Following a 2,500% explosion in market capitalization during 2025, the infrastructure for on-chain stocks has moved from proof-of-concept to institutional-grade production. We will also examine the specific integration of these assets into credit markets, highlighted by TermMax’s launch of tokenized-stock collateral markets on the BNB Chain, marking a significant milestone for fixed-rate DeFi lending.

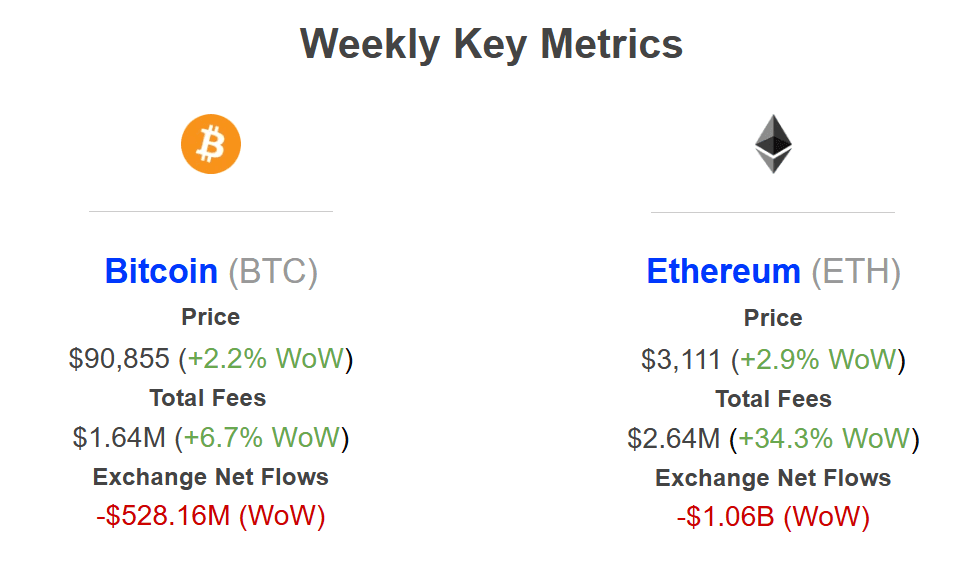

Weekly Key Metrics

Network Fees

Bitcoin: On-chain fees rose by +6.7% to $1.64M, slightly outpacing the asset’s +2.2% price gain. This modest uptick reflects a gradual return of transactional demand as institutional interest stabilizes following the New Year. The alignment between fees and price suggests a healthy, organic recovery in network utility without the speculative “overheating” seen in late 2025.

Ethereum: Fees experienced a massive +34.3% surge to $2.64M , far outstripping its +2.9% price move. This “rebound effect” is directly tied to the resumption of on-chain activity after the Christmas holiday stall. As DeFi protocols and L2 scaling solutions ramp back up to full capacity, Ethereum has reasserted its position as the primary engine of crypto-economic activity.

Exchange Netflows

BTC: Bitcoin recorded -$528.16M in net outflows. This shift into negative territory indicates a “supply squeeze” in the making. Rather than selling into the early January rally, whales and long-term holders are moving assets into cold storage, signaling a collective expectation of further upside and reducing the immediate liquid supply available on order books.

ETH: Ethereum saw a staggering -$1.06 billion in net outflows this week. This billion-dollar exodus from exchanges is one of the strongest accumulation signals in recent months. Combined with the 120% spike in the validator entry queue and record address growth, this data suggests that the “post-holiday” period is being used by major players to lock up ETH for staking and long-term positioning, effectively drying up exchange liquidity.

2026: The Year of Tokenized Equities and Infrastructure Convergence

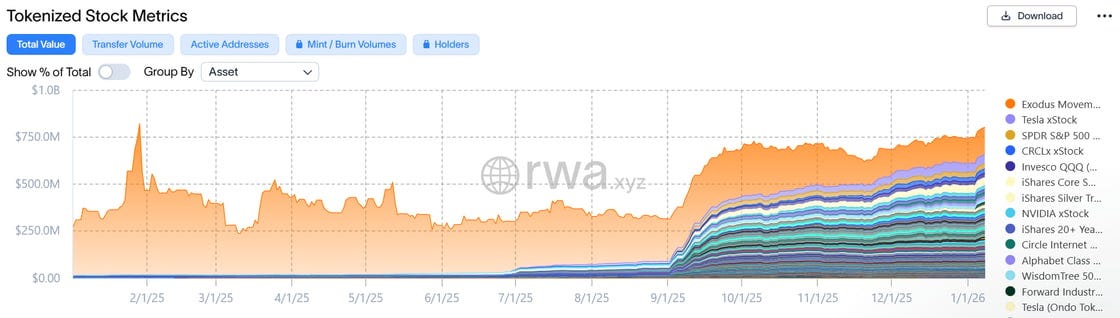

The tokenized equities market entered 2026 with a massive tailwind, having reached a $800M in market capitalization in early January 2026. This represents a 2,500% increase from the $16 million recorded at the start of last year. While this sector still only accounts for less than 5% of the broader $20B billion tokenized RWA market, its trajectory mirrors the early 2020 era of stablecoins, signaling a pending breakout.

The current market sizing reveals a classic early-stage exponential growth pattern. As of early January 2026, on-chain value stands at $801.36M (per RWA.xyz), but monthly transfer volume surges to $2.66B, with almost 40,000 monthly active addresses engaging with these assets:

Source: RWA.xyz

This high velocity suggests that tokenized equities are increasingly being used for active financial strategies rather than passive “buy and hold” retail positions.

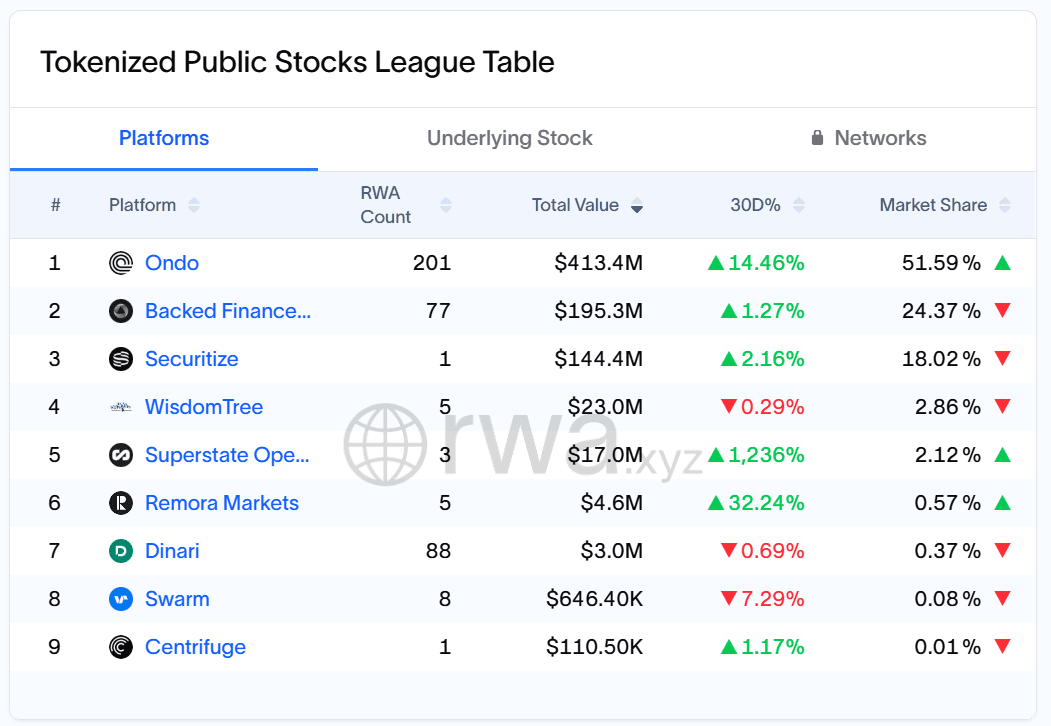

The competitive landscape for issuance has consolidated around four dominant leaders:

Source: RWA.xyz

As shown in the current data from rwa.xyz, the sector exhibits high concentration, with the top three providers: Ondo, Backed Finance, and Securitize, controlling over 90% of the total on-chain equity value. Ondo Finance maintains a commanding lead with 51.59% market share and the most expansive product suite at 201 underlying stocks, reflecting a high-velocity 14.46% monthly growth rate. While established players dominate the leaderboard, the 1,236% monthly surge from Superstate Opening Bell signals how rapidly new institutional entrants can capture market share when deploying collateral.

The product landscape is also diversifying beyond simple large-cap stocks like NVDA or TSLA. We are seeing a rise in tokenized ETFs, such as Ondo’s SPYon (S&P 500) and QQQon (Nasdaq-100), which provide diversified exposure to institutional portfolios.

Despite this growth, the scale differential remains immense. For example, NVDAx on Solana has approximately 13,000 holders, while the underlying Nvidia stock trades nearly $28 billion daily on traditional venues.

Operational hurdles still persist, particularly regarding liquidity fragmentation. Trading activity is split across regulated venues, and decentralized protocols, which can lead to wide bid-ask spreads during off-market hours. However, the entry of institutional market makers like Flow Traders is beginning to tighten these spreads and provide the depth necessary for the 24/7 trading promise of DeFi to be realized for equities.

Tokenized Equities Enter Fixed-Rate DeFi Credit: TermMax Launches on BNB Chain

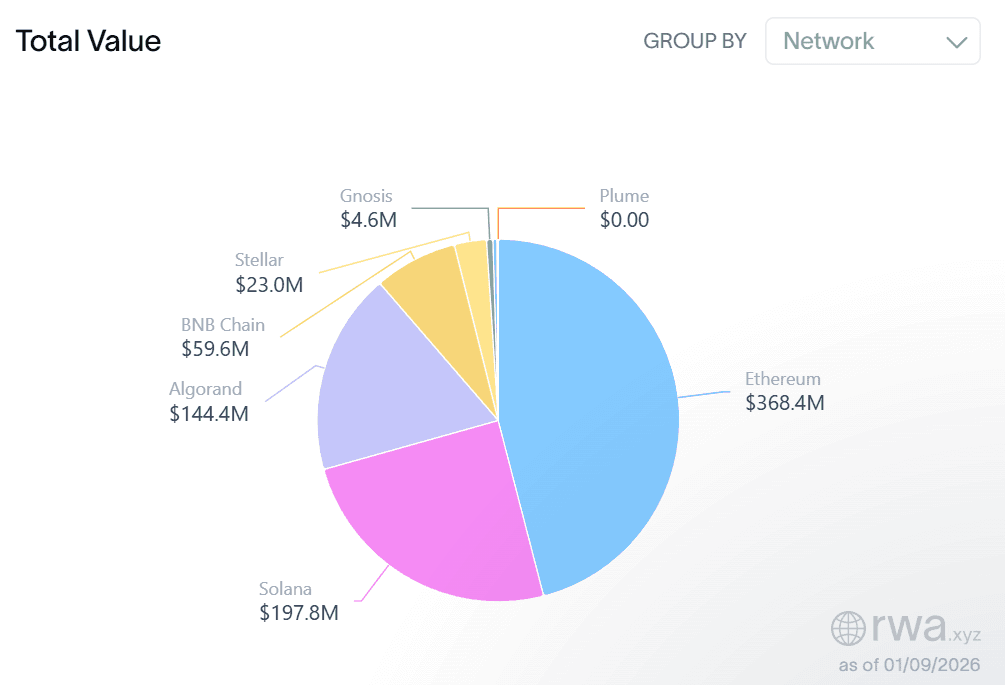

As the supply of tokenized equities grows, the focus is shifting toward DeFi composability. The most significant development in the last week is the launch of TermMax’s tokenized-stock collateral markets on the BNB Chain. This move represents a critical bridge between traditional equity value and the $100B+ DeFi credit market, allowing users to borrow against their stock portfolios without liquidating their positions. BNB Chain stays as the 4th largest chain with tokenized equities exposure at the moment:

Source: RWA.xyz

TermMax differentiates itself by offering fixed-rate, fixed-term lending. This structure is particularly attractive to institutional users who require predictable cost-of-capital for leverage or hedging strategies. By integrating tokenized stocks as collateral, TermMax is effectively bringing lending against securities to the blockchain with atomic settlement and 24/7 monitoring.

The technical integration relies on institutional-grade tokens provided by partners like Backed Finance. These tokens are 1:1 asset-backed and held via licensed custodians, ensuring that the collateral in the TermMax smart contracts is legally tied to real-world shares. This mitigates the “synthetic risk” that plagued earlier DeFi attempts at stock trading and provides a more robust foundation for credit markets.

This launch addresses one of the primary “non-regulatory” friction points of 2025: the lack of utility for tokenized assets. Previously, holding a tokenized stock was largely a bet on price appreciation. Now, through protocols like TermMax, these assets become productive collateral. This is expected to drive a new wave of TVL as investors move their dormant stock tokens into active credit strategies.

Looking ahead, the success of TermMax on BNB Chain will likely trigger a competitive race among lending protocols. We anticipate that major players will expand their collateral offerings to include a wider range of tokenized equities.

This convergence of TradFi assets and DeFi credit is one of the “killer apps” that could finally bring the trillions of dollars in global equity value onto blockchain rails.

It is a signal that on-chain credit markets are maturing. This is the structural evolution required for DeFi to scale beyond its “crypto-native” bubble and into the mainstream financial system.

The data from late 2025 and the first week of 2026 confirms that tokenized equities have moved past the experimental stage. With a $800M market cap and the DTCC/Nasdaq infrastructure coming online, the “Year of Tokenized Equities” is officially here.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

EXPLORE MORE ARTICLES