Summary

2025 represented the definitive professionalization of the decentralized finance (DeFi) ecosystem. Moving beyond the retail-led cycles of the past, the industry successfully integrated with global capital markets through three primary vectors: regulated investment wrappers (ETFs), on-chain credit markets (RWAs), and the standardization of stablecoins as a global settlement layer.

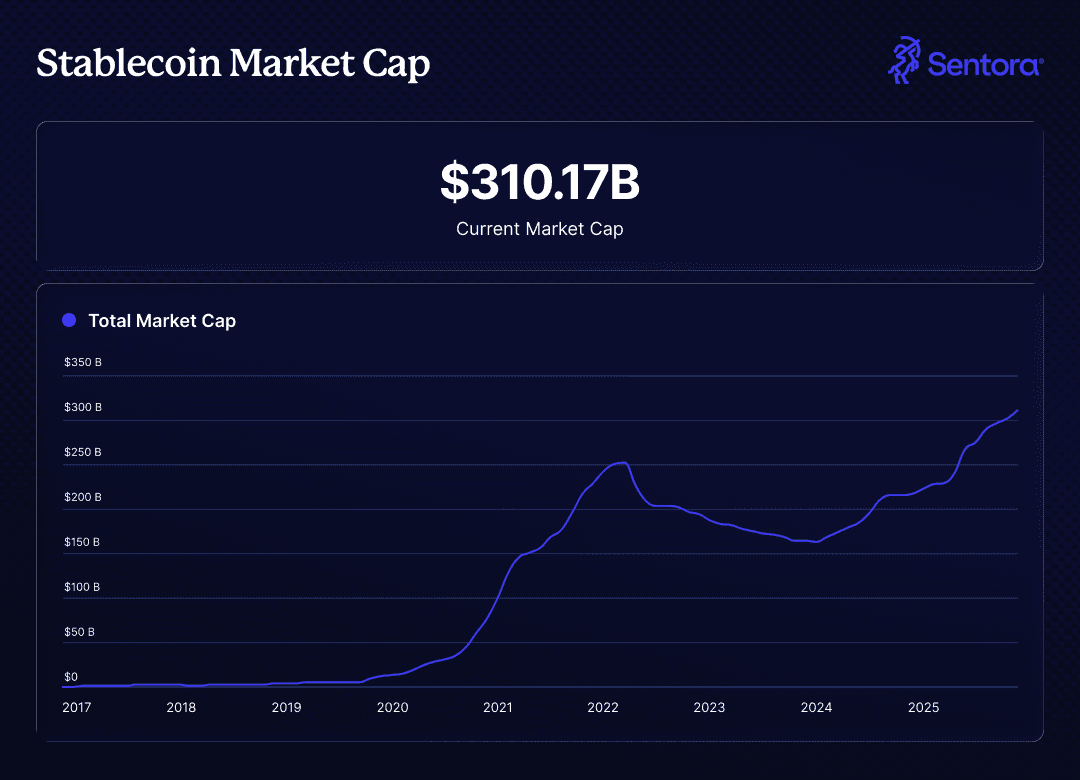

While the year saw record-breaking growth, highlighted by a $310 billion stablecoin market cap, it was also defined by a "Stress Test of Complexity." The violent deleveraging events of Q4 revealed that while smart contract security has matured, systemic risk has migrated to the operational and counterparty layers. The central theme of 2025 was not merely growth, but TVL consolidation into key protocols that could withstand extreme market volatility.

Stablecoins and RWA Expansion

Stablecoins solidified their role as the primary liquidity backbone of the digital economy. The total stablecoin market capitalization reached a record $310 billion by year end. This represents a massive expansion from approximately $204.8 billion at the start of the year.

Source: Sentora and Defillama

Key Insights:

Year-End Market Cap: $310B (ATH)

US Legal clarity has set a clear path for more regulated stablecoins to launch

Whitelisted stablecoin options are gaining traction with multiple companies offering the service

Diversity and TVL are poised to explode in 2026

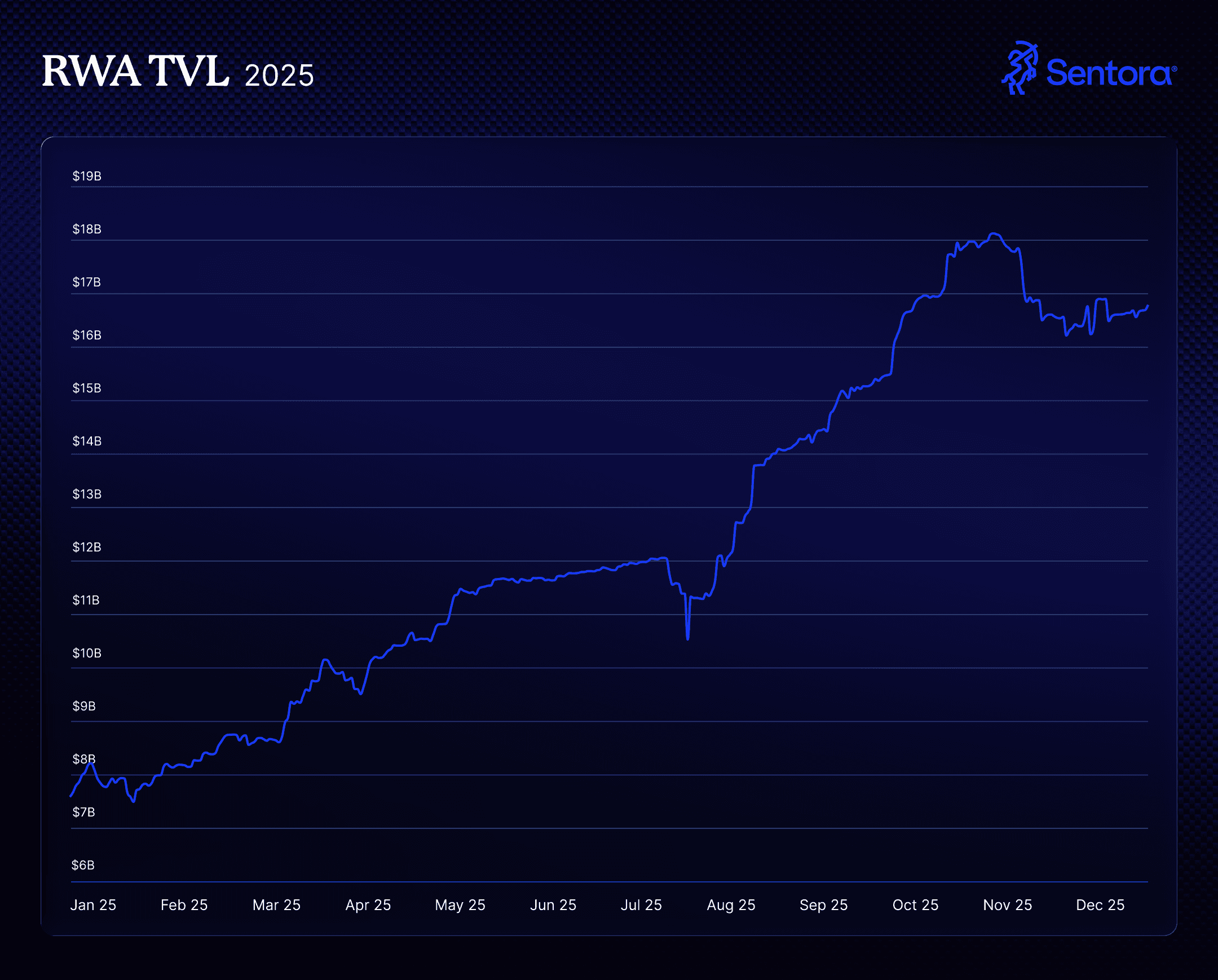

The RWA Breakthrough

Real-World Assets (RWAs) transitioned from experimental concepts to core infrastructure, providing consistent, low-risk yield for institutional allocators.

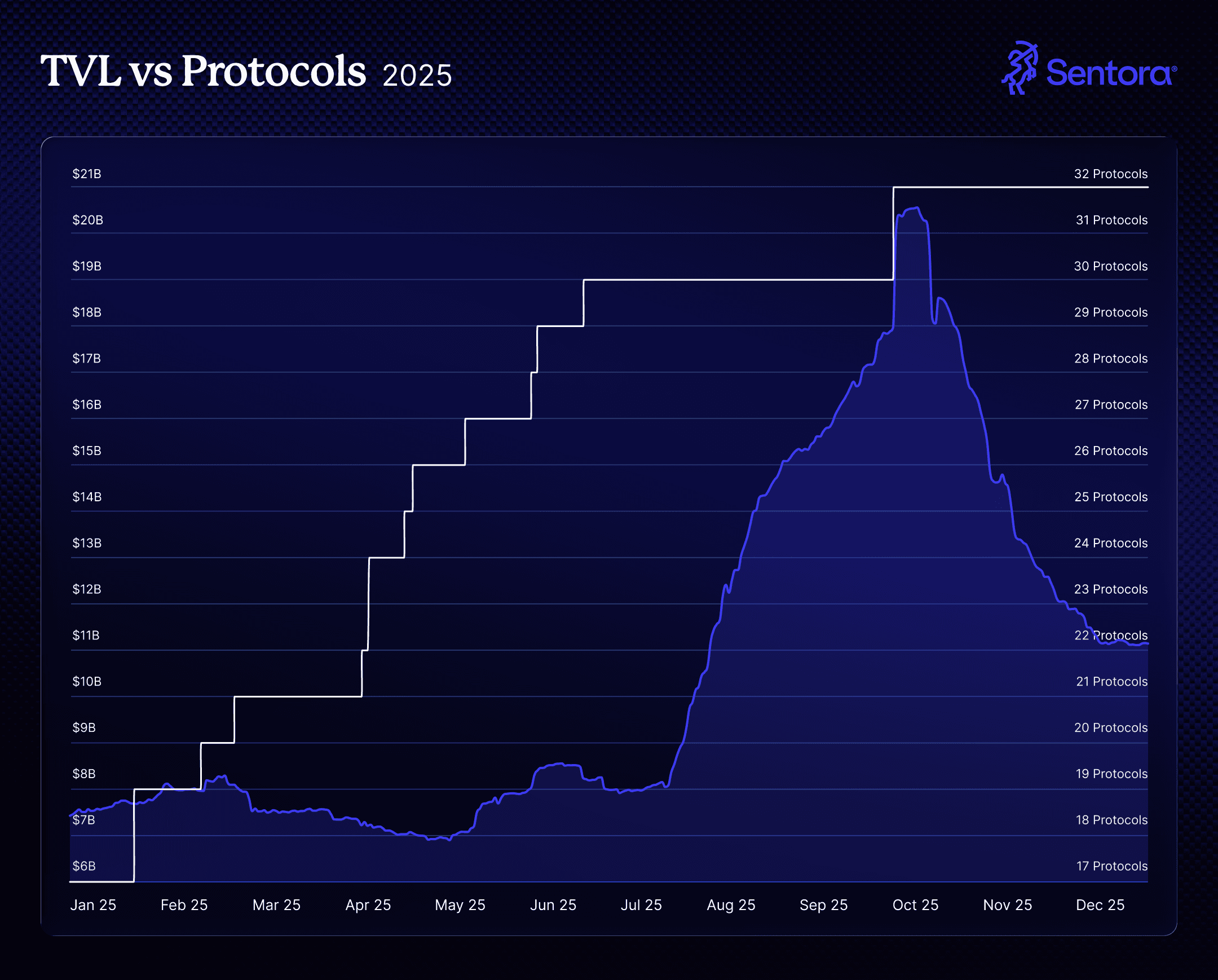

RWA Sector Growth: The sector reached a $18B all-time high in TVL by late October.

Institutional Integration: BlackRock’s BUIDL fund and Ondo Finance led the charge in tokenized treasuries, while Aave Horizon successfully integrated RWA collateral into mainstream markets, reaching ~$550 million in net deposits.

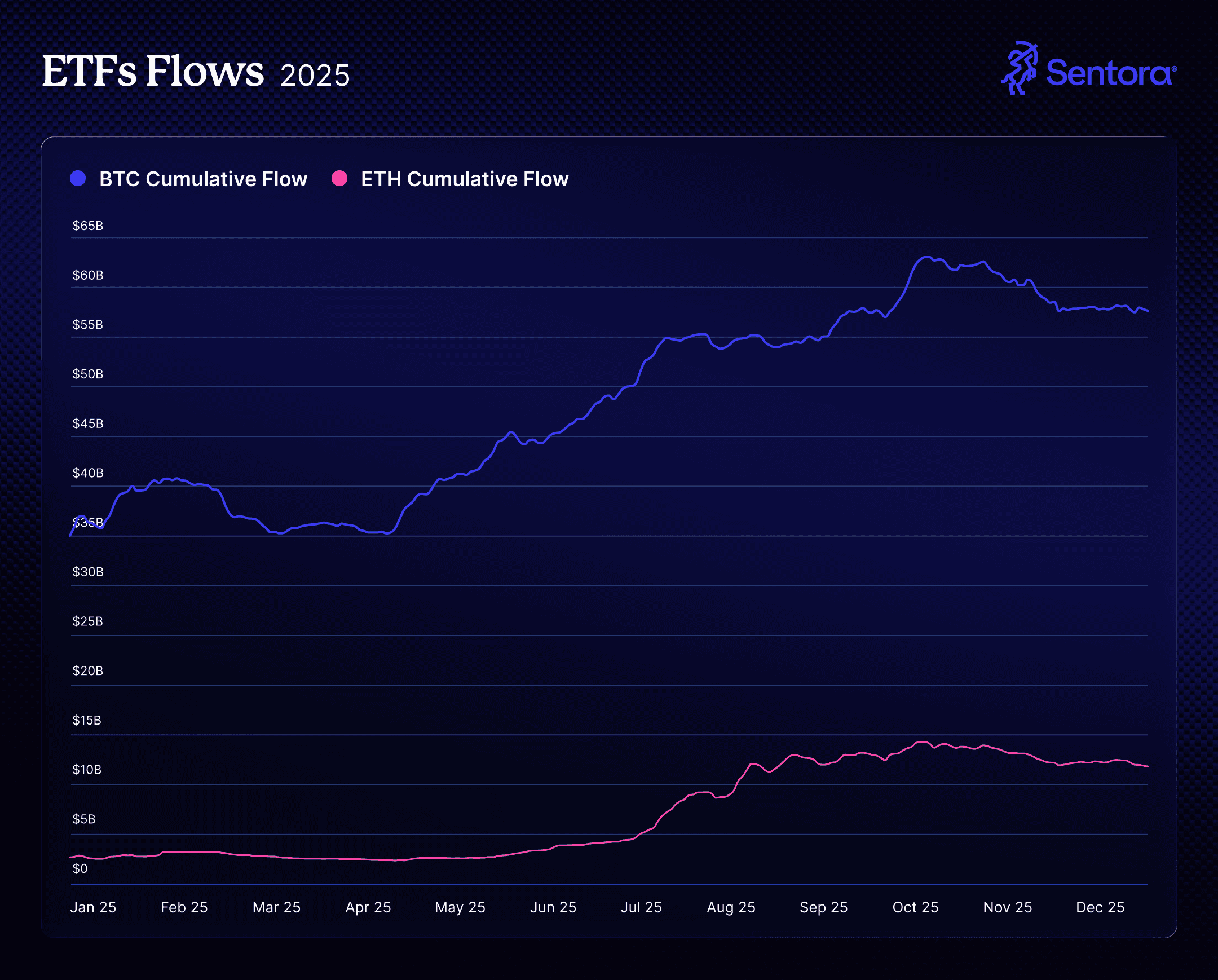

ETFs Steady Growth

Exchange-Traded Funds became a standardized on-ramp for institutional capital. While Bitcoin and Ethereum ETFs dominated the first half of the year, Solana and Ripple ETFs began gaining traction in the second half shortly after their launches.

Source: Sentora and Defillama

Bitcoin ETFs: Though momentum has slowed, AUM in Bitcoin ETFs has by over $20B since beginning of the year

Ethereum ETFs have more than 5x growth in AUM this year

Institutional Shift: The trend suggests increasing interest with institutions to access crypto through regulated wrappers

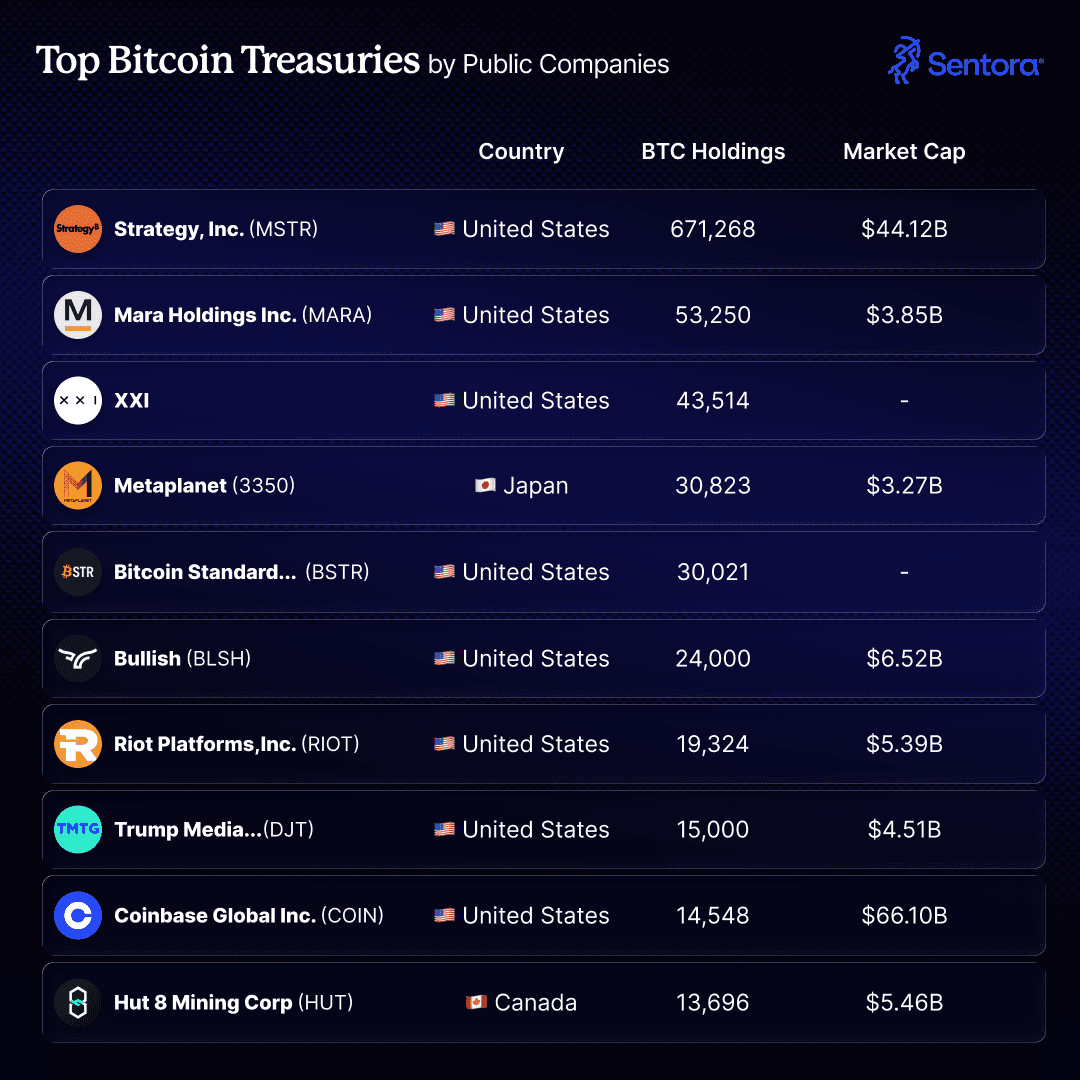

DATs Boom and Bust

Digital Asset Treasuries (DATs) emerged as a new corporate archetype, treating digital assets as the core engine of the balance sheet. Unlike a passive ETF, these companies, exemplified by firms like Strategy (formerly MicroStrategy), actively use capital markets to issue debt or equity to fund the continuous accumulation of assets like Bitcoin. The goal is to transform the company's stock into a high-liquidity proxy for the underlying crypto asset, often allowing it to trade at a premium while generating additional value through staking, lending, or yield-bearing DeFi protocols.

While in a Bull market, the DAT strategy is intriguing as the new capital received by issuing debt or equity can create a reflexive environment where the price of the crypto asset continues to go up allowing the DAT to buy more. However, in flat or bearish markets this structure is problematic as the value of the shares potentially become worth more than the crypto reserves and costs to run a public company eat into any potential revenues.

Source: Sentora

Strategy (MicroStrategy) Dominance: By September, the company held over 632,000 BTC at an aggregate cost of $46.5 billion. The company kept accumulating BTC and now holds over 671k Bitcoin.

The Peak: At the trade's peak, monthly DAT purchases exceeded $13 billion.

The Correction: As BTC prices retreated from October peaks of $126,000 to $85,000 in December, many DAT companies saw their equity premiums compress. Metaplanet (Japan) notably swung from $600M in unrealized profits to a $530 million loss as its $107k cost basis was breached.

Takeaway: DATs appear to have run their course and will likely begin to consolidate into one or two DATs per asset. Look for buy outs and acquisitions.

Basis Trade Rise and Fall

The basis trade that longs spot/ETFs and shorting perpetual futures, served as a primary vehicle for hedge fund deployment throughout 2025. Ethena, the largest protocol running this trade, saw tremendous growth with several integrations across DeFi and CeFi. As the success of Ethena became more apparent, new entrants began flooding the market, doubling the amount of protocols that included a basis trade component in their strategy. This however saturated the capacity of the trade, suppressing the overall yield of the trade.

Source: Sentora and Defillama

The 10/10 Flash Crash

On October 10, 2025, the market experienced a violent deleveraging event:

Liquidation Event: $3B in positions were liquidated in an instant.

Open Interest Wipeout: $36B evaporated in 24 hours.

This had a pronounced impact on basis trade strategies as auto-deleverating (ADL) in different perps markets were triggered, which exposed basis trade protocols to potential price exposure.

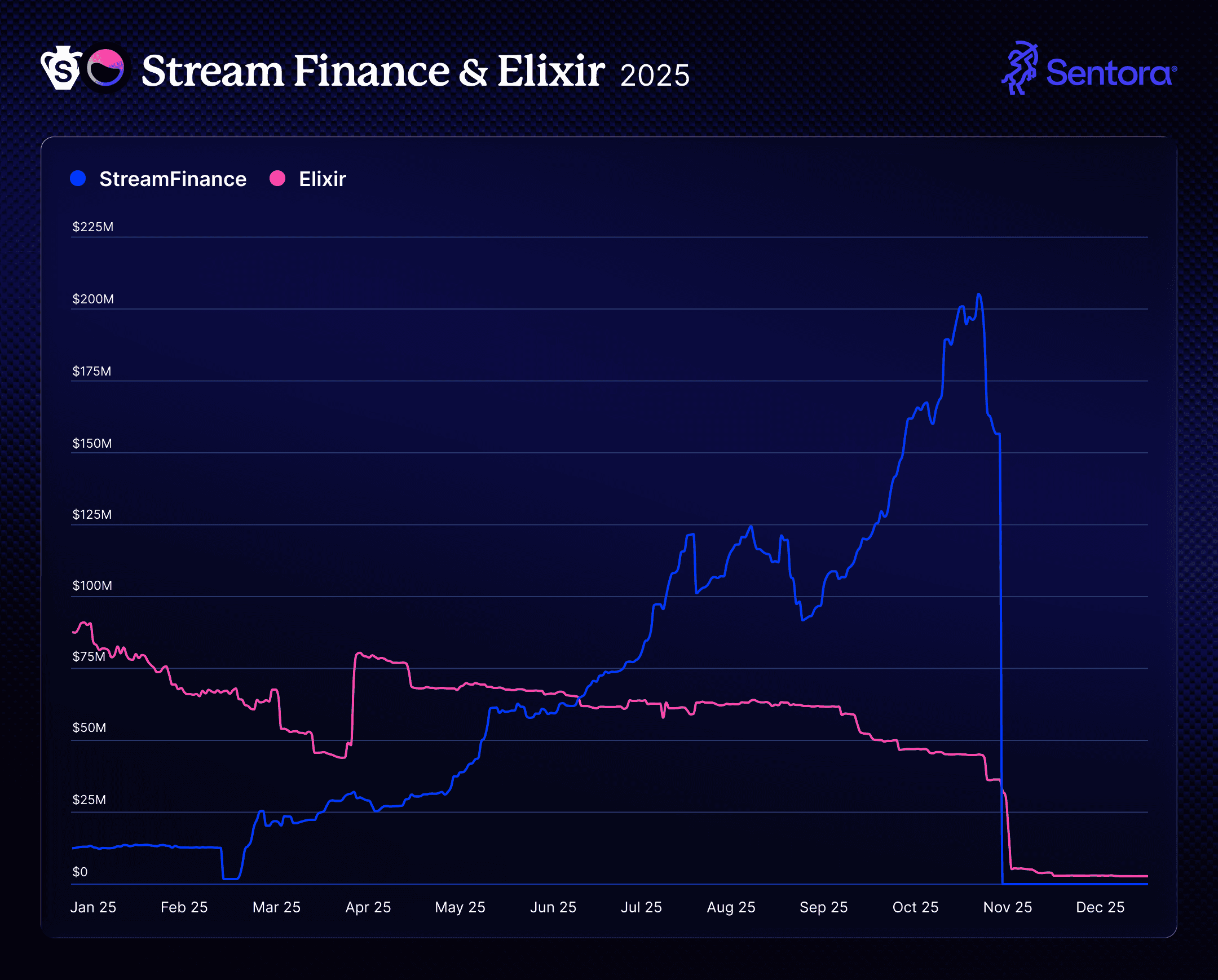

Stream and Elixir Collapse

In the aftermath of the 10/10 flash crash, November 2025 brought the year's most significant contagion event. Stream Finance suffered a $93 million loss due to external fund manager failure, triggering a catastrophic default for their xUSD token. As the markets scrambled to identify what curators and protocols were exposed, Elixir announced that they had significant allocation in Stream Finance and would not be able to cover the gap to repeg their stablecoin.

The entire event highlighted the need for further transparency in DeFi vaults and asset curation as many curators and strategists were exposed to losses as they sought higher yields.

Source: Sentora and Defillama

deUSD Failure: Elixir’s synthetic stablecoin, deUSD, was sunsetted after its peg failed.

Contagion Impact: Over $1 billion in capital fled yield-generating platforms in a single week.

TVL Collapse: Stream Finance TVL plummeted from ~$200 million in October to zero as withdrawals were frozen. Non-Stream holders were fortunately redeemed at 1:1 using Elixir’s reserves.

Downstream Impacts: multiple curators either exposed to Stream or Elixir saw bad debt in their curated money markets.

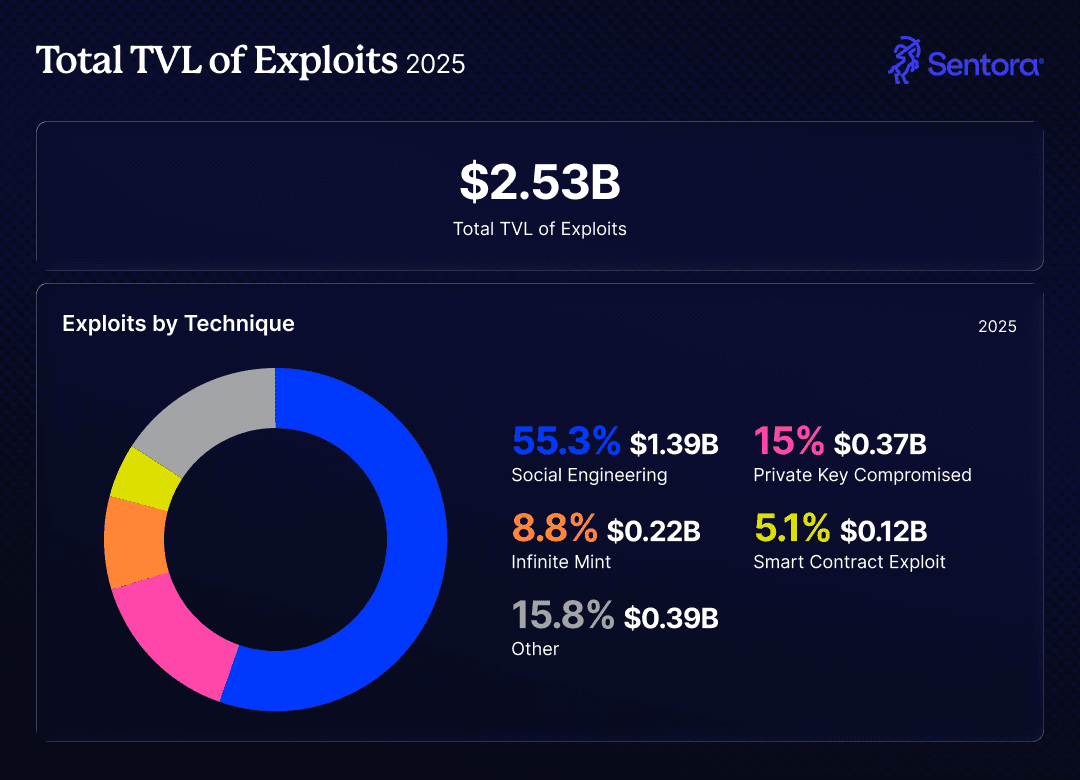

DeFi Exploits

2025 was one of the costliest years on record for security, with losses totaling billions. One prominent shift has been that many exploits this year were due to “web 2” operational security failures instead of the smart contracts themselves. This is a silver-lining as it shows that smart contracts security is continuing to harden and leaving fewer opportunities for hackers.

Top 2025 Incidents

Bybit (Feb): $1.4 Billion (Multi-sig cold wallet vulnerability).

Balancer V2 (Nov): $128 Million (Composable stable pool exploit).

Bitget (Apr): $100 Million (market-making bot glitch).

GMX V1 (Jul): $42 Million (Re-entrancy exploit).

Source: Sentora and Defillama

With 70% of value lost this year being caused by social engineering or key compromises (or a mix of the two), it is becoming apparent that DeFi protocols need to increase their vigilance on their more traditional operational security.

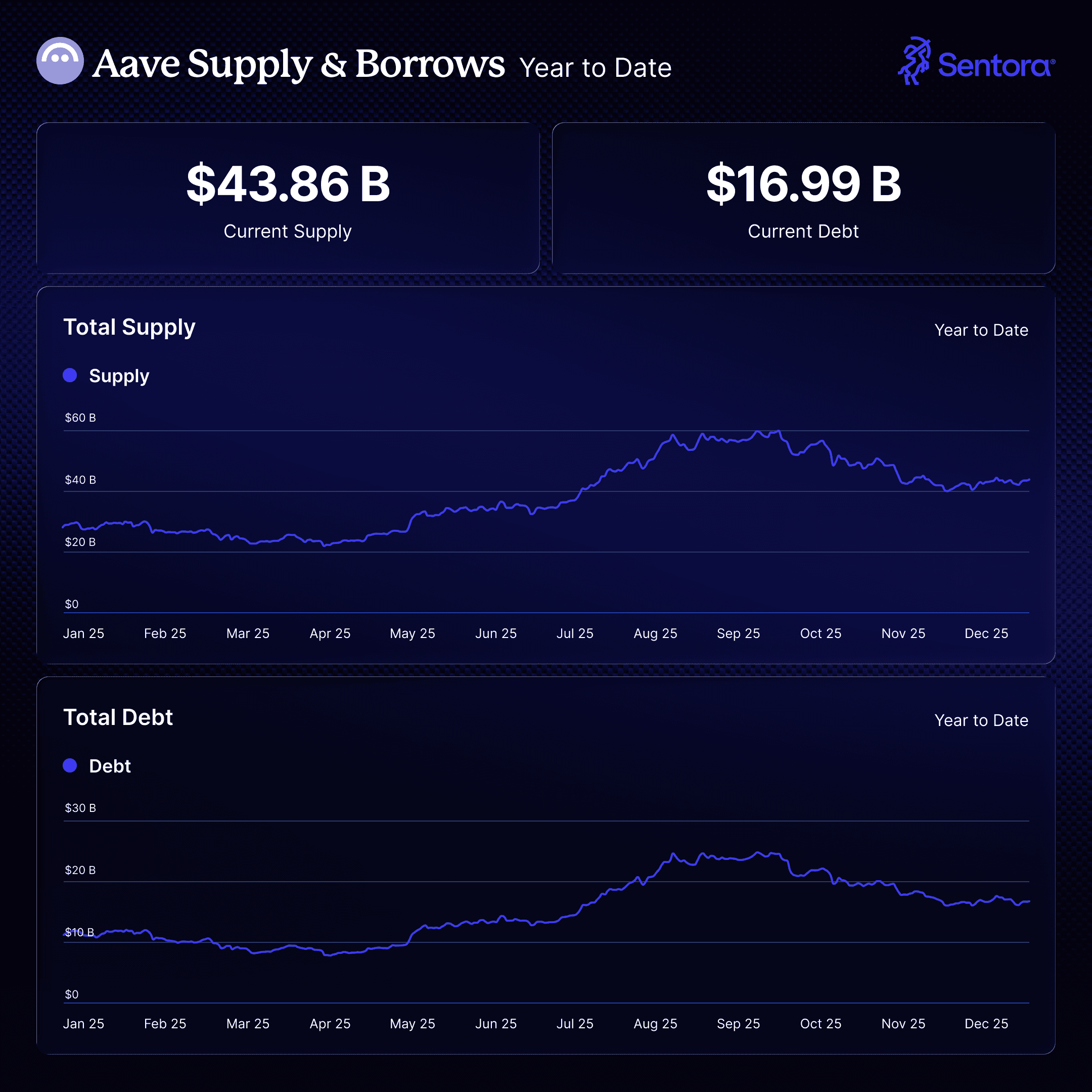

Aave Dominance

Aave consolidated its position as the foundational infrastructure for global on-chain lending. At its peak, it had over $70B of assets supplied in its instances across chains. The majority of that TVL is housed on Ethereum Mainnet where there is still $44B of assets supplied today.

Source: Sentora and Defillama

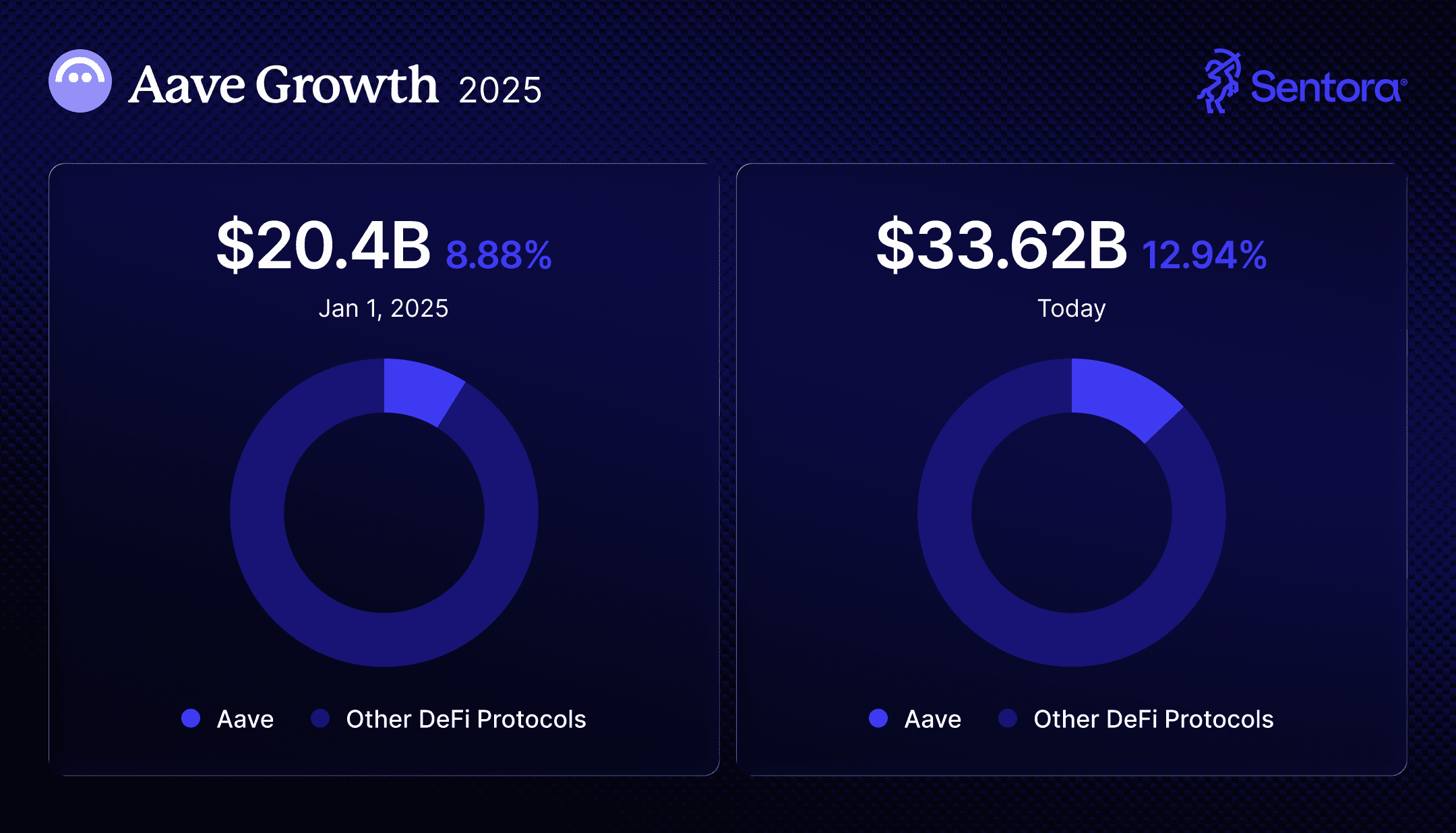

Growing Slice of the Pie

Source: Sentora and Defillama

Comparing snapshots of Aave from the beginning of the year until now, the protocol has grown its dominance in DeFi, grabbing 4% more of the total share of TVL in DeFi. This is an exceptional feat with many new and growing protocols entering into the ecosystem.

In Reflection

The year 2025 marked the "Structural Institutionalization" of DeFi, characterized by a move away from retail speculation toward sophisticated financial architecture. The record $310 billion stablecoin market cap and the $18 billion RWA milestone prove that on-chain liquidity is now a permanent fixture of global capital markets. However, the year’s growth was tempered by a harsh reality check: the "10/10" flash crash and the subsequent Stream/Elixir contagion revealed that while smart contracts are hardening, the human and operational layers remain vulnerable.

Looking toward 2026, the industry faces a dual mandate. First, it must address the "OpSec Gap" moving past smart contract audits to secure the traditional "Web2" vulnerabilities that accounted for 70% of 2025’s losses. Second, it must manage the transition from experimental yield strategies, like the now-saturated basis trade and the thinning herd of Digital Asset Treasuries (DATs), toward the proven resilience of blue-chip protocols like Aave. The growth and integrations of 2025 proved that DeFi can attract institutional capital. The challenge for 2026 is proving it can keep it through periods of systemic deleveraging.

EXPLORE MORE ARTICLES