TL;DR:

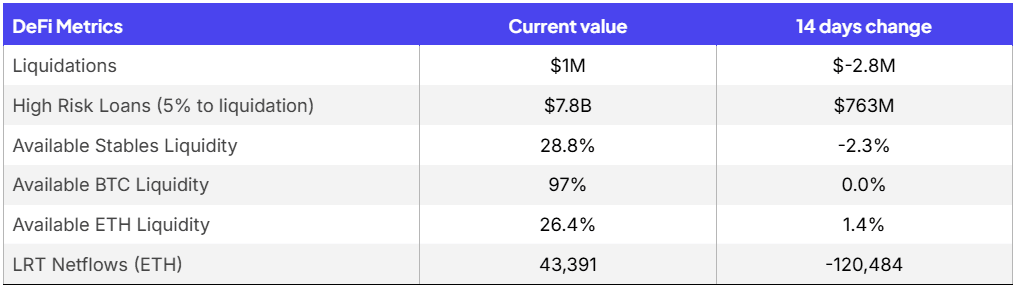

Available liquidity remains high, indication hesitation to take leverage in turbulent market

Liquidations have dropped to $1M over the holidays

Exploit Vector Trends

Changes in liquidity have remained fairly flat as markets stay quiet over holidays

Featured Product: Sentora’s Strategy Portal

Risk Pulse and Radar Highlights

Sentora Risk Pulse

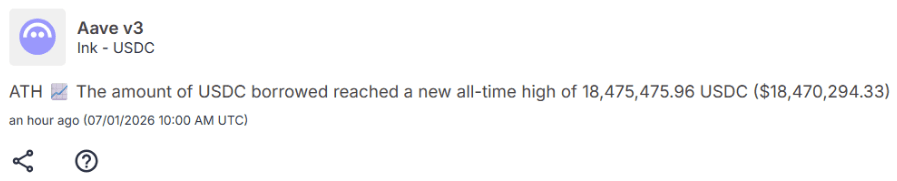

Tydro (Ink’s Aave v3) instance has growing traction

USDC borrow have been continuing to grow with new ATH borrows

Existing USDC borrowers will want to track if this is pushing up the utilization ratio which will increase borrows rates

Sentora Risk Pulse

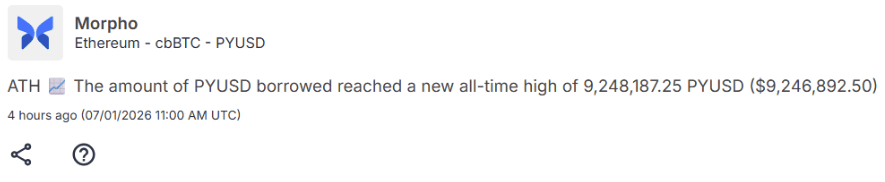

PYUSD is gaining traction on Morpho

Alerts from pulse can identify quickly new markets allowing users to find optimal borrow rates, especially if they are indifferent among stablecoins

Current Event Risks

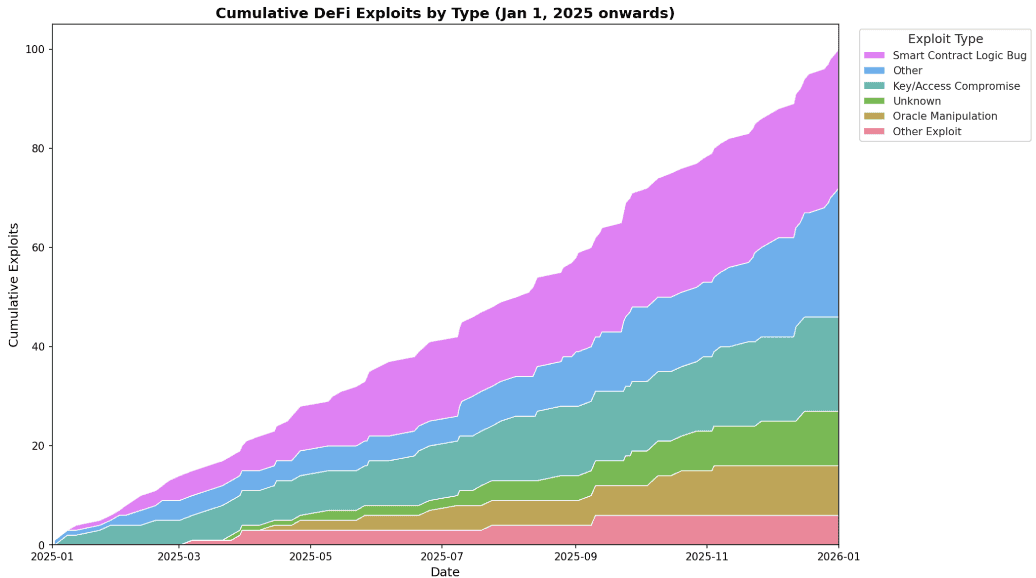

Exploit Trends Moving Away from Smart Contracts

Smart contract auditing and best practices have been improving in leaps and bounds over the past several years. Additionally, newer Layer 1 blockchains have adopted newer smart contract languages like rust and move that are seen as more resilient from a security perspective than languages like solidity. This evolution has meant the portion of exploits that are tied to smart contract bugs has been shrinking. While this is a positive sign of the DeFi ecosystem maturing, hackers have moved onto other attack channels.

Source: Sentora Research and DefiLlama

Key management has become an increasingly large proportion of exploits

This signals that hackers are turning to social engineering and other methods to attack projects from traditional technology attack vectors instead of through smart contracts

The silver-lining here is that it is becoming harder to exploit smart contracts and higher operational security standards could begin to limit many attack vectors

Feature Dashboard: Strategy Discovery Portal

While Sentora has grown significantly as a vault curator, most of our work centers on institutional partners with specific strategy design, risk constraints, and reporting requirements through our Smart Yields platform. Sophisticated yield activity increasingly happens behind the scenes, bespoke allocations, gated strategies, curated vaults, creating a market where strategy information is unevenly distributed and discovery is largely relationship-driven. DeFi runs on transparent rails, but strategy execution remains opaque: when allocators only see headline APY, the real questions go unanswered. Strategy Discovery aims to change that by reducing information asymmetry and encouraging competition on risk-adjusted yield rather than marketing-driven yield.

Explore Strategy Discovery: portal.sentora.com/discover

What Strategy Discovery shows

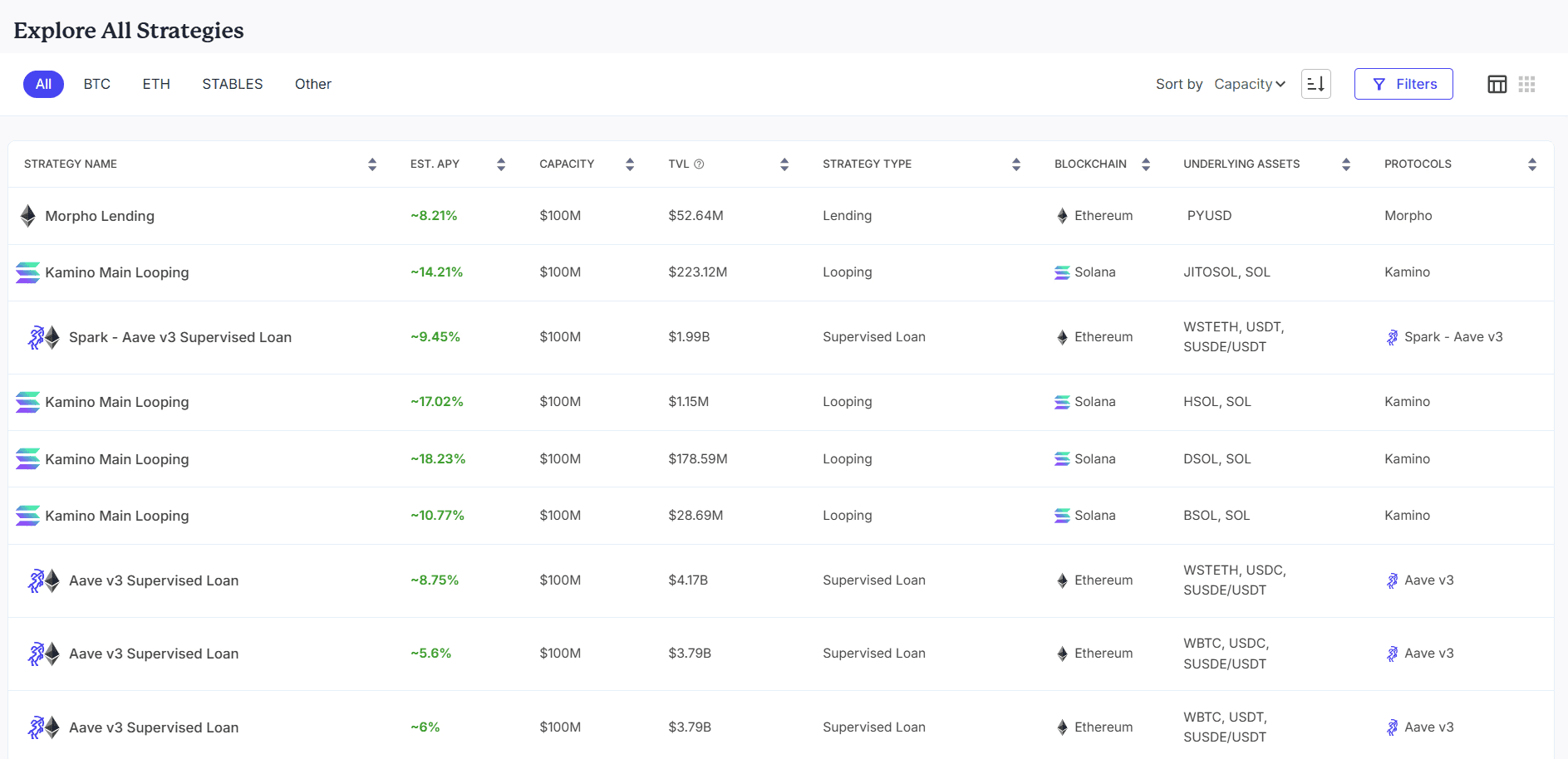

Strategy overview built for comparison: Each strategy displays estimated APY, capacity, TVL, strategy type, blockchains, assets, and protocols.

Sentora Strategy Discovery

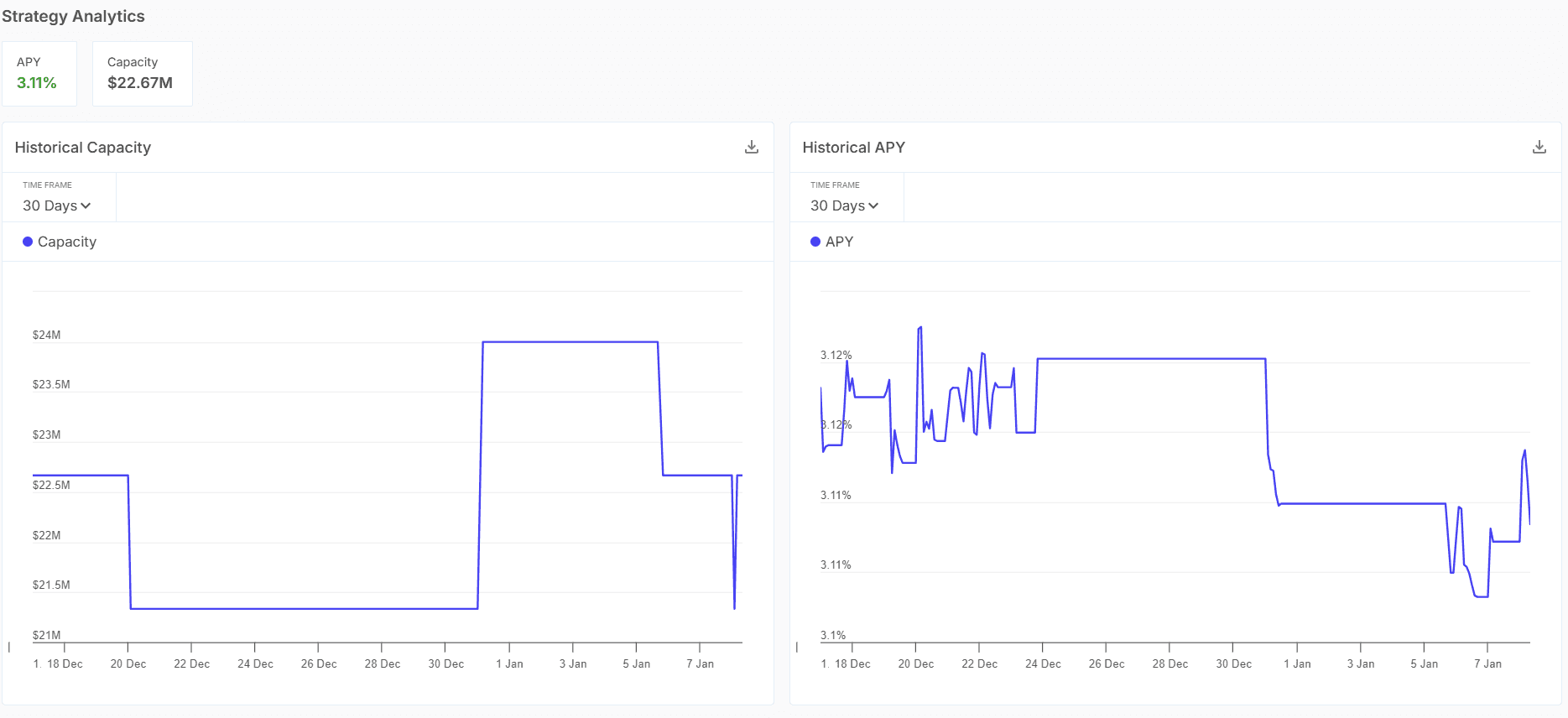

Strategy pages with analytics: Individual strategies show historical APY, historical capacity, and concise descriptions pairing performance with operational reality.

Sentora Strategy Discovery

Note: To access these strategies you need to be a Sentora client

Stay informed, manage risks wisely, and stay liquid

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice.

EXPLORE MORE ARTICLES