TL;DR

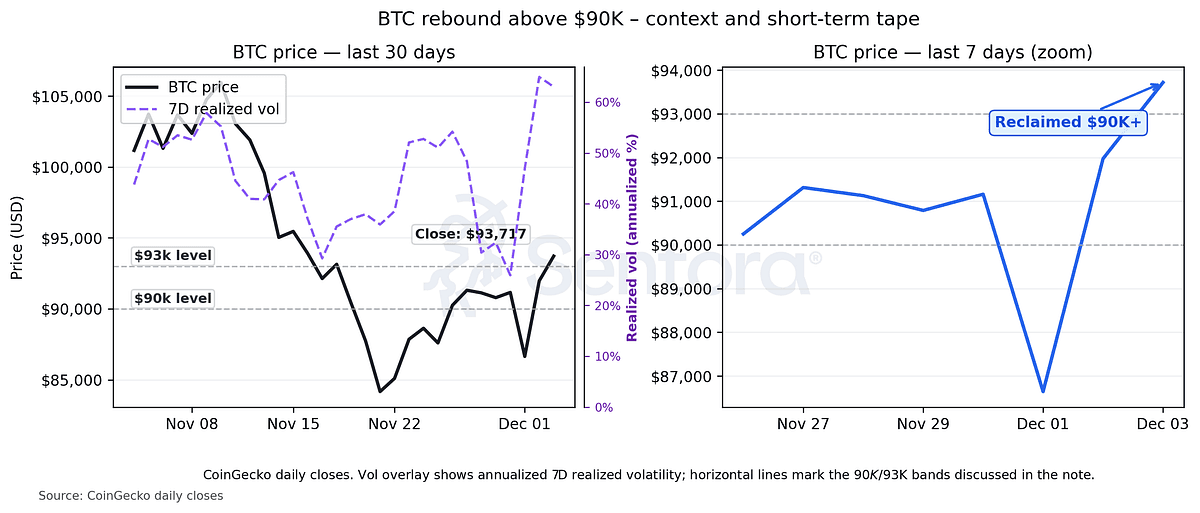

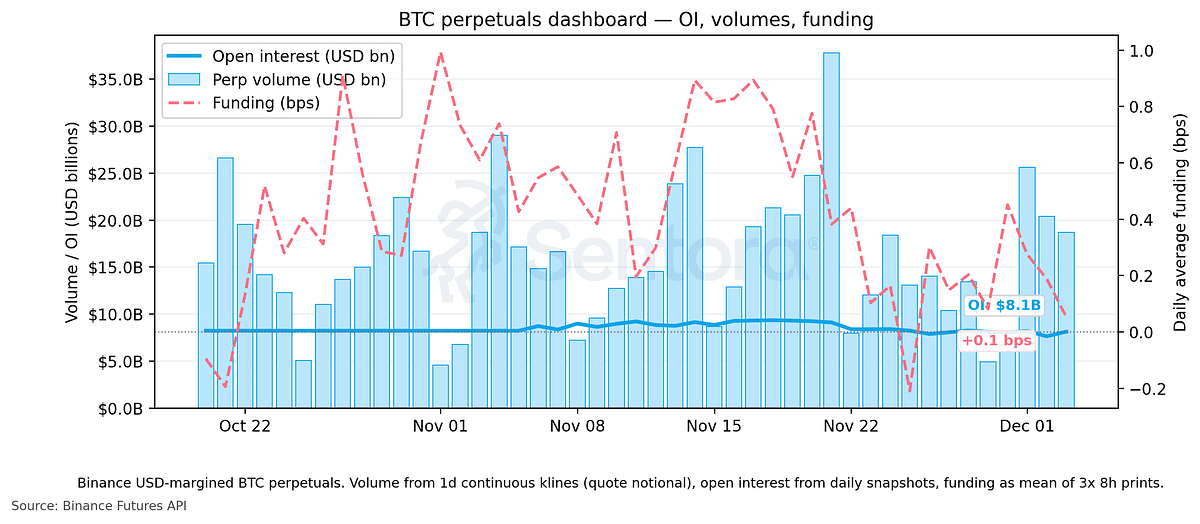

BTC bounced back above ~$90K amid a broader “risk wobble → stabilization” backdrop as markets refocused on central-bank expectations.

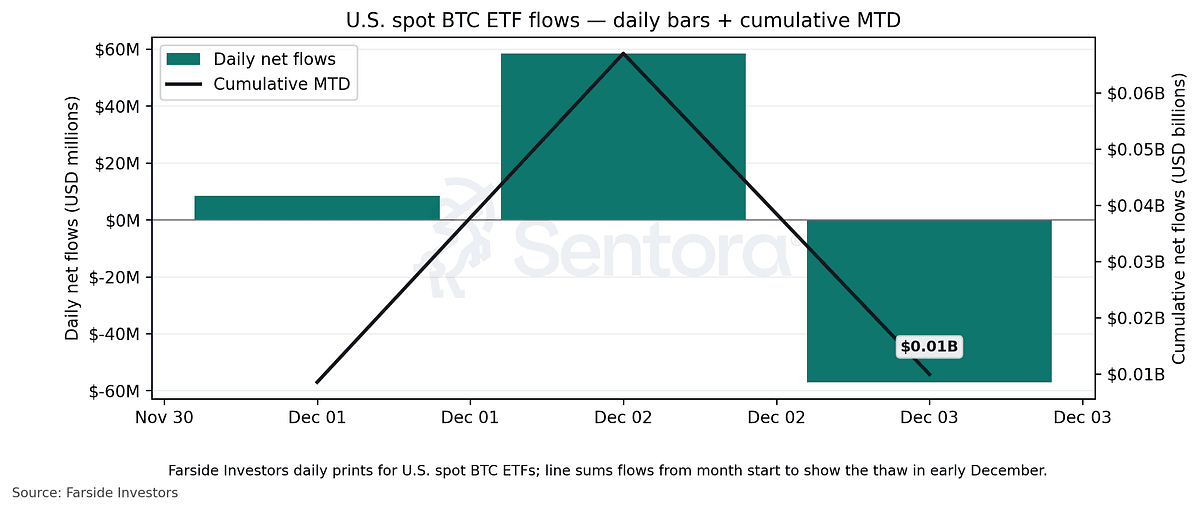

Spot BTC ETF flows look like they’re thawing after a heavy November drawdown, with early-December inflows showing up again.

Ethereum’s Fusaka upgrade activated on Dec 3, aiming to push scalability (especially for L2s) via data-availability improvements.

Sentora/Flare launched Firelight vaults, the first live piece of a DeFi cover engine.

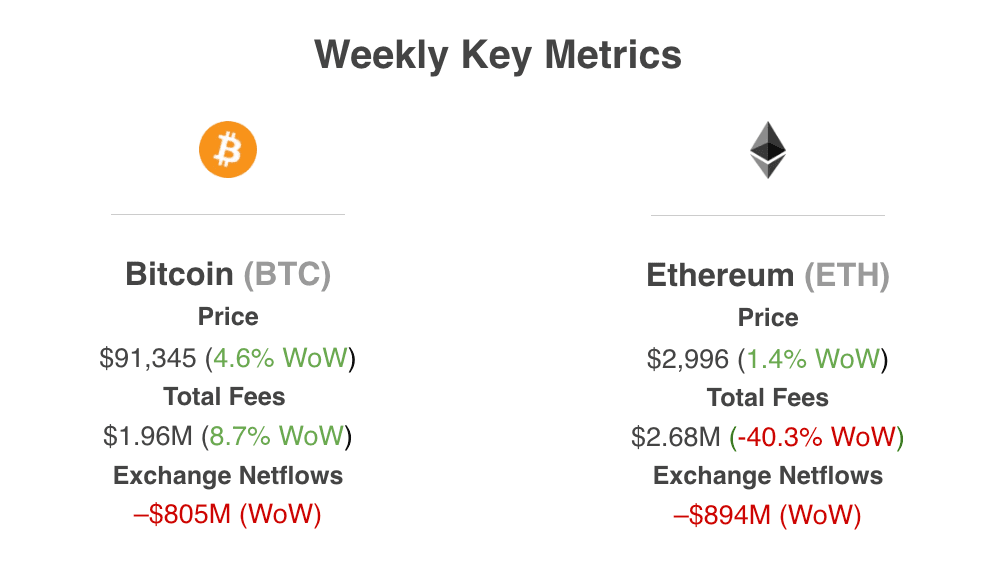

Network Fees

Bitcoin: ~$1.96M (+8.7% w/w; fees ticked up from ~$1.80M last week, but still sit near the low end of the post-halving range as mempools remain relatively light).

Ethereum: ~$2.68M (–40.3% w/w; down sharply from ~$4.49M last week — base-layer spend cooled further, with activity still largely expressed on L2s rather than L1).

Exchange Netflows

BTC: Outflows ≈ –$805M over the past week (still net withdrawing from exchanges, but the outflow is much smaller than last week’s –$46.0B print, implying a major normalization after that prior-week outlier move).

ETH: Outflows ≈ –$894M (outflows accelerated by ~$82M w/w vs last week’s –$812M, continuing the steady drain of exchange inventories).

Macro & Price Action: “Wobble, then bid.”

This week’s tape felt like classic late-cycle macro reflexivity: a risk-off squall tied to global rates anxiety (with BOJ hike chatter in the mix), followed by stabilization as traders rotated back toward the next major focus point — the Fed’s upcoming meeting and the probability distribution around the path of cuts. In that context, Bitcoin reclaimed >$90K as broader markets regained their balance.

Flows & Positioning: ETFs thaw after a brutal November

After four consecutive weeks of spot BTC ETF net outflows (and a large monthly outflow print in November), early-December flow data is showing signs of net inflows returning, even if still modest relative to peak “ETF bid” regimes.

The key takeaway: flows shifting from “persistent sell pressure” to “marginal support” can materially change the market’s short-term elasticity — especially in a tape where positioning can be forced to chase.

A related equity/structure watch: Strategy (MSTR) is reportedly engaging with MSCI over potential index exclusion risk — an event that matters because index membership can mechanically influence passive flows and, indirectly, market narrative around BTC proxy exposure.

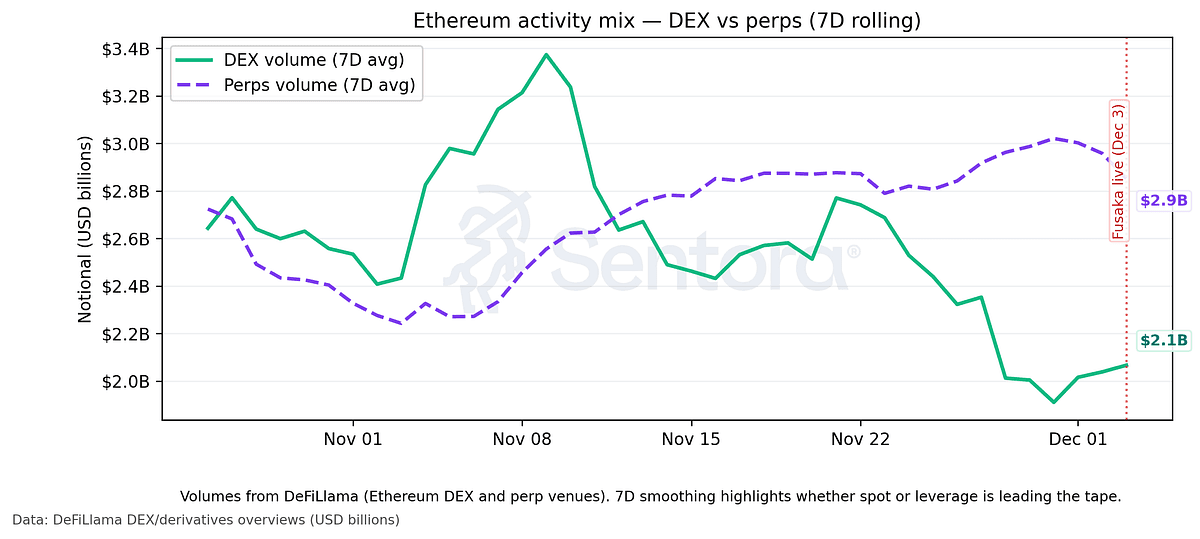

Protocol & Tech: Ethereum Fusaka is live (and L2 economics are the real story)

Fusaka activated on the Ethereum mainnet on December 3, 2025, positioning itself as the next leg in Ethereum’s scaling arc (especially for rollups) with proposed improvements focused on making data availability more scalable/efficient.

For DeFi, the second-order effects matter most:

If L2 costs compress, we should expect more on-chain routing, more active orderflow, and more competition among venues (DEXs, perps, aggregators) for the same user intent.

Cheaper DA tends to push higher cadence strategies (perps arbs, MEV-aware routing, liquidations) to become more dominant — good for volumes, tricky for risk.

Sentora Spotlight: Firelight vaults are live

This week, Sentora shipped a major milestone: Firelight launch vaults are live, marking the first production piece of Project Firelight, positioned as a DeFi cover engine. This is the kind of missing primitive institutions repeatedly ask for when yield is visible, but risk transfer is not.

What to watch next

Post-Fusaka KPIs: L2 fee/latency changes, rollup DA dynamics, and any follow-through in DEX/perps routing behavior.

ETF flow regime: does “modest positive” become “persistent positive”, or do flows stall again?

Macro catalyst risk: next week's central-bank decision window and cross-asset volatility (rates → dollar → crypto beta).

Not investment advice. This report is for informational purposes only.

EXPLORE MORE ARTICLES