In Washington, the Senate Banking Committee finally marked up the Digital Asset Market Clarity Act (CLARITY Act), moving us closer to a statutory regime than ever before. While the 137 proposed amendments signal a contentious floor debate ahead, the bipartisan consensus on the “SEC vs. CFTC” jurisdictional split is now codified in committee text.

Simultaneously, the wholesale infrastructure layer just leveled up. The London Stock Exchange Group (LSEG) and J.P. Morgan’s Kinexys both executed major strategic moves to bring commercial bank money onto shared ledgers.

The common denominator? The Canton Network. We are seeing the formation of a synchronized, privacy-enabled Global Ledger for regulated liabilities. The era of isolated “crypto casinos” is ending; the era of connected global markets is beginning.

Weekly Key Metrics

Weekly key metrics

Network Fees

Bitcoin: On-chain fees saw a slight contraction of -2.2% to $1.60 million, even as price nudged upward by +1.7%. This stability suggests that the current price action is being driven by efficient spot accumulation rather than network congestion, allowing value to accrue without the burden of rising transaction costs.

Ethereum: Fees declined more sharply, dropping -8.8% to $2.45 million, while price remained essentially flat (+0.8%). Despite the reduction, the network continues to generate roughly 1.5x the revenue of Bitcoin, maintaining its baseline demand as a settlement layer even as specific transactional volume softens.

Exchange Netflows

BTC: A massive shift towards accumulation is evident with -$1.65 billion in net outflows from exchanges. This indicates a strong preference for cold storage holding at these price levels, effectively creating a supply shock that removes significant liquidity from the sell-side order books.

ETH: In contrast to Bitcoin, Ethereum experienced +$519.2 million in net inflows to exchanges. This migration of assets onto trading venues hints at potential profit-taking or increased sell-side pressure, presenting a short-term supply overhang relative to BTC’s tightening availability.

Legislative Breakthrough: Senate Markup of the CLARITY Act

On Tuesday, January 13, the Senate Banking Committee held its highly anticipated markup of the Digital Asset Market Clarity Act (CLARITY Act). This is the most significant legislative action since the FIT21 Act passed the House. The markup session underscored a shift in legislative tone: the debate is no longer if crypto should be regulated, but how to tailor the regime for distinct asset classes.

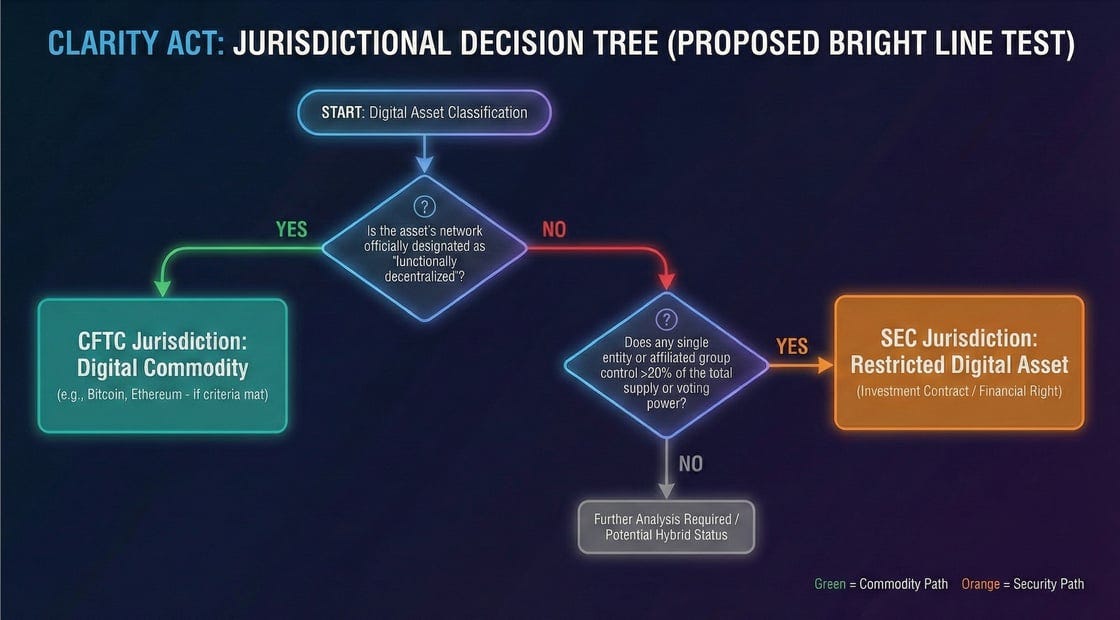

The “Bright Line” Jurisdictional Split

The core value proposition of the CLARITY Act is the establishment of a “bright line” test to determine asset classification, replacing the SEC’s amorphous “crypto asset security” labeling with statutory definitions.

CFTC Jurisdiction: Assets intrinsically linked to “mature” decentralized blockchain systems are classified as Digital Commodities.

SEC Jurisdiction: Assets representing investment contracts or financial rights in centralized entities remain Restricted Digital Assets.

For power users, the most critical development is the protection of code. The bill explicitly distinguishes between software developers (who publish code) and financial intermediaries (who control funds). DeFi protocols that remain truly non-custodial are largely shielded from broker-dealer registration requirements, provided they do not facilitate illicit finance.

CLARITY Act: Proposed Bright Line Test

Key Provisions & The Stablecoin Compromise

The markup revealed intense negotiation regarding stablecoins, resulting in a pragmatic but controversial compromise.

Yield Ban: The draft effectively prohibits stablecoin issuers from paying interest/yield solely for holding the asset. This was a concession to the banking lobby, aimed at preventing non-bank stablecoins from functioning as unregulated demand deposit accounts.

Transaction Rewards: However, issuers can offer incentives tied to transactions or specific programmatic utility. This nuance preserves the “money leg” of DeFi while appeasing prudential regulators.

Illicit Finance: The bill introduces the toughest AML/sanctions framework to date for centralized intermediaries, authorizing the Treasury to target high-risk foreign activity with surgical precision.

The Analyst View: While the bill faces a gauntlet of 137 amendments — ranging from strict environmental reporting to granular custody rules — the momentum is undeniable. The explicit exclusion of software developers from the “financial intermediary” definition is a massive win for the DeFi stack, potentially unleashing a wave of U.S.-based protocol development that has been sidelined by legal uncertainty.

Wholesale Infrastructure: LSEG and J.P. Morgan Expand Digital Rails

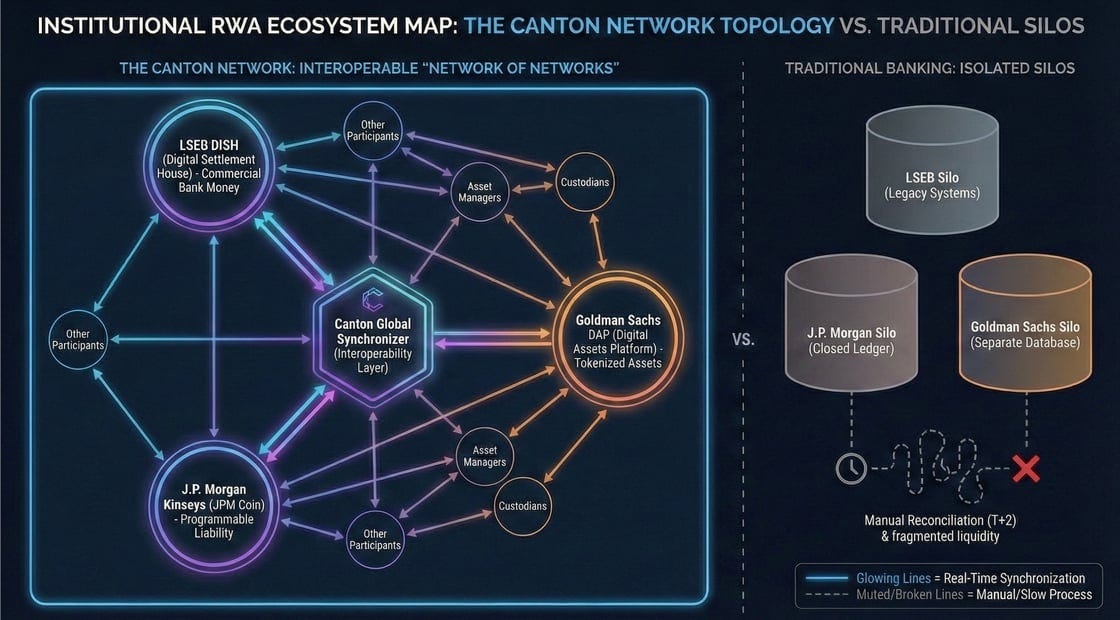

In a coordinated maturation of market structure, two G-SIBs (Global Systemically Important Banks) and infrastructure giants effectively validated the Canton Network as a primary liquidity layer for institutional assets.

LSEG Launches “DiSH” (Digital Settlement House)

Today, January 15, the London Stock Exchange Group announced the go-live of its Digital Settlement House (DiSH). This is not a pilot. It is an open-access platform designed to move commercial bank money natively on-chain.

The Asset: DiSH Cash. Unlike stablecoins (which require reserve backing and operate as bearer assets), DiSH Cash allows commercial bank deposits to be tokenized and settled 24/7.

The Utility: It enables atomic Settlement (PvP and DvP) across both blockchain-based and traditional payment networks.

The Tech: LSEG successfully concluded a Proof-of-Concept on the Canton Network, proving that privacy-enabled blockchains can handle the throughput of global capital markets.

J.P. Morgan’s Kinexys Deploys on Canton

Parallel to LSEG, J.P. Morgan’s Kinexys (formerly Onyx) announced it will issue JPM Coin (JPMD) natively on the Canton Network.

From Private to Privacy-Enabled: Previously, JPM Coin largely lived within J.P. Morgan’s walled garden. Moving it to Canton allows JPMD to interact with assets from other institutions (like Goldman Sachs or BNY) in a synchronized environment.

Liquidity Unlocked: This allows institutional clients to use JPMD for intraday margin, repo settlement, and cross-border payments without leaving the secure Canton ecosystem.

Institutional RWA Ecosystem Map

Why This Matters: The “Synchronization” Thesis

We are witnessing the death of “reconciliation.” In traditional finance, LSEG and JPM would maintain separate ledgers, reconciling trades T+2. By converging on Canton:

LSEG DiSH provides the settlement engine.

Kinexys provides the programmable liability (cash).

Smart Contracts execute the trade atomically.

This reduces counterparty risk to near zero and frees up billions in trapped collateral. For the crypto-native, this validates the Real World Asset (RWA) thesis but with a twist: the “assets” aren’t coming to public chains like Ethereum Mainnet yet; they are aggregating on privacy-enabled institutional chains that can interoperate.

The last seven days have provided the two missing pillars for a mature digital asset market: Regulatory Clarity and Institutional Settlement Rails. The Senate’s markup of the CLARITY Act suggests that the U.S. is finally building a regulatory moat that accommodates innovation. Meanwhile, LSEG and J.P. Morgan are proving that blockchain’s “killer app” for institutions is not speculation, but synchronization — moving cash and assets simultaneously, 24/7.

Key Takeaway: Watch the “DiSH Cash” adoption metrics closely. If LSEG successfully routes significant FX volume through this rail, it validates the “Tokenized Deposit” model over the “Stablecoin” model for high-value wholesale finance.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

EXPLORE MORE ARTICLES