TL;DR:

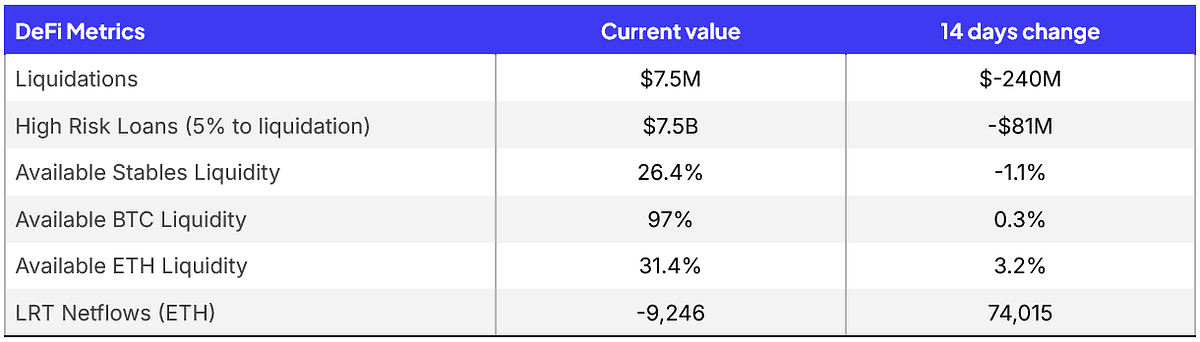

Available liquidity remains high, indication hesitation to take leverage in turbulent market

Liquidations have dropped to $7.5M

Diving into risks of RWA backed portfolio tokens

Featured Dashboard: Aave Plasma

NOTE: Data incorporated from new plasma dashboard has caused mismatch in values from last Pulse

Risk Pulse and Radar Highlights

Source: Sentora Risk Pulse

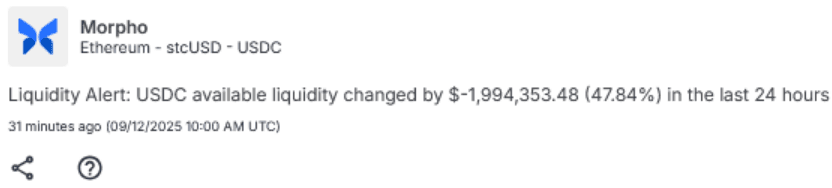

Large suppliers to stcUSD market are withdrawing USDC supply from market

This can indicate an expected drop in yields from stcUSD or potential concerns over the asset as collateral

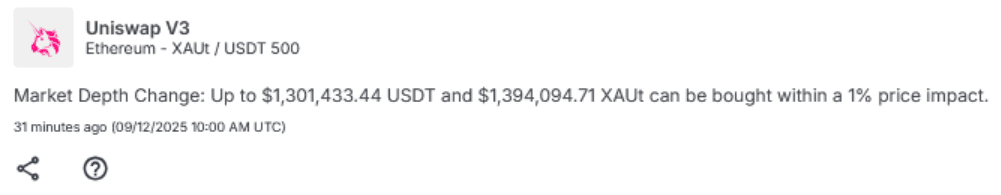

Source: Sentora Risk Pulse

A recent deposit into the USDT-XAUt pool has improved market depth for buying and selling tokenized gold

This suggests large holders are positioning themselves for more volatility in XAUt demand and are looking to earn fees on trades

Current Event Risks

Onchain Strategies ≠ Offchain Strategies

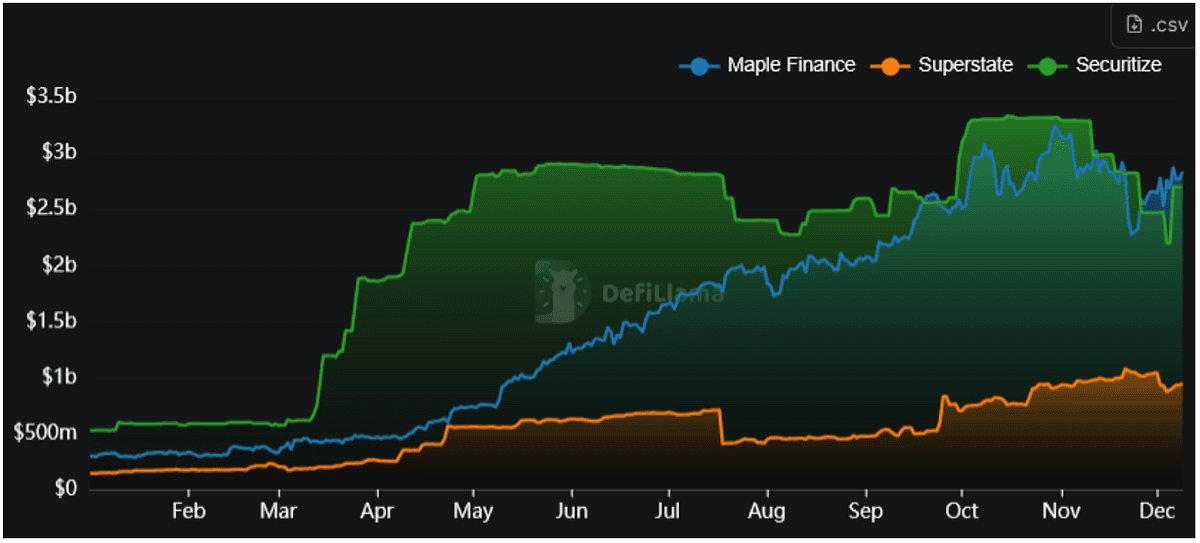

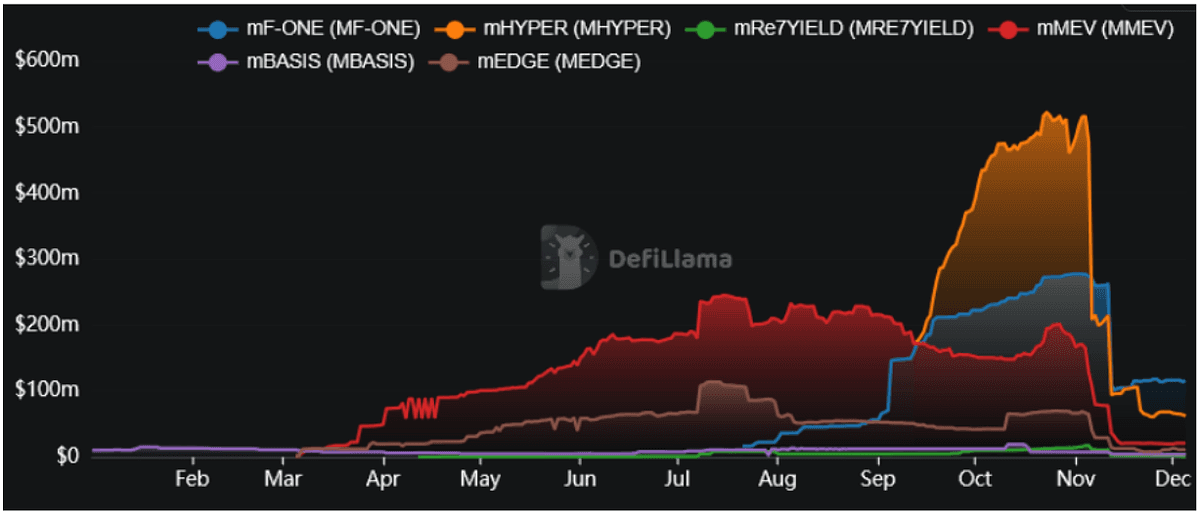

2025 has truly been the year of RWA integrations into DeFi. Maple, Superstate, and Securitize have all immensely successful years with substantial gains in their TVL. While success has been seen across these different example protocols, the way that they access RWAs is completely different.

Source: DefiLlama

Maple: operates as a decentralized lending platform that provides overcollateralized loans to institutional borrowers, backed by tokenized RWAs such as corporate debt and real estate, allowing lenders to earn yield from real-world interest payments.

Superstate: utilizes Tbills in their USDTB asset. In their USCC asset they perform a basis trade (similar to Ethena) but with CME futures.

Securitize: focuses on the compliant issuance, management, and trading of tokenized digital securities backed by traditional assets like real estate, equity, or debt, expanding access to these assets via blockchain.

The similarity between each of these protocols is that they have one or many tokenized assets that represent a basket of underlying offchain components. This means that in DeFi data points that can be seen are only related to the asset’s supply, value, exchange rates, and other higher level information. The more critical information on the risks of the assets lie offchain. Onchain users therefore need to rely on the protocols to produce transparency reports to understand what the real risks are for the asset. Unfortunately this means that there is a latent information gap between the onchain and offchain data that can be difficult to overcome when trying to manage risks on strategies.

While the mentioned protocols above are among the more established protocols using RWA, a growing number of smaller strategists are entering into offchain strategies via protocol infrastructures such as Midas.

Source: DefiLlama

For each of the tokenized assets in the chart above, there is a strategist that has full discretion into allocations of the assets deposited into the strategy. The strategies behind each of these tokens can vary greatly, from private equity/credit and basis trades to onchain DeFi deployments. Since the strategists have full discretion on allocations, the strategies backing the value of the tokens can change quickly. This leaves onchain holders needing to either trust the due diligence of the strategists or continuously track the composition of allocations behind the token.

As seen with the collapse of Stream and their xUSD token, tracking allocations is not a simple task, as offchain strategies can become opaque very quickly. Especially when there are multiple addresses connected to the main strategy vault, it can be difficult to understand who is operating them.

Takeaways for Onchain Users

Don’t trust, verify: Strategists often move quickly and relying on their due diligence could put users in a position where they are holding tokens that are misaligned with their risk profile.

Transparency is key: Even if a strategist has offchain deployments, users should be able to track allocations with onchain reporting or consistently produced offchain reports.

Information latency: Offchain reporting isn’t as immediate as onchain data. This means losses in strategies might only become apparent weeks or months afterwards.

Outlier APYs: Any yields that are significantly higher than comparable products or typical on-chain returns almost always imply extra risk. If the numbers look unusually high, dig deeper before investing.

Feature Dashboard: Aave Plasma

Sentora’s newest Aave Dashboard covers the Plasma Aave v3 instance. Plasma focuses on leveraging USDT as a global payment currency while hosting several DeFi protocols that users can deploy their stables into. A primary focus on the Aave v3 Plasma instance is to create opportunities for leverage looping with stable borrow rates.

Follow along by accessing the Aave Risk Dashboard here.

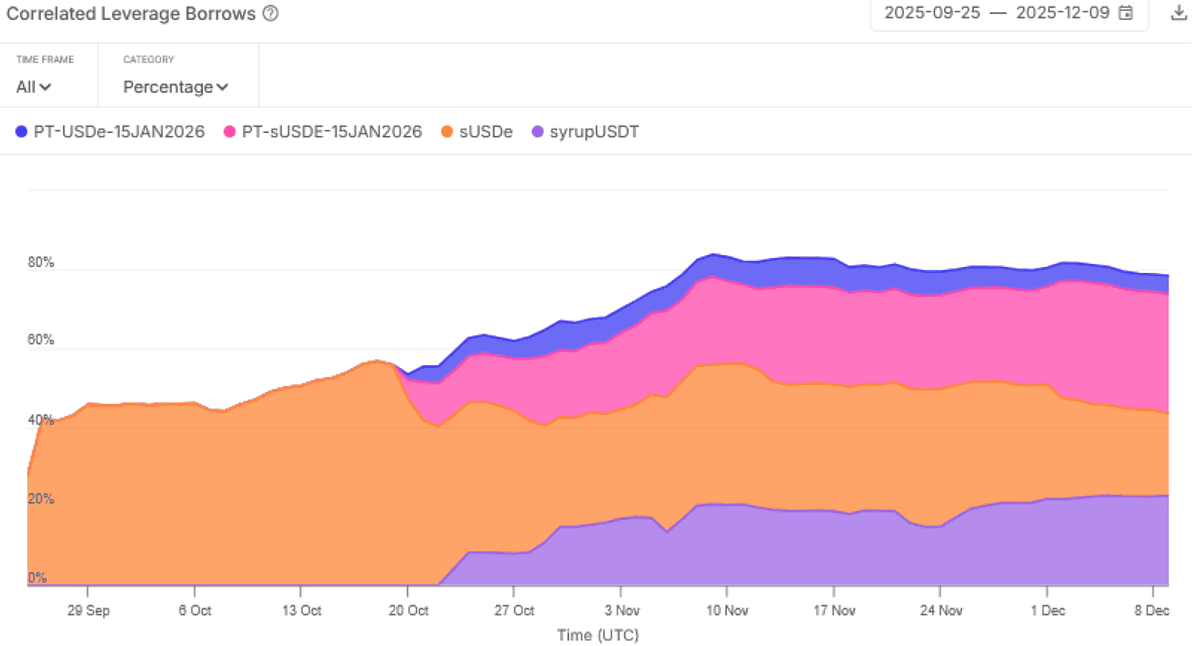

Concentration

Source: Aave Plasma Risk Radar

Understand borrow concentrations against correlated assets

If a large share of collateral is correlated to the borrowed asset there are reduced liquidations risks on price volatility

However, if the carry trade between yields on the collateral and the borrow rates goes negative, expect large unwinds of borrowed assets which can affect supply rates

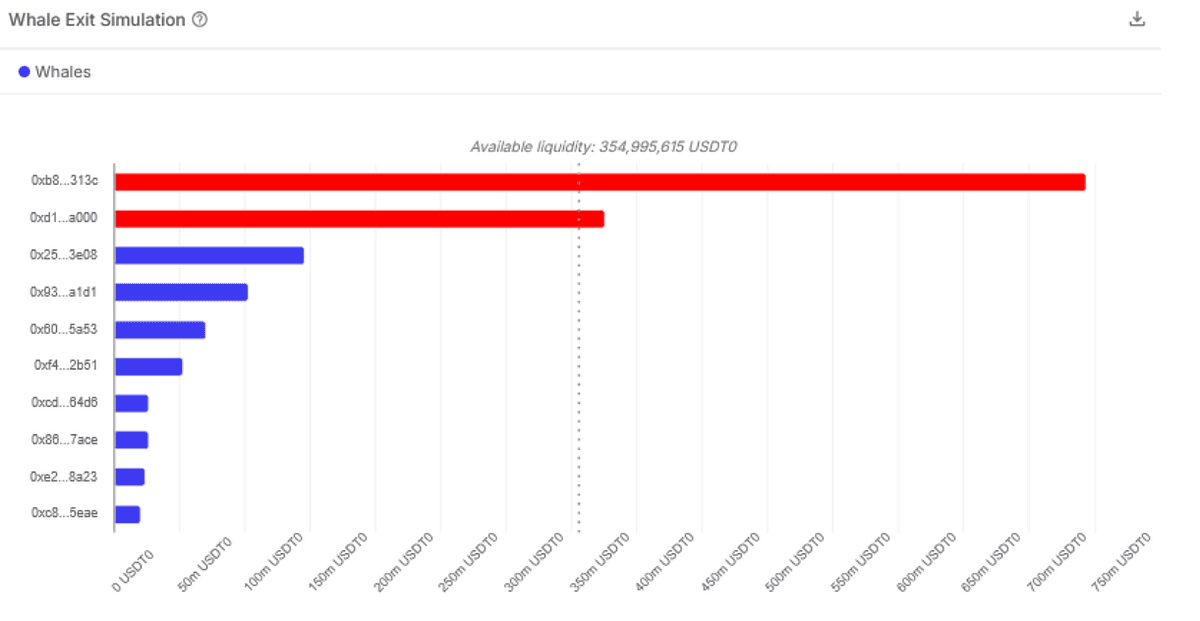

Dependency

Source: Aave Plasma Risk Radar

Track whale dependencies and concentration to understand potential supply risks and borrow rate spikes if a single whale withdraws

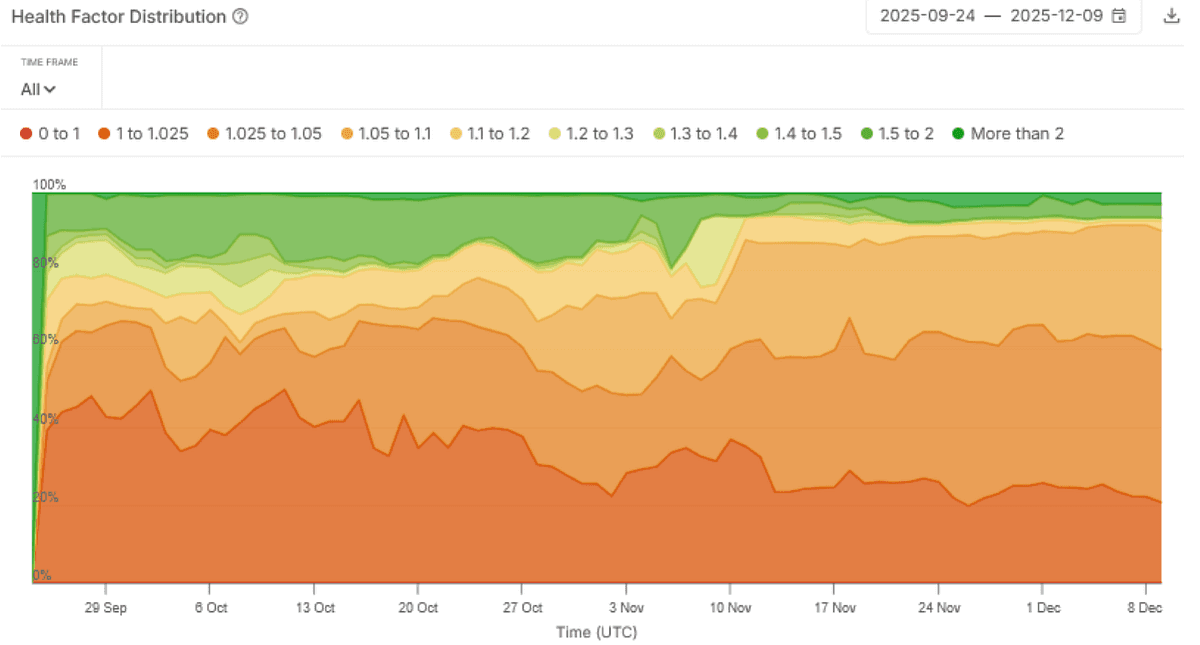

Ecosystem

Source: Aave Plasma Risk Radar

Monitor overall health of largest lending protocol on Plasma

As Plasma instance focuses on leveraged looping strategies, lower health factors can be expected, but the importance is to monitor the stability of the different health factor bands over time

Stay informed, manage risks wisely, and stay liquid

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice.

EXPLORE MORE ARTICLES