Introduction

The US Securities and Exchange Commission’s Division of Corporate Finance (the “Division”) published its views on the regulatory classification of liquid staking and the issuance of corresponding liquid staking tokens (LSTs) in a statement in August. This was done in order to provide greater clarity on the application of US federal securities laws to crypto assets, according to the Division. However, it is extremely important to note that guidance in the Division’s Statement on Certain Liquid Staking Activities is very fact specific and does not cover all activities currently labeled as liquid staking in the market.

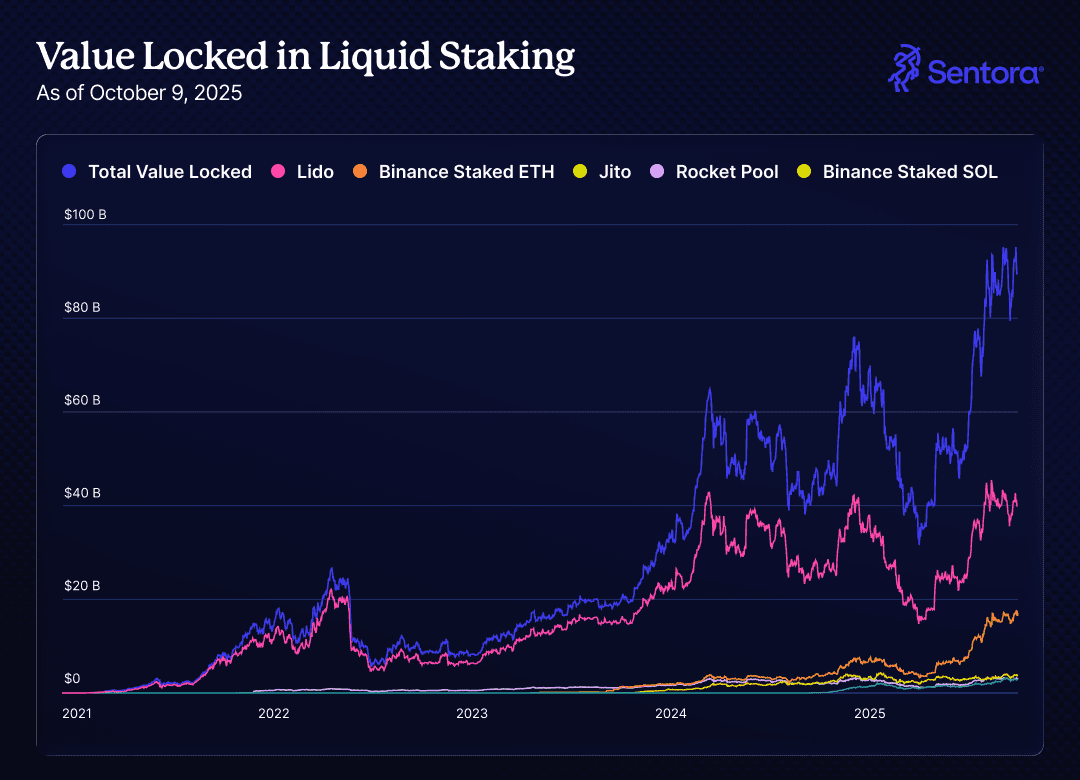

Size of the Liquid Staking Token Market

The liquid staking token market was approximately US$ 83 billion total value locked (“TVL”) as at October 10, 2025, with the largest being Lido at approximately US$ 37 billion in TVL. Other protocols in the top 5 are Binance Staked Ether, Jito Liquid Staking, Rocketpool and Binance Staked Sol.¹

Clarification of the Statement

In order to understand the extent of the liquid staking activity covered by the Division’s statement, it is important to consider the nature of the liquid staking tokens and their underlying crypto assets that are covered by the statement, and (b) the activities of the liquid staking provider.

The only underlying tokens covered by the statement (referred to as Covered Crypto Assets) are: crypto assets that are intrinsically linked to the programmatic functioning of a public, permissionless proof of stake blockchain network, and that are used to participate in and/or are earned for participating in such proof of stake network’s consensus mechanism or are otherwise used to maintain and/or earned for maintaining the technological operation and security of such proof of stake network.

The activities covered by the statement include:

The process whereby owners of Covered Crypto Assets deposit their Covered Crypto Assets with a liquid staking provider or third party custodian and in return receive newly minted crypto assets (Liquid Staking Tokens) that evidence the depositors’ ownership of the deposited Covered Crypto Assets and any rewards that accrue to the deposited Covered Crypto Assets;

The activities undertaken by the liquid staking provider or third party custodian which facilitates the staking of the deposited Covered Crypto Assets on behalf of the depositor, including the process around the collection and distribution of staking rewards, slashing, along with the minting, issuing and redeeming of Staking Receipt Tokens, holding deposited Covered Crypto Assets (in a wallet or smart contract) on behalf of the depositors, issuing staking receipt tokens evidencing the depositors’ ownership of the deposited Covered Crypto Assets; and

Ancillary services (activities that are merely administrative or ministerial in nature), which include providing slashing coverage, early unbonding, and aggregating crypto assets to meet a protocol's staking minimums.

The Liquid Staking Tokens that are excluded from the SEC’s registration requirements pursuant to the Division’s statement are those that are issued exactly for the purposes listed above, except for those Liquid Staking Tokens issued for deposited Covered Crypto Assets that are part of or subject to an investment contract - this potentially signifies that there will still need to be an investment contract analysis (i.e. a review of whether there is an investment of value in a common enterprise with the expectation of profits from the entrepreneurial or managerial efforts of others) done in every instance where Liquid Staking Tokens are issued.

What does all this mean? It means that the only liquid staking tokens covered by the statement are those that are issued by a liquid staking provider where the only material activities that the liquid staking token provider engages in are:

the technical activity of deploying Covered Crypto Assets on behalf of others for the purpose of maintaining a proof of stake blockchain, and

issuing receipt tokens representing the deposited Covered Crypto Assets to token owners on whose behalf the liquid staking provider performs staking activities on a proof of stake blockchain.

Certain other non-material activities are permitted, but are restricted to the ancillary activities summarized in c. above as provided for in the statement.

How might the SEC statement apply to the current universe of Liquid Staking Tokens?

The statement is limited to liquid staking tokens representing underlying tokens used in the technical activity of protocol staking central to the maintenance of the corresponding blockchain where new tokens are minted as a consequence of this maintenance activity. As such the statement only applies to a subset of the current liquid staking token universe. The below table presents the potential application of the statement to the top 5 liquid staking protocols² (TVL data³ presented as of October 10, 2025).

Protocol (Underlying Asset) | Comments |

|---|---|

Lido (ETH) $36.90 billion TVL | Lido’s protocol staking activities along with the issuance of the stEth liquid staking token in return for, and as a representation of, clients’ deposited Eth and where Eth and stEth are exchanged on a one to one basis, are likely to benefit from the Division’s liquid staking statement that these types of activities do not involve the offer and sale of securities within the meaning the federal securities acts. The use of stEth for any purpose other than as a receipt for Eth, is not covered by the statement. |

Binance Staked Ether (ETH) $15.43 billion TVL | Binance’s Eth protocol staking activities along with the issuance of the BETH liquid staking token in return for, and as a representation of, clients’ deposited Eth and where Eth and BETH are exchanged on a one to one basis, are likely to benefit from the Division’s statement that these types of activities do not involve the offer and sale of securities within the meaning the federal securities acts. The use of BETH for any purpose other than as a receipt for Eth, is not covered by the statement. |

Jito Liquid Staking (SOL) $3.34 billion TVL | Jito’s protocol staking activities along with the issuance of the JitoSOL liquid staking token in return for, and as a representation of, clients’ deposited Solana (and accumulated staking rewards) are likely to benefit from the Division’s liquid staking statement that the activities do not involve the offer and sale of securities within the meaning the federal securities acts. The use of JitoSOL for any purpose other than as a receipt for Solana, is not covered by the statement. |

Rocketpool (ETH) $2.78 billion TVL | Rocketpool’s protocol staking activities along with the issuance of the rETH liquid staking token in return for, and as a representation of, clients’ deposited Eth are likely to benefit from the Division’s liquid staking statement that these types of activities do not involve the offer and sale of securities within the meaning the federal securities acts. The use of rETH for any purpose other than as a receipt for Eth, is not covered by the statement. |

$2.67 billion TVL | Binance’s SOL protocol staking activities along with the issuance of the BNSOL liquid staking token in return for, and as a representation of, clients’ deposited SOL (plus accumulated staking rewards) are likely to benefit from the Division’s liquid staking statement that these types of activities do not involve the offer and sale of securities within the meaning the federal securities acts. The use of BNSOL for any purpose other than as a receipt for SOL, is not covered by the statement. |

What are the limitations on the Division’s Statement?

It is important also to note that if a Liquid Staking Provider selects whether, when, or how much of a depositor’s Covered Crypto Assets to stake, its activities are outside the scope of the Division’s statement, meaning it could amount to a securities transaction. If a Liquid Staking Provider guarantees or otherwise sets the amount of rewards owed to the depositors, these activities are also outside the scope of the Division’s statement, meaning that the totality of the activities involved could amount to a securities transaction. Also, where a Liquid Staking Provider provides the means by which the staking receipt tokens it issues can be used to generate additional returns above and beyond those directly accruing from the technical activity of protocol staking, those activities are outside the scope of the Division’s statement, and such additional revenue generation activities could taint the entirety of the activities involved and be considered securities transactions.

The statement, although helpful in providing clarity on the Division’s thinking about liquid staking, is very fact specific, and does not have the weight of an action by the full Securities and Exchange Commission and therefore cannot be relied on. A footnote in the statement makes the caveat not to rely clear. The Division of Corporate Finance states that its Statement on Certain Liquid Staking Activities is not an SEC rule, regulation, guidance, or statement, and that the SEC has neither approved nor disapproved its content. The Division also states that the statement has no legal force or effect. Full SEC action on this is therefore needed for the market to fully be able to rely on it. Alternatively, although it would be inefficient for the industry to do so, individual entities could seek a no-action letter from the SEC’s staff relating to their liquid staking product to the extent that it differs in any respect from the specific facts in the Division’s statement. No-action letters indicate that, based on the specific facts and circumstances presented to the SEC by the entity seeking the letter, the SEC staff would not recommend that the SEC take enforcement action against the relevant entity. No other party may rely on the letter unless expressly permitted to do so by the SEC.

Some Remaining Grey Areas

So far, among the activities in the existing staking universe, the SEC’s staff has published statements, including the most recent liquid staking statement discussed above, which seek to bring regulatory clarity, albeit fact specific, to four such activities, namely self (or solo) protocol staking, self-custodial protocol staking directly with a third party, custodial protocol staking arrangements and liquid staking. The staff has concluded that these types of fact specific staking activities would not be considered securities transactions.

However, the staff has not specifically publicly spoken about restaking other than to define it as “a process that allows Covered Crypto Assets staked on their native crypto network to be used on additional crypto networks or crypto applications” and makes clear that their liquid staking statement does not address restaking.⁴ The staff has also not spoken on liquid restaking. Therefore these activities remain grey areas and counterparties seeking to set up restaking or liquid restaking activities in the US or providing US customers with access from an offshore location must undergo a regulatory analysis based on the facts and circumstances surrounding each such activity. The same goes for governance tokens in connection with any Decentralized Autonomous Organizations set up to manage liquid staking protocols. The statement does not address these governance tokens and a similar regulatory analysis should take place to assess whether based on the facts and circumstances surrounding the governance tokens and their issuance, the tokens or their issuance are securities or involve the offer and sale of securities within the meaning of the federal securities acts, and if so, whether any exemptions from the SEC registration requirements apply.