A record $19B crypto wipeout hit after the U.S. threatened 100% tariffs on China. BTC dipped near $105k, yet Sentora’s systems stayed fully operational with no losses and no bad debt. Automated risk controls rebalanced positions instantly across DeFi markets.

TL;DR

Context: A late-Friday tariff shock, 100% U.S. tariffs threatened on Chinese imports, sparked a record crypto deleveraging, with >$19B liquidated in <24 hours. BTC briefly traded near $105k.

Sentora outcome: No downtime, no operational losses, and no client bad-debt exposure on supported DeFi money markets. Our automation executed actions to limit risk exposure without impacting client positions.

Why it mattered: When centralized venues throttled or adjusted controls, DeFi liquidations cleared transparently and fast. Aave and Morpho processed nine-figure liquidations without systemic bad debt.

Market backdrop

Catalyst

On Friday, Oct 10, the U.S. announced 100% tariffs on Chinese goods, escalating the trade conflict into the long U.S. holiday weekend. Risk assets slumped; BTC fell ~8–9% to ~$105k intraday; ETH and alts sold off harder.

Scale

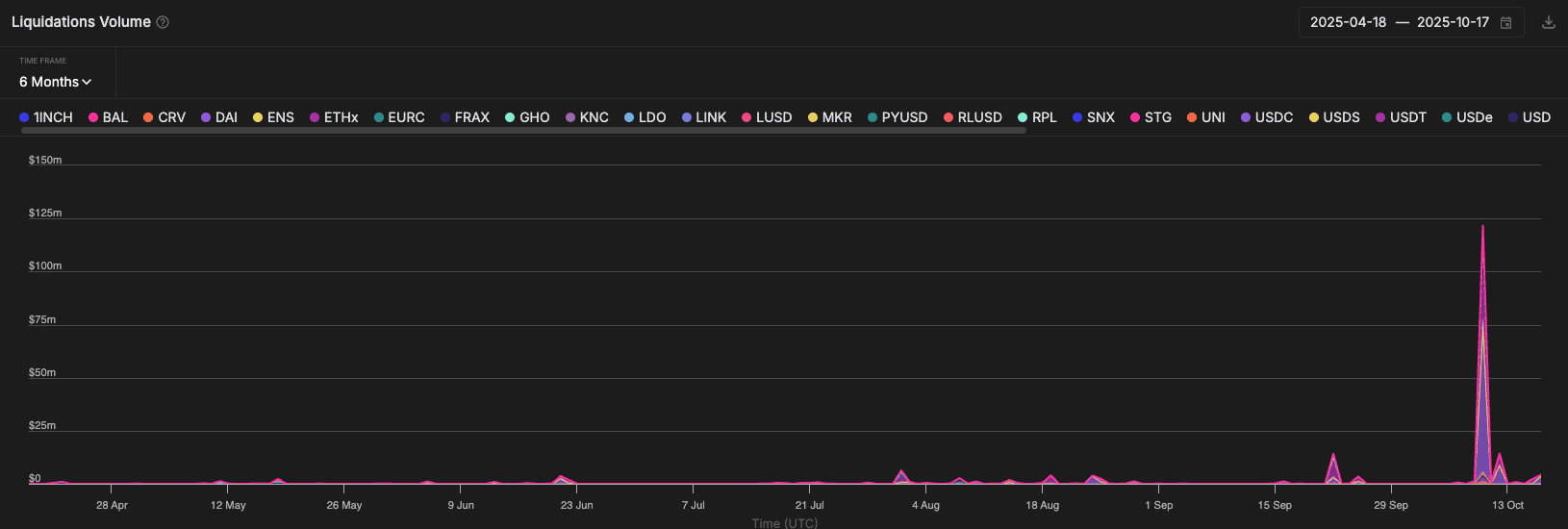

Multiple outlets converged on ~$19–20B in forced liquidations—the largest single-day crypto deleveraging on record.

What we saw on-chain

CEX vs DEX dynamics

Centralized venues absorbed billions in forced closes while tweaking insurance/ADL and funding; on-chain, keeper-driven liquidations executed continuously and transparently.

DeFi resilience

Aave: weathered a major stress test with ~$180M liquidations processed; protocol functionality remained intact.

Broader DeFi: Coverage across the sector pointed to minimal accrued bad debt despite the size of the cascade.

Source: Aave v3 DeFi Risk Radar

Sentora: how our systems handled the event

Objective

Preserve client capital, deleverage positions, have thick and sufficient liquidity to swap between assets used in strategies, while maintaining continuous access to risk controls.

What happened under the hood

Our off-chain Liquidation and Slippage Monitors detected increased volatility across ETH and stablecoin pairs.

The monitors continuously evaluate collateral health factors, pool liquidity, and slippage conditions block-by-block using statistical and linear models.

As asset volatility rose, the system automatically reprioritized capital across strategies to preserve collateral integrity, utilizing Sentora's optimized liquidity routes when needed.

How automated position hygiene works

Dynamic deleveraging

When monitored health factors approached preset thresholds, the Strategy Manager withdrew liquidity from secondary strategies (e.g., Aave Horizon, Euler) and repaid debt positions to restore target collateralization.

Continuous monitoring

All strategies operated under automated rules-based triggers, allowing instant reactions to changing market conditions.

Practical Example

10,000 ETH was deposited through a Supervised Lending strategy on Spark and Aave targeting 9.7% APY. The strategy was preset with parameters to automatically rebalance positions when collateral value (in this case ETH) decreases to specific levels to protect against liquidation risk.

As the price of ETH dropped, this position reached the pre-set minimum health factor. Liquidity was then automatically removed from the secondary strategy , swapped to the borrowed asset and used to repay debt until the position reached the target health factor.

Outcome metrics

0 incidents of client bad debt on supported lending markets.

0 downtime in monitoring, alerting, or execution pipelines.

No manual circuit-breakers needed; all actions executed per policy.

In short: our risk management systems worked as designed—automated, rules-based, and transparent—across the sharpest DeFi stress of 2025 to date.