1. Post-Options Expiry Relief: Unwinding the Largest-Ever Overhang

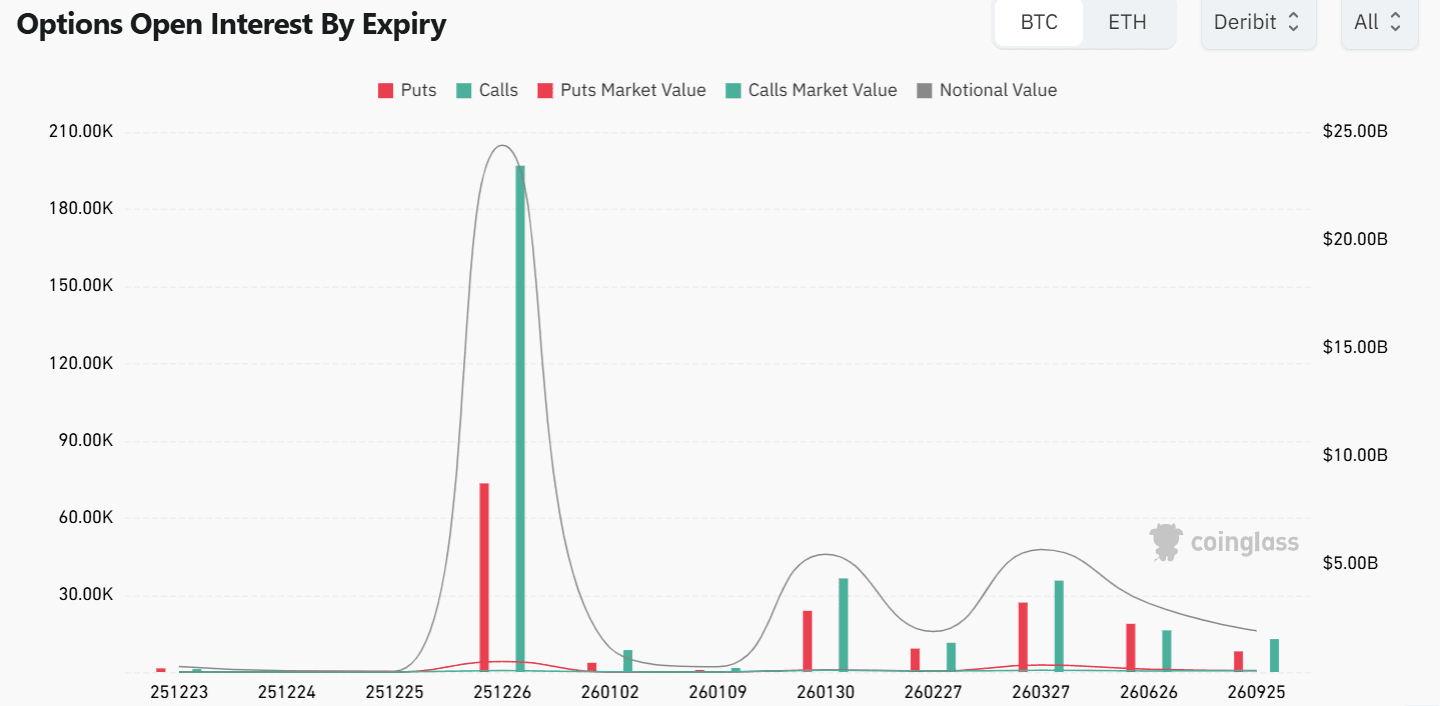

On December 26, 2025, Bitcoin faces its largest options expiration in history, with approximately ~$24 billion in notional value set to settle, primarily on platforms like Deribit. This event, dwarfing previous expiries, has compressed implied volatility to around 44% and clustered heavily around strikes like $100,000, $106,000, and higher. In the lead-up, market makers hedging these positions have amplified whipsaw price action, contributing to recent downside pressure.

Source: Coinglass

However, historical patterns suggest that post-expiry periods often catalyze rallies. With the bulk of open interest in out-of-the-money calls, the unwind could release suppressed buying power, as dealers no longer need to sell BTC to delta-hedge. Analysts anticipate a "measured reset" into early 2026, paving the way for upward momentum. Combined with Ethereum's concurrent $3.9 billion expiry, this could mark the end of 2025's structural suppression, freeing BTC to target $100,000+ in Q1 2026 as volatility normalizes and fresh capital enters.

2. Institutional Inflows: January's Allocation Wave via BTC ETFs

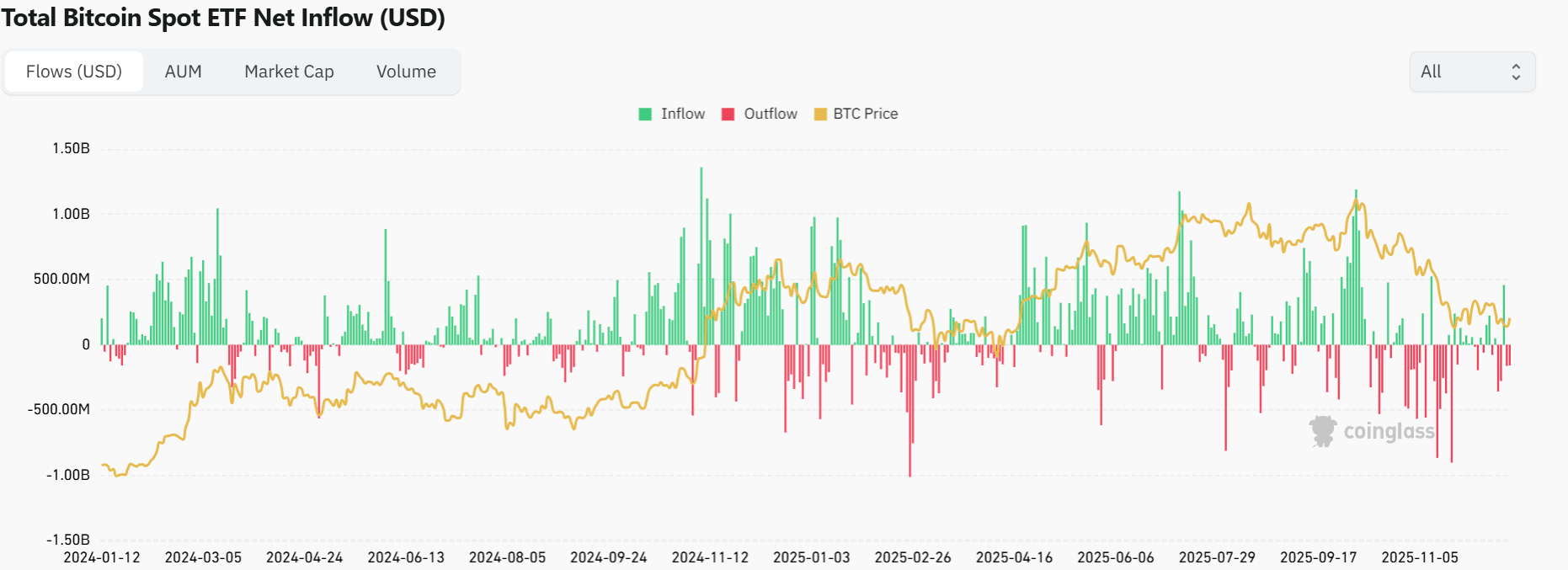

The advent of spot Bitcoin ETFs in early 2024 transformed institutional access, and 2025 has seen record inflows exceeding $1.3 trillion across U.S.-listed ETFs through early December. BlackRock's iShares Bitcoin ETF alone attracted around $15 billion since January 2024, underscoring BTC's maturation as an asset class. January stands out as the "biggest month" for asset reallocation, when pensions, endowments, and wealth managers deploy new capital based on year-end mandates and risk budgets. January is the biggest month for reallocation of portfolios and with models pointing toward a 1-5% allocation of BTC the buy pressure can be significant.

Source: Coinglass

With BTC's institutional demand on the rise, driven by its role in diversified portfolios alongside traditional assets, this seasonal influx could propel prices higher. Early 2025 data showed over $900 million in BTC purchases on January 3 alone. If BTC outperforms benchmarks like the S&P 500 post options expiry, expect allocations to accelerate, targeting 1-5% portfolio exposure. This "January effect" in crypto could drive BTC toward $120,000 by mid-2026, bolstered by a broadening market beyond mega-caps and favorable regulatory tailwinds under the Trump administration.

3. Geopolitical Tailwind: An Early January Ukraine Deal Reduces Risk Premium

The ongoing Russia-Ukraine conflict has weighed on global risk assets, including BTC, by elevating energy prices and uncertainty. However, recent developments point to a potential peace deal in early 2026, with U.S. President Trump declaring it "closer than ever" and Russian officials describing talks as "proceeding constructively." Negotiations involve U.S. envoys, European officials, and even indirect Indian mediation, with proposals including security guarantees and territorial concessions. While this saga has been ongoing, the market is underpricing a potential deal in January.

A resolution would slash BTC's geopolitical risk premium, mirroring how past de-escalations boosted risk-on sentiment. Lower oil prices (already falling on deal optimism) would ease inflationary pressures, allowing for more accommodative monetary policy. Experts remain cautiously optimistic, noting that while immediate ceasefire hopes may be premature, progress by Q1 2026 could unlock global growth. For BTC, this translates to a sentiment shift, potentially adding 20-30% to prices as investors pivot from safe havens to high-beta assets like crypto.

Synthesis: A Bullish Convergence for 2026

These factors aren't isolated; they amplify each other. The options expiry clears the deck just before January's inflow surge, while a Ukraine deal provides the macro green light for sustained risk-taking. Despite BTC's 7% YTD loss through mid-December 2025, its resilience signals underlying strength. Broader forecasts from firms like Goldman Sachs and JPMorgan project economic acceleration in H1 2026, with more rate cuts and market broadening favoring BTC.

In summary, 2026 could see BTC eclipse $150,000, driven by technical relief, institutional adoption, and global stability. While risks like prolonged negotiations or liquidity crunches persist, the setup favors bulls. Investors should monitor post-expiry flows and deal announcements closely. Fingers crossed, but we have the perfect setup for a post-Christmas rip.

EXPLORE MORE ARTICLES