over-collateralised lending against crypto assets using stablecoins. It has been reported that other traditional finance players, like JPMorgan, are also preparing to offer clients collateralized lending opportunities.³

Regulatory Considerations for Banks

One of the key considerations for banks looking to lend against cryptoassets would be the assessment of the regulatory environment in which they currently operate and horizon scanning for potential regulatory developments that may impact forays into cryptoasset lending.

Regulatory considerations include the permissibility of acting as a principal or agent in connection with crypto transactions as well as the permissibility of custodying cryptoassets and other handling of cryptoassets.

With the Trump Administration well into the process of recreating the US into the crypto capital of the world, the federal banking agencies have been active in clarifying the permissibility of activities relating to cryptoassets. For example, the Office of the Comptroller of the Currency (OCC) in March 2025 published an interpretive letter (Interpretive Letter 1183) to clarify the OCC’s stance on the permissibility of banks that it supervises to engage in cryptoasset activities.⁴ Interpretive Letter 1183 reaffirmed that certain cryptoasset activities, including custodying client cryptoassets, were permissible within the federal banking system, but reminded banks that like all other activities, they must conduct all cryptoasset activities in a safe, sound and fair manner.

In April 2025, the Federal Reserve Board and Federal Deposit Insurance Corporation (FDIC) joined the OCC, which had already withdrawn a previous statement which had conclusively stated that “issuing or holding as principal crypto-assets that are issued, stored or transferred on an open, public and/or decentralized network, or similar system is highly likely to be inconsistent with safe and sound banking practices.”⁵ These actions by the Federal banking regulators showcase the agencies’ current focus on enabling a regulatory ecosystem that supports innovation, but one where banks remain vigilant about engaging in all such activities in a safe and sound manner.

As discussed in the paper, Crypto Asset Adoption within the US Banking System - Bank Lending Against Crypto Collateral, banks also need to be aware of the new Basel capital requirements that classify cryptoassets into two main groups, Group 1 cryptoassets (e.g. tokenized real world assets and stablecoins backed by high quality liquid assets) and Group 2 cryptoassets (all other cryptoassets that don’t qualify as Group 1) , and prescribe minimum capital requirements against a bank’s exposure⁶ to those assets. The Basel capital requirements for Group 1 cryptoassets are based on the risk weights of the underlying assets, e.g. for eligible stablecoins, this would include short-dated US government debt. Total bank exposure to Group 2 cryptoassets must not exceed 2% of a bank’s Tier 1 capital. A 1,250% risk weight will be applied to a subset of Group 2 assets and the Basel capital requirement for Group 2 cryptoassets is equal to 100% of the cryptoasset exposure. For example, if a bank lends a customer US $50 million secured by bitcoin, it will have to hold another US $50 million in capital (the Basel risk weight of 1,250% multiplied by $50 million in exposure and then further multiplied by the Basel III minimum total capital adequacy ratio of 8%), in the absence of any hedging that may be permitted under the Basel cryptoasset requirements.

However, the US has not pursued implementation of the Basel standards and in fact provisions within the GENIUS Act seem to limit the applicability of at least one aspect of the Basel cryptoasset standards in the US, i.e. the add-on capital requirement for infrastructure risk, discussed in Crypto Asset Adoption within the US Banking System - Bank Lending Against Crypto Collateral.

Furthermore, the Federal Reserve’s Vice Chair for Supervision, Michelle Bowman, has said that the United States is not adopting the Basel risk weights, calling them “not very realistic”.⁷ More recently, in light of resistance from the US and UK over the exorbitant risk weights for some cryptoassets prescribed by the Basel Committee, the Chair of the Committee, Erik Thedéen, said that a different approach for bank cryptoasset capital requirements was needed, but provided no details on what a new approach would look like.⁸

Custodians

For Sentora’s cryptoasset lending facilities, Kraken, Bitgo and Komainu are the primary custodians for collateral custody, with others available subject to agreement. These are regulated entities specializing in secure storage of cryptoassets, ensuring segregation of assets, compliance with anti-money laundering (AML) standards, and protection against hacks or insolvencies. Below is a brief description of each entity, focusing on their roles in the crypto custody space.

Kraken: Founded in 2011, Kraken is a major US-based cryptocurrency exchange that expanded into institutional custody services. In 2024, it launched a dedicated crypto custody platform targeted at traditional finance firms and institutions, offering secure storage for digital assets with features like offline cold storage and multi-signature wallets. Kraken emphasizes self-custody options, where users control their private keys, but its institutional arm provides third-party safekeeping to mitigate risks. It operates under regulatory oversight and has been recognized for its security protocols amid market volatility.⁹

BitGo: Established in 2013, BitGo is one of the leading regulated crypto custodians, focusing on institutional-grade storage and wallet services. It powers custody for major exchanges and integrates with protocols for native tokens, using advanced security like multi-party computation (MPC) and insurance coverage up to US$250 million. By mid-2025, BitGo's assets under custody exceeded $100 billion, reflecting strong growth in demand for compliant solutions.¹⁰

Komainu: Launched in 2020 as a joint venture among Nomura, Ledger, and CoinShares, Komainu is a regulated cryptoasset custodian providing segregated, blockchain-verifiable storage for institutions. It supports a wide range of assets, including tokenized funds like BlackRock's BUIDL, and focuses on clear asset segregation to protect clients in exchange-traded products (ETPs) and other vehicles. Komainu has expanded through acquisitions and partnerships, such as with CoinShares for ETP custody, and operates under licenses in jurisdictions like the UK and Jersey. It is listed among top custodians alongside BitGo and others in industry reports.¹¹

¹Girimath, Akash, How Crypto Traders Are Positioning Following 'Black-Friday's' Crash, Decrypt (October 12, 2025).

²Coinbase, Coinbase Asset Management and Apollo Partner to Develop Stablecoin Credit Strategies (October 27, 2025).

³Nicolle, Emily and Levitt, Hannah, JPMorgan Plans to Offer Clients Financing Against Crypto ETFs, Bloomberg (June 4, 2025).

⁴See Office of the Comptroller of the Currency, Interpretive Letter 1183: OCC Letter Addressing Certain Crypto-Asset Activities (March 7, 2025).

⁵Board of Governors of the Federal Reserve System, Federal Reserve Board Announces the Withdrawal of Guidance for Banks Related to their Crypto-Asset and Dollar Token Activities and Related Changes to its expectations for these Activities (April 24, 2025); Board of Governors of the Federal Reserve System, the FDIC and OCC, Joint Statement on Crypto-Asset Risks to Banking Organizations (January 3, 2023) (withdrawn April 24, 2025).

⁶References to “exposure” in the Basel Standards include any on or off-balance sheet amounts that give rise to credit, market, operational and/or liquidity risks. The operational risk requirements along with the risk management and supervisory review sections are applicable to a bank’s custody services” (see SCO60.4 of the Basel Cryptoasset Standards).

⁷Arnold, Martin, Global Crypto Rules for Banks Need Reworking, Says Basel Chair, Financial Times (November 19, 2025) and Remarks of Vice Chair Michelle Bowman at the 2025 Santander International Banking Conference (November 4, 2025).

⁸Arnold, Martin, Global Crypto Rules for Banks Need Reworking, Says Basel Chair, Financial Times (November 19, 2025).

⁹MK Manoylov, Kraken's institutional platform debuts custody service named Kraken Custody, The Block, (March 20, 2024).

Tim Ogilvie, Introducing Kraken Institutional, Kraken Blog, (February 27, 2024).

¹⁰Sidhartha Shukla, Crypto firm Bitgo's assets in custody jump to top 100 billion, Bloomberg, (June 24, 2025)

On-Exchange vs. Third-Party Crypto Custody: What Institutions Need to Know , BitGo Blog, (September 22, 2025).

BitGo Expands Services to Enable Seamless and Secure Bitcoin Treasury Adoption, Business Wire, (July 9, 2025).

¹¹ Digital Asset Custodian Komainu Closes $25M Series A to Expand Institutional Custody Offering, Komainu

Staff

Nomura-backed Komainu custody gets $75m in Bitcoin funding, Ledger Insights, (January 16, 2025)

Shanny Basar, Digital Asset Custodian Komainu Plots International Growth, Markets Media, (June 18, 2025)

Komainu Expands Custody Support to Include BlackRock’s BUIDL Token, Komainu

CoinShares picks Komainu as custodian, Asset Servicing Times, (December 3, 2024)

Disclaimer

This document has been prepared by Poseidon Digital Hub (BVI) Ltd (“Sentora” “we,” or “us”) for discussion and/or information purposes only. This document is an indicative summary of the terms and conditions of the transaction(s) described herein. It may be amended, superseded or replaced by subsequent summaries or definitive documentation and should not be relied on. Should a transaction ultimately be entered into between us, the final terms and conditions of the transaction will be set out in full in a binding transaction document and reference and reliance should only be made to such document and not this indicative term sheet.

This document shall not constitute an underwriting commitment, an offer to sell, or the solicitation of an offer to buy any securities, commodities or other instruments, or a recommendation to enter into any transaction by Poseidon Digital Hub (BVI) Ltd or any of its affiliates. Although the indicative information set forth herein is reflective of terms, as of the date of this communication, under which we believe transactions might be structured, no assurance can be given that such a transaction could in fact be executed on the terms set forth herein, whether or not complete, nor is any entity obligated to enter into any transaction.

To the extent that you subsequently enter into a transaction with Poseidon Digital Hub (BVI) Ltd and/or any of its affiliates, you would do so on the basis of transacting with us directly as principal (and not as agent or in any other capacity, fiduciary or otherwise) and no other person would have an interest herein.

All information, terms and pricing set forth herein is indicative and subject to change without notice. Any opinions expressed herein reflect our judgment at the date and time hereof and are subject to change without notice. The information contained in this document has been internally developed or taken from trade and statistical services and other sources which we deem reliable, but no warranty or representation is made that such information is accurate or complete and it should not be relied on by any other party.

Transactions of the type described herein may involve a high degree of risk, and the value of such instruments may be highly volatile. Such risks may include without limitation risk of adverse or unanticipated market developments, risk of issuer default, risk of volatility and risk of illiquidity. In certain transactions counterparties may lose their entire investment or incur an unlimited loss.

This brief statement does not disclose all the risks and other significant aspects in connection with transactions of the type described herein, and counterparties should ensure that they fully understand the terms of the transaction, including the relevant risk factors relating to any legal, tax, regulatory and accounting considerations applicable to them, prior to transacting. This document does not constitute legal or other advice. No representation is made concerning the legal, tax, regulatory or accounting implications in any applicable jurisdiction and we are not advising you in respect of such matters.

Accordingly you must independently determine, with your own advisors, the appropriateness for you of any such transaction before transacting.

To the fullest extent permissible by law, Poseidon Digital Hub (BVI) Ltd accepts no liability for any loss (including consequential losses) arising from the use of this document or reliance on the information contained herein. Poseidon Digital Hub (BVI) Ltd is acting solely in the capacity of an arm's length contractual counterparty and not in the capacity of your financial adviser or fiduciary.

EXPLORE MORE ARTICLES