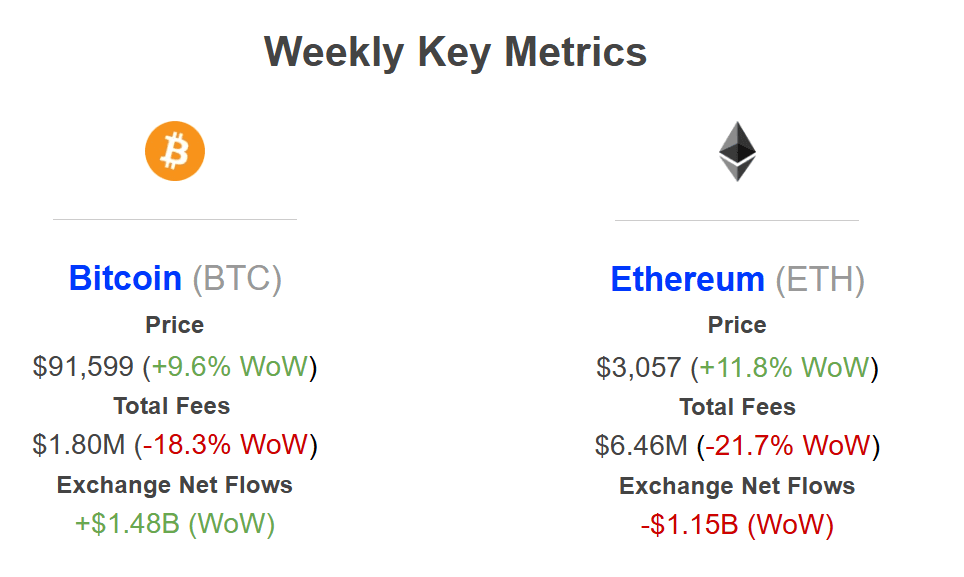

Weekly Key Metrics

Network Fees

Bitcoin: On-chain fees retracted by -18.3% to $1.80 million, creating a notable divergence from the asset’s +9.6% price surge. This suggests the current rally is driven by spot demand and ETF flows rather than on-chain saturation, allowing for an “efficient” price expansion without the friction of high blockspace costs.

Ethereum: Fees mirrored the decline, dropping -21.7% to $6.46 million, even as price climbed over 11%. This continued fee suppression highlights the successful offloading of transactional load to Layer-2s; however, with fees still generating 3.5x that of Bitcoin, the mainnet retains its status as the premium settlement layer for high-value DeFi activity.

Exchange Netflows

BTC: A significant shift in sentiment is visible with +$1.48 billion in net inflows to exchanges. This suggests a cohort of holders is moving assets onto trading venues, likely to realize profits at these $91k highs or to deploy capital as collateral for derivatives, presenting a potential supply overhang in the short term.

ETH: In a stark contrast to Bitcoin, Ethereum saw -$1.15 billion in net outflows, signaling aggressive accumulation. Users are withdrawing ETH at a rapid pace, likely migrating to on-chain DeFi environments, effectively tightening the liquid supply just as price momentum builds.

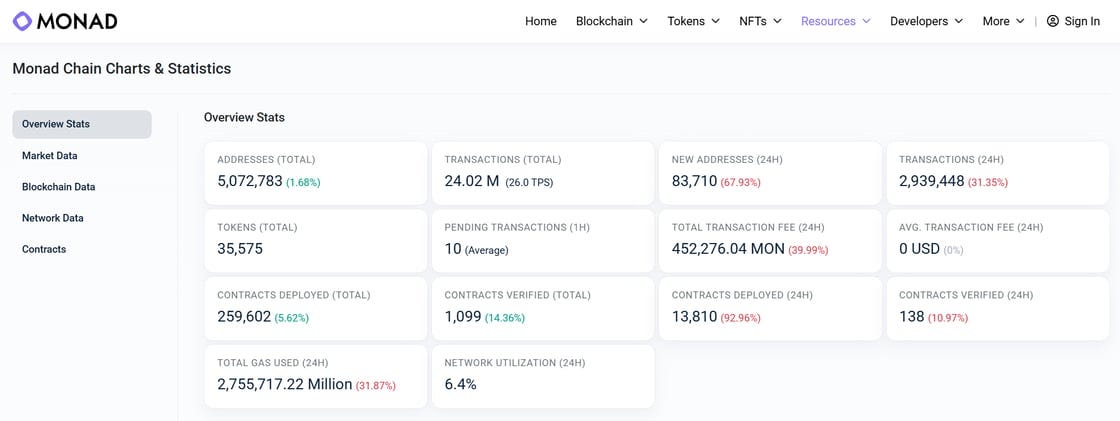

Monad Blockchain Mainnet Launch

After months of testnet stress-testing and one of the year’s most hyped build-ups, Monad officially launched its Mainnet on November 24, 2025.

The launch introduces the first production-grade Parallel EVM (Ethereum Virtual Machine), designed to solve the bottleneck of sequential execution that plagues traditional EVM chains. By allowing transactions to process simultaneously rather than one after another, Monad targets a throughput of 10,000 Transactions Per Second (TPS) with a 1-second block time, all while maintaining full compatibility with Ethereum tooling (MetaMask, Etherscan, etc.).

Key Launch Metrics (First 96 Hours):

Transactions: Surpassed 4.7 million executed transactions within the first 3 days.

Adoption: Over 5 million of unique addresses interacted with the blockchain, signaling strong initial interest beyond just airdrop farmers.

Token (MON): The native token, MON, saw significant volatility. Following the airdrop distribution and Coinbase public sale unlock, price discovery was aggressive. The token initially surged ~60% from its pre-market reference before cooling off, a common pattern for highly anticipated L1 launches.

Ecosystem & Sentiment

The ecosystem is already live with key DeFi primitives. Major protocols like Uniswap, Morpho, Euler, Gearbox, Curve and LayerZero have already deployed. However, the launch wasn’t without drama; volatility spiked mid-week following bearish comments from prominent figures like Arthur Hayes, causing a temporary 16% drawdown. Despite the noise, the fundamental metric to watch remains sustained TPS under load. If Monad can maintain sub-second finality during high-congestion events, it validates the “Parallel EVM” thesis as a viable competitor to Solana.

Source: MonadScan

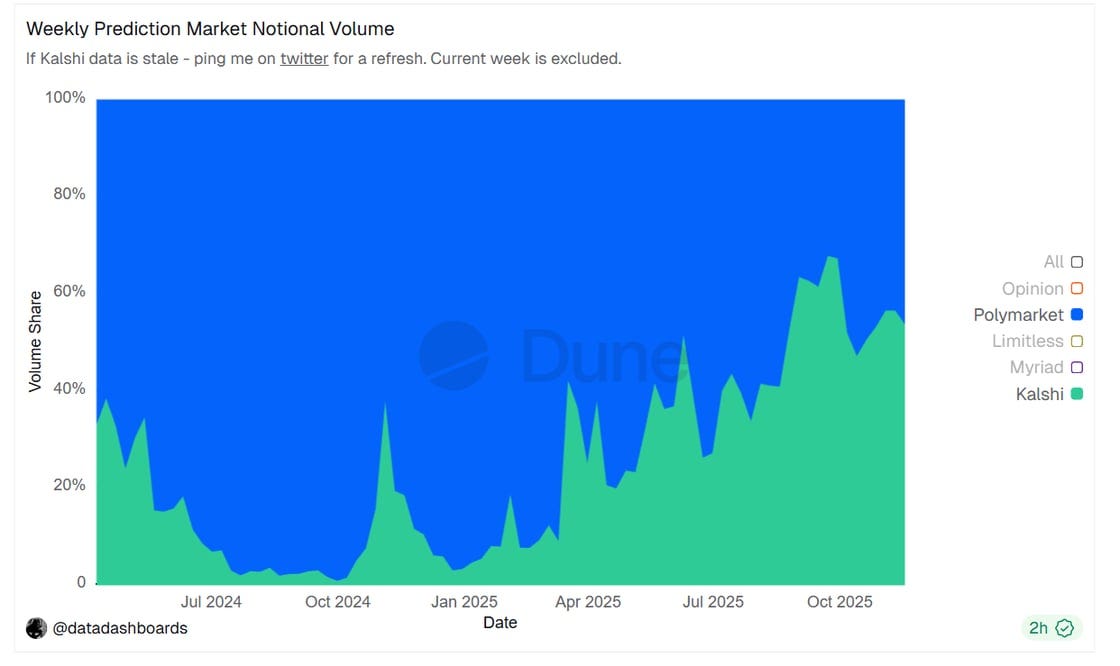

The Institutionalization of Prediction Markets

Prediction markets have evolved from a niche crypto experiment into a primary source of alternative data. Following the “Election Bump” of 2024, volume didn’t vanish, it migrated to financial and macro events. We are now witnessing the infrastructure war to own this vertical in the US.

Robinhood’s Vertical Integration

Robinhood is no longer just an aggregator; it is becoming an exchange operator. This week, Robinhood announced a joint venture with Susquehanna International Group to launch an independent futures and derivatives exchange.

The Strategy: Rather than routing orders to third parties, Robinhood is building the stack. The venture will acquire MIAXdx, a CFTC-licensed Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO).

The Scale: Prediction markets are already Robinhood’s fastest-growing product line, with 9 billion contracts traded by over 1 million customers in just one year.

Impact: By controlling the exchange and clearinghouse (with Susquehanna providing day-one liquidity), Robinhood can list new event contracts faster and offer tighter spreads, effectively commoditizing the “event contract” for retail users.

Polymarket’s Regulatory Breakthrough

In a massive convergence of events, Polymarket received CFTC approval this week (Nov 25) to operate as an intermediated trading platform.

The Shift: After years of geo-blocking US users, the CFTC issued an “Amended Order of Designation” following Polymarket’s acquisition of QCX, a licensed exchange.

What Changed: Polymarket is no longer a “peer-to-pool” gray market in the US; it is now a regulated venue that can onboard customers through registered brokerages (FCMs).

The Landscape: This puts Polymarket and Robinhood on a collision course. While Robinhood is building a walled garden for its users, Polymarket is positioning itself as the liquidity backbone that other brokers might plug into.

Source: Dune @datadashboards

The theme of this week is maturity. Monad is about to prove that the EVM can scale horizontally, potentially rendering “L2 fragmentation” obsolete for high-frequency apps. Meanwhile, the regulatory approvals for Robinhood and Polymarket signal that prediction markets are now a permanent fixture of US financial markets, not just a gambling novelty.

Disclaimer: This content is for informational purposes only and does not constitute financial advice.

EXPLORE MORE ARTICLES